Leveraging AI in Risk Management for Smarter Trading Decisions

Explore how AI-driven tools can enhance your risk management strategies and protect your investments.

How to Use AI for Risk Management in Trading: A Comprehensive Guide

AI technology is revolutionizing risk management in trading. With tools that analyze market data, provide predictive insights, and automate decision-making, traders can now safeguard their portfolios more effectively. In this guide, we’ll explore how AI can help you manage risk and make smarter trading decisions.

What is AI Risk Management?

AI risk management leverages machine learning and predictive analytics to identify and mitigate potential threats to your investments. By processing historical data and real-time inputs, AI provides actionable insights that help traders:

- Anticipate market volatility.

- Optimize portfolios dynamically.

- Automate risk assessment processes.

Top Benefits of AI in Risk Management

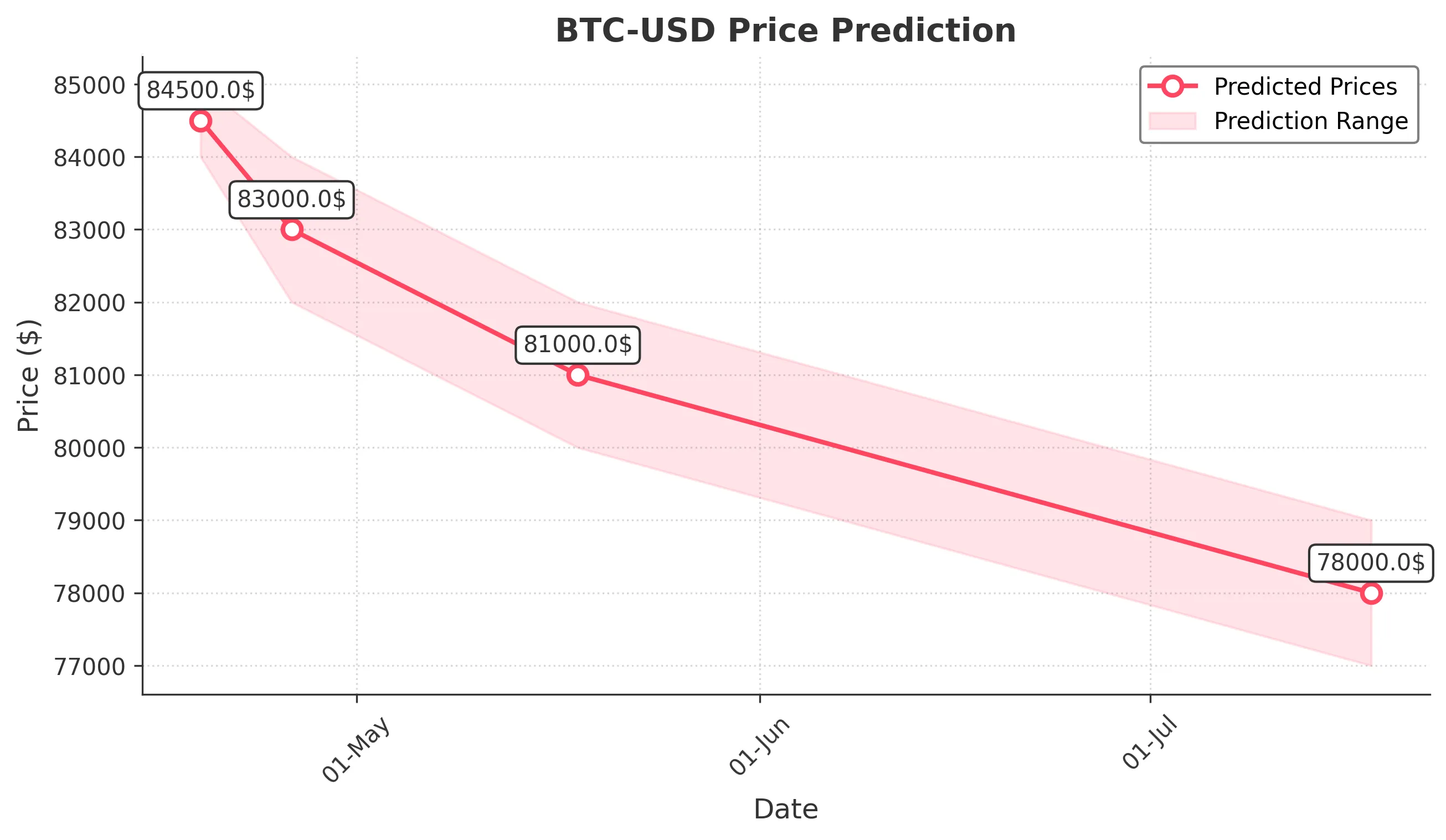

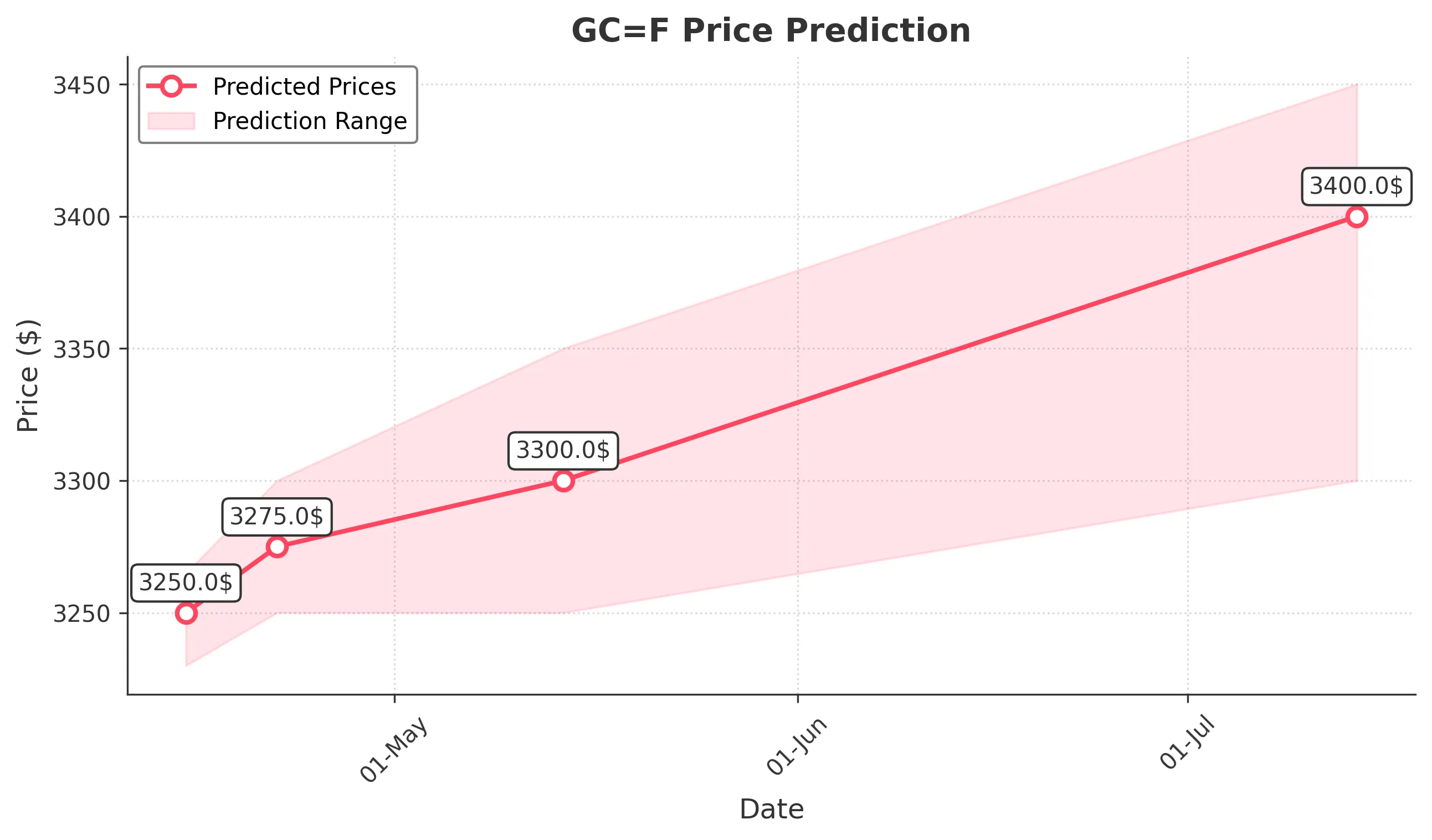

1. Predicting Market Volatility

AI systems can analyze patterns in market activity to predict volatility spikes. This allows traders to:

- Adjust strategies proactively.

- Avoid high-risk trades during uncertain periods.

2. Automated Risk Alerts

AI generates instant alerts when predefined risk thresholds are breached. This includes:

- Rapid price changes.

- Portfolio imbalances.

- Global economic events.

3. Portfolio Optimization

AI continuously reviews portfolio performance to recommend adjustments, helping traders achieve better risk-to-reward ratios.

How to Implement AI-Driven Risk Management

Step 1: Set Clear Parameters

Define your risk tolerance and let AI enforce these limits automatically.

Step 2: Use Diversification Tools

Leverage AI insights to reduce overexposure by diversifying across sectors, geographies, and asset classes.

Step 3: Integrate AI with Traditional Analysis

Combine AI insights with technical and fundamental analysis to create robust strategies.

Best Practices for AI-Enhanced Risk Management

- Regularly review and update AI parameters based on market conditions.

- Always cross-check AI alerts with human judgment.

- Stay informed about advancements in AI risk management tools.

By incorporating AI into your risk management strategy, you can make more informed, data-driven decisions while minimizing potential losses.