AAPL Trading Predictions

1 Day Prediction

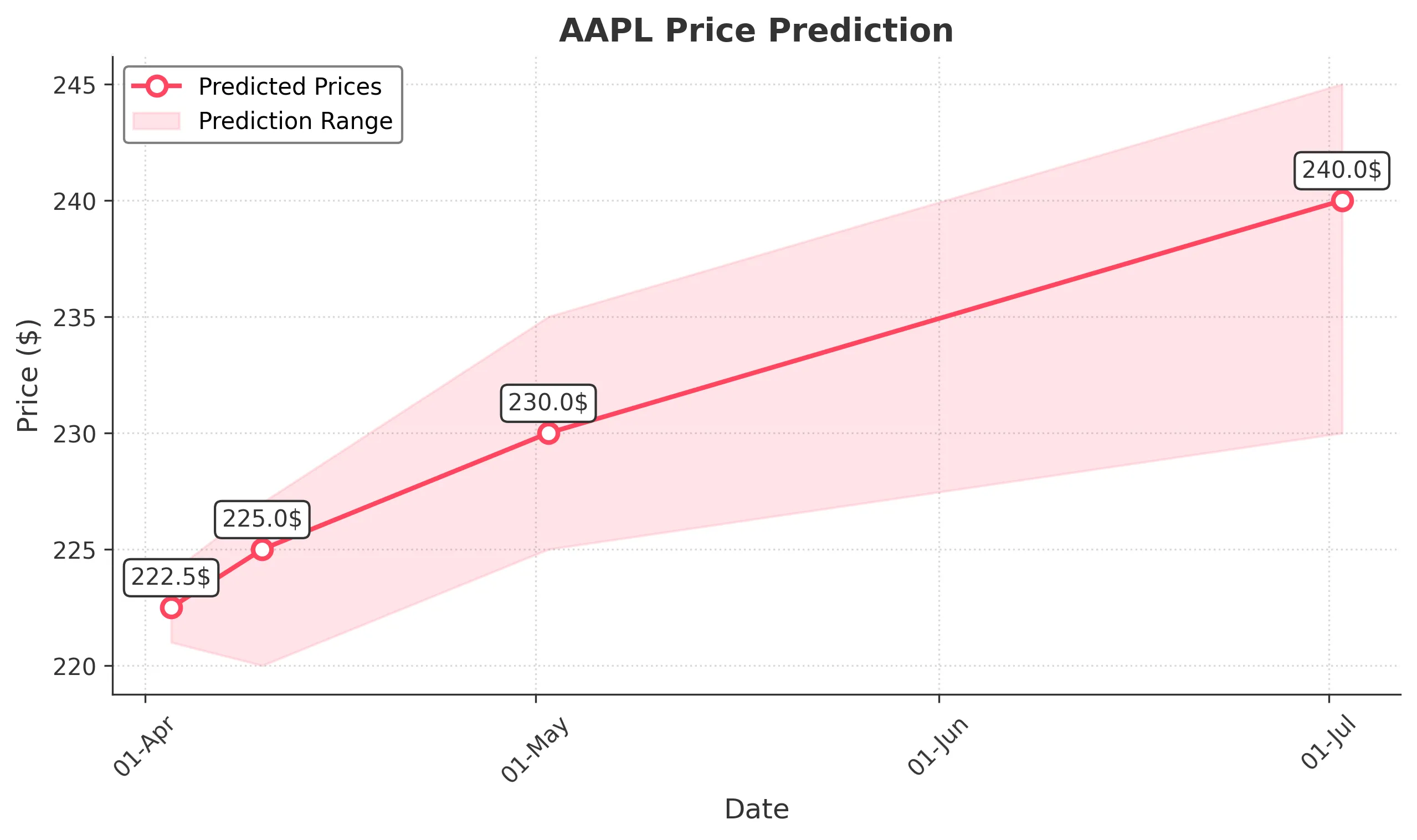

Target: April 3, 2025$222.5

$222

$224

$221

Description

AAPL shows a slight bullish trend with a recent Doji candlestick indicating indecision. The RSI is neutral, and MACD is close to crossing above the signal line, suggesting potential upward momentum. However, recent volatility may limit gains.

Analysis

Over the past 3 months, AAPL has experienced a bearish trend with significant support around $220. The recent price action shows a potential reversal, but the overall market sentiment remains cautious. Volume spikes indicate increased interest, but volatility remains high.

Confidence Level

Potential Risks

Market sentiment could shift due to macroeconomic news or earnings reports, which may impact the stock's performance.

1 Week Prediction

Target: April 10, 2025$225

$222.5

$227

$220

Description

The bullish momentum may continue as the MACD shows signs of a bullish crossover. The RSI is approaching overbought territory, indicating potential upward pressure. However, resistance at $227 could limit gains.

Analysis

AAPL has shown signs of recovery after a bearish phase, with key resistance at $227. The stock's performance is influenced by broader market trends and investor sentiment, which remains mixed. Volume patterns suggest cautious optimism.

Confidence Level

Potential Risks

Potential market corrections or negative news could reverse the upward trend, impacting the prediction.

1 Month Prediction

Target: May 2, 2025$230

$225.5

$235

$225

Description

If the bullish trend continues, AAPL could reach $230, supported by a favorable MACD and RSI. However, the stock faces resistance at $235, and any negative macroeconomic news could hinder progress.

Analysis

AAPL's performance over the last three months has been volatile, with a recent shift towards bullish sentiment. Key support at $220 and resistance at $235 are critical levels to watch. The market's reaction to economic indicators will be pivotal.

Confidence Level

Potential Risks

Unforeseen market events or earnings results could lead to volatility, affecting the stock's trajectory.

3 Months Prediction

Target: July 2, 2025$240

$235

$245

$230

Description

If the current bullish trend persists, AAPL could reach $240, supported by positive market sentiment and technical indicators. However, resistance at $245 may pose challenges, and external factors could impact performance.

Analysis

AAPL's recent performance indicates a potential recovery from a bearish trend, but the stock remains sensitive to market fluctuations. Key resistance levels and macroeconomic factors will play a significant role in determining future price movements.

Confidence Level

Potential Risks

Long-term predictions are uncertain due to potential market corrections and economic shifts that could affect investor confidence.