AAPL Trading Predictions

1 Day Prediction

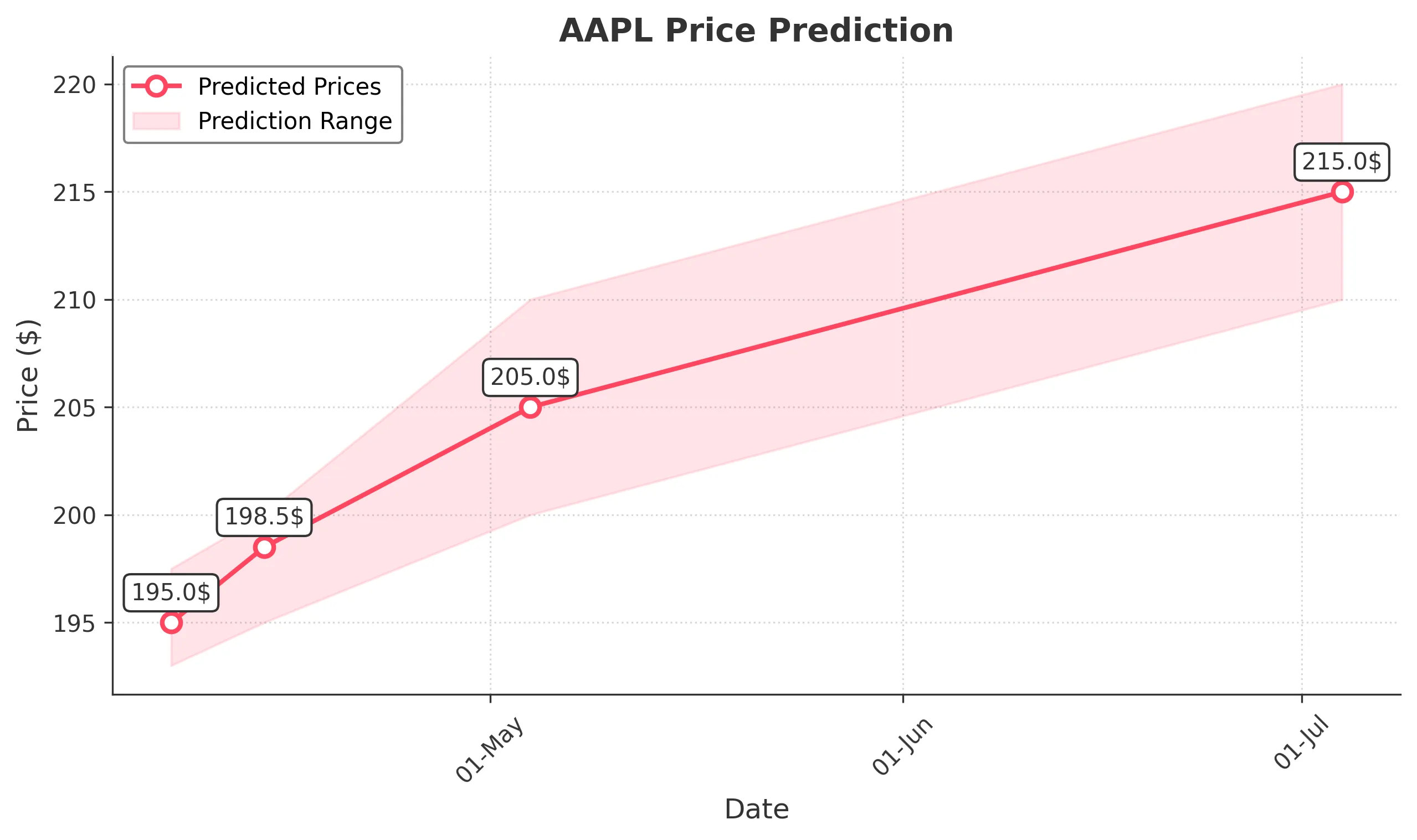

Target: April 7, 2025$195

$196

$197.5

$193

Description

AAPL shows bearish momentum with recent declines. The MACD is below the signal line, and RSI indicates oversold conditions. A potential bounce could occur, but overall sentiment remains weak due to recent volatility.

Analysis

Over the past 3 months, AAPL has experienced significant volatility, with a bearish trend evident in the last few weeks. Key support is around $195, while resistance is at $220. Volume spikes during declines suggest selling pressure.

Confidence Level

Potential Risks

Market sentiment could shift rapidly, and any positive news could lead to a reversal. Watch for volume spikes that may indicate a change in trend.

1 Week Prediction

Target: April 14, 2025$198.5

$196.5

$200

$195

Description

AAPL may see a slight recovery as it approaches key support levels. However, bearish indicators persist, and any upward movement could be limited by resistance at $200.

Analysis

The stock has been in a bearish phase, with significant selling pressure. The recent price action suggests a potential short-term bounce, but overall market sentiment remains cautious. Key support at $195 is critical.

Confidence Level

Potential Risks

Continued bearish sentiment and macroeconomic factors could hinder recovery. Watch for external news that may impact market conditions.

1 Month Prediction

Target: May 4, 2025$205

$202

$210

$200

Description

AAPL may stabilize around $205 as it tests previous support levels. The RSI could recover from oversold conditions, but bearish trends remain a concern.

Analysis

The stock has shown a bearish trend with significant volatility. Support at $200 is crucial, and any failure to hold could lead to further declines. The market sentiment is mixed, with potential for recovery if conditions improve.

Confidence Level

Potential Risks

Market volatility and external economic factors could lead to unexpected price movements. Watch for earnings reports or macroeconomic data releases.

3 Months Prediction

Target: July 4, 2025$215

$212

$220

$210

Description

If the bearish trend reverses, AAPL could reach $215 as it tests higher resistance levels. However, macroeconomic factors and market sentiment will play a significant role in this potential recovery.

Analysis

AAPL's performance has been characterized by volatility and bearish trends. Key resistance at $220 and support at $200 will be critical in determining future price movements. The outlook remains cautious amid economic uncertainties.

Confidence Level

Potential Risks

Uncertainty in the broader market and potential economic downturns could impact AAPL's performance. Watch for changes in consumer sentiment and tech sector performance.