AAPL Trading Predictions

1 Day Prediction

Target: April 9, 2025$185

$185.5

$190

$180

Description

AAPL shows bearish momentum with recent declines. The RSI indicates oversold conditions, but a potential bounce could occur. Volume spikes suggest increased selling pressure. Watch for a possible reversal near support at 180.

Analysis

Over the past 3 months, AAPL has experienced significant volatility, with a bearish trend evident since early April. Key support is around 180, while resistance is at 190. The MACD shows a bearish crossover, and the ATR indicates increased volatility.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. AAPL's recent downtrend raises concerns about further declines.

1 Week Prediction

Target: April 16, 2025$182

$180.5

$185

$175

Description

The bearish trend may continue, with potential for a slight recovery. The Bollinger Bands indicate a squeeze, suggesting a breakout could occur. However, the overall sentiment remains negative.

Analysis

AAPL's performance has been characterized by a downward trend, with significant resistance at 190. The recent price action shows a lack of buying interest, and the volume patterns indicate selling pressure. The market sentiment is cautious.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or earnings reports could lead to unexpected price movements. The bearish sentiment may persist longer than anticipated.

1 Month Prediction

Target: May 8, 2025$190

$185

$195

$175

Description

A potential recovery could occur as AAPL approaches key support levels. If the price holds above 180, a rally towards 190 is possible. Watch for bullish candlestick patterns for confirmation.

Analysis

AAPL has faced downward pressure, but key support at 180 may provide a base for a potential recovery. The RSI is approaching oversold levels, indicating a possible reversal. However, the overall market sentiment remains cautious.

Confidence Level

Potential Risks

The bearish trend may continue if market conditions do not improve. Economic indicators and earnings reports could significantly impact the stock's performance.

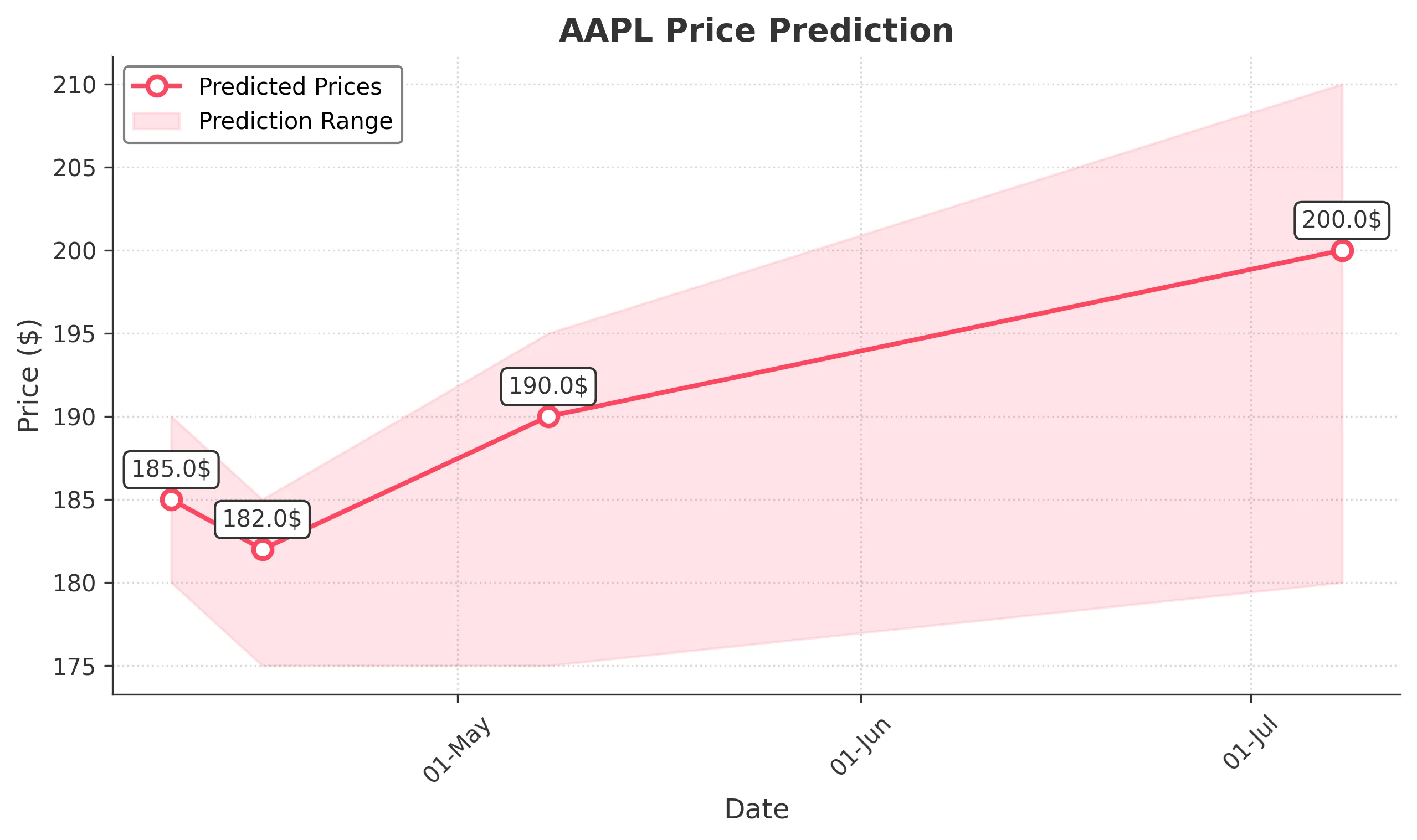

3 Months Prediction

Target: July 8, 2025$200

$195

$210

$180

Description

If AAPL can stabilize above 180, a gradual recovery towards 200 is feasible. Positive macroeconomic developments or product launches could drive sentiment higher.

Analysis

The stock has been in a bearish phase, but if it can hold above critical support levels, there is potential for recovery. The market remains volatile, and external factors could significantly influence AAPL's trajectory.

Confidence Level

Potential Risks

Long-term predictions are uncertain due to potential market volatility and economic conditions. AAPL's performance is highly sensitive to external factors.