AAPL Trading Predictions

1 Day Prediction

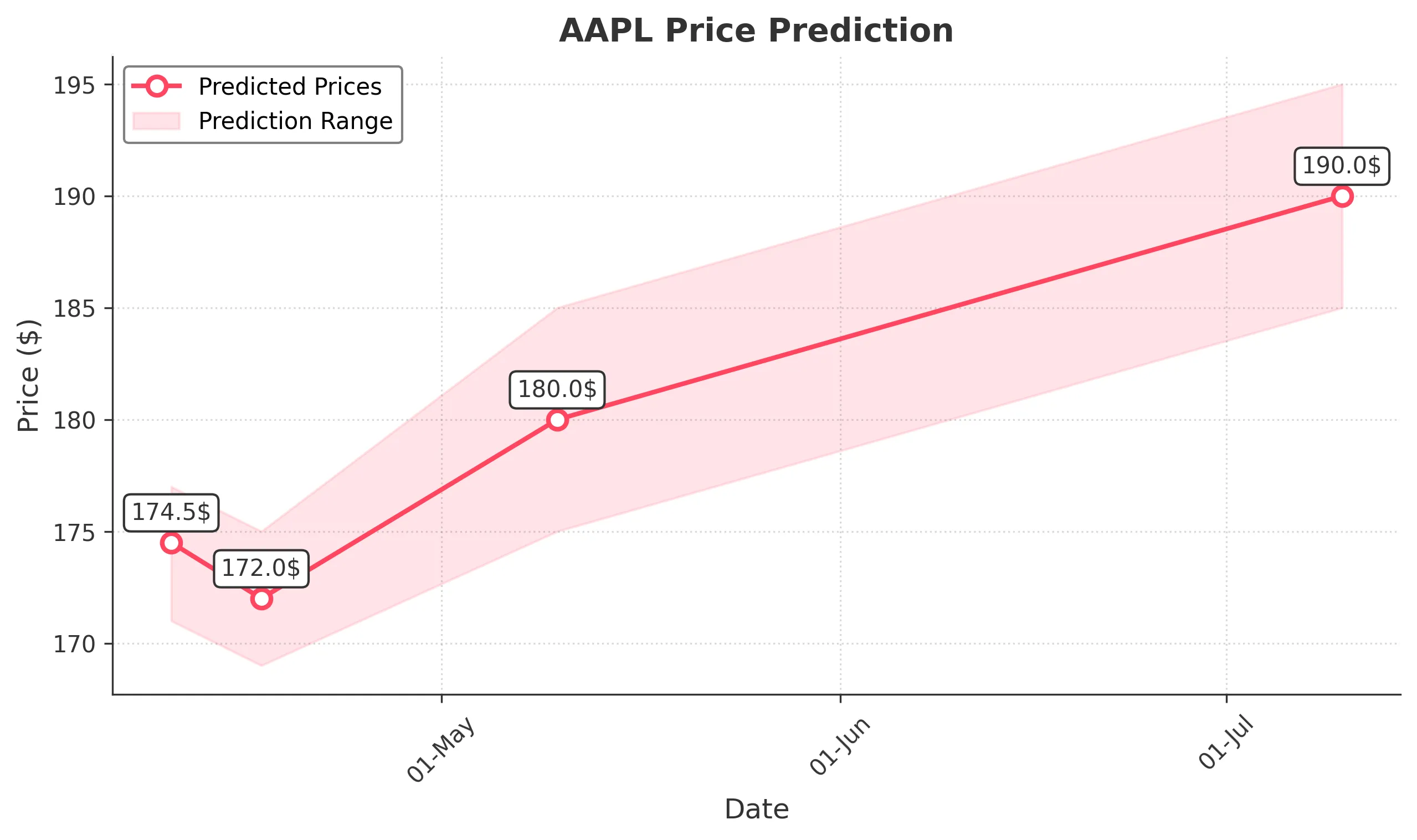

Target: April 10, 2025$174.5

$173

$177

$171

Description

AAPL shows bearish momentum with recent declines. The RSI indicates oversold conditions, but a potential bounce could occur. Watch for resistance at 177.00. Volume spikes suggest volatility, but overall sentiment remains cautious.

Analysis

Over the past 3 months, AAPL has experienced significant volatility, with a bearish trend evident since early April. Key support is around 170.00, while resistance is at 180.00. The MACD shows a bearish crossover, and the ATR indicates increased volatility.

Confidence Level

Potential Risks

Market volatility and potential news could impact the prediction. AAPL's recent downtrend raises concerns about further declines.

1 Week Prediction

Target: April 17, 2025$172

$171.5

$175

$169

Description

The bearish trend may continue, with potential support at 170.00. The MACD remains negative, and RSI suggests further weakness. AAPL may face resistance at 175.00, limiting upside potential.

Analysis

AAPL's performance has been bearish, with significant declines in recent weeks. The stock is testing key support levels, and the overall market sentiment is cautious. Volume analysis shows increased selling pressure.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or earnings reports could lead to unexpected price movements.

1 Month Prediction

Target: May 10, 2025$180

$178

$185

$175

Description

AAPL may recover slightly as it approaches key support levels. A potential bullish reversal could occur if it holds above 175.00. Watch for volume spikes indicating renewed interest.

Analysis

The stock has been in a bearish phase, but a potential reversal is possible if it holds above critical support. The MACD is showing signs of convergence, indicating a possible shift in momentum.

Confidence Level

Potential Risks

Market sentiment remains fragile, and any negative news could derail recovery efforts.

3 Months Prediction

Target: July 10, 2025$190

$188

$195

$185

Description

If AAPL can stabilize and build on recent support, a gradual recovery towards 190.00 is feasible. The market may respond positively to upcoming product launches or earnings reports.

Analysis

AAPL's long-term outlook remains cautious, with recent bearish trends. However, if the stock can break above resistance levels, it may attract buyers. The overall market sentiment will play a crucial role in determining future performance.

Confidence Level

Potential Risks

Long-term predictions are uncertain due to potential macroeconomic shifts and competitive pressures.