AAPL Trading Predictions

1 Day Prediction

Target: April 12, 2025$188.5

$189

$190

$186

Description

AAPL shows bearish momentum with recent declines. The RSI indicates oversold conditions, but a potential bounce could occur. Watch for resistance at 190.00. Volume spikes suggest volatility, but overall sentiment remains cautious.

Analysis

Over the past 3 months, AAPL has experienced significant volatility, with a bearish trend emerging. Key support is around 180.00, while resistance is at 190.00. The MACD shows a bearish crossover, and the ATR indicates increased volatility. Volume patterns suggest heightened trading activity, particularly during price drops.

Confidence Level

Potential Risks

Market volatility and potential news could impact the price. AAPL's recent downtrend raises concerns about further declines.

1 Week Prediction

Target: April 19, 2025$185

$186

$188

$180

Description

The bearish trend may continue, with potential support at 180.00. The MACD remains negative, and RSI indicates oversold conditions. AAPL may face resistance at 188.00, and market sentiment is cautious due to recent declines.

Analysis

AAPL's performance has been bearish, with significant price drops and increased volatility. Key support at 180.00 is critical, while resistance at 188.00 may limit upward movement. The volume analysis shows spikes during sell-offs, indicating strong selling pressure.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or earnings reports could lead to unexpected price movements. The overall market sentiment is fragile.

1 Month Prediction

Target: May 12, 2025$190

$185

$195

$175

Description

AAPL may stabilize around 190.00 if it can hold above 180.00. The RSI could recover, indicating potential for a rebound. However, resistance at 195.00 remains a challenge, and market sentiment is still cautious.

Analysis

The stock has shown a bearish trend with significant volatility. Support at 180.00 is crucial, while resistance at 195.00 may hinder recovery. The MACD remains bearish, and volume patterns indicate strong selling pressure. Overall, the market sentiment is cautious.

Confidence Level

Potential Risks

Market conditions are unpredictable, and any negative news could lead to further declines. The potential for a rebound is contingent on broader market sentiment.

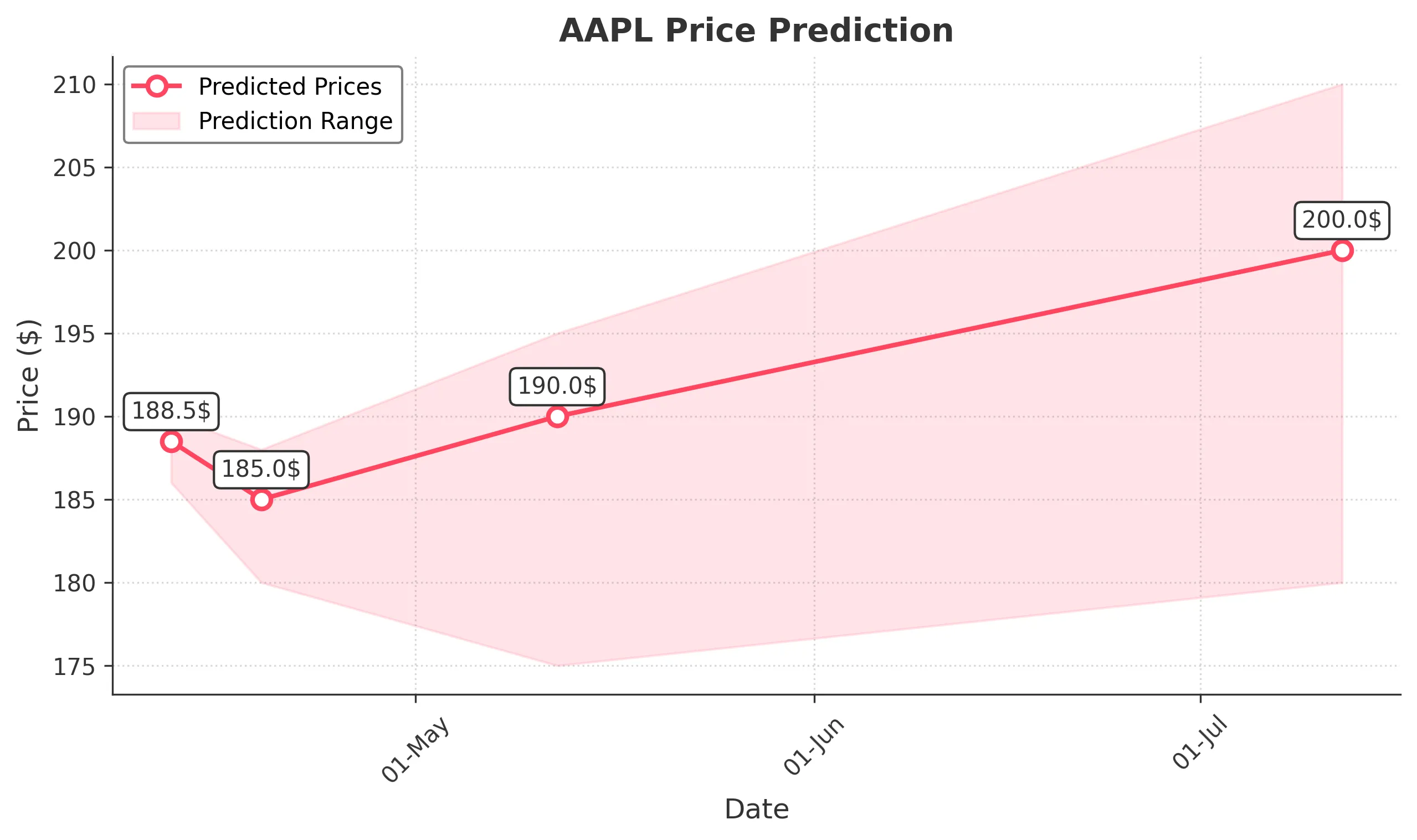

3 Months Prediction

Target: July 12, 2025$200

$195

$210

$180

Description

If AAPL can break above 195.00, it may trend towards 200.00. The RSI could improve, indicating a potential recovery. However, macroeconomic factors and market sentiment will play a significant role in this prediction.

Analysis

AAPL's performance has been volatile, with a bearish trend dominating. Key support at 180.00 is critical, while resistance at 195.00 poses a challenge. The MACD indicates bearish momentum, and volume spikes during declines suggest strong selling pressure. Market sentiment is cautious, with potential for recovery if conditions improve.

Confidence Level

Potential Risks

Potential economic downturns or negative news could impact the stock's recovery. The overall market sentiment remains uncertain.