AAPL Trading Predictions

1 Day Prediction

Target: April 23, 2025$195

$195.5

$198

$192

Description

AAPL shows signs of a potential rebound after recent declines. The RSI is approaching oversold levels, indicating a possible short-term bounce. However, the MACD remains bearish, suggesting caution. Volume is expected to be moderate as traders assess market sentiment.

Analysis

Over the past three months, AAPL has experienced significant volatility, with a bearish trend recently. Key support is around $192, while resistance is near $198. The MACD indicates bearish momentum, but the RSI suggests a potential short-term recovery.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. AAPL's recent downtrend may continue if bearish sentiment prevails.

1 Week Prediction

Target: April 30, 2025$198.5

$197

$202

$195

Description

AAPL may see a slight recovery as it approaches key support levels. The Bollinger Bands indicate potential for a bounce, but the overall trend remains bearish. Watch for volume spikes that could signal a reversal.

Analysis

AAPL's performance has been bearish, with significant selling pressure. The stock is currently testing support levels, and a rebound could occur if buying interest increases. However, the overall sentiment remains cautious.

Confidence Level

Potential Risks

Uncertainty in market conditions and potential earnings reports could lead to unexpected price movements.

1 Month Prediction

Target: May 22, 2025$205

$204

$210

$200

Description

If the current bearish trend reverses, AAPL could stabilize around $205. The Fibonacci retracement levels suggest potential support at $200, while bullish divergence in the RSI may indicate a recovery.

Analysis

AAPL has faced downward pressure, but signs of stabilization are emerging. Key support at $200 and resistance at $210 will be crucial in determining the stock's direction. The market's overall sentiment remains mixed.

Confidence Level

Potential Risks

Market sentiment and macroeconomic factors could heavily influence the stock's trajectory, leading to potential volatility.

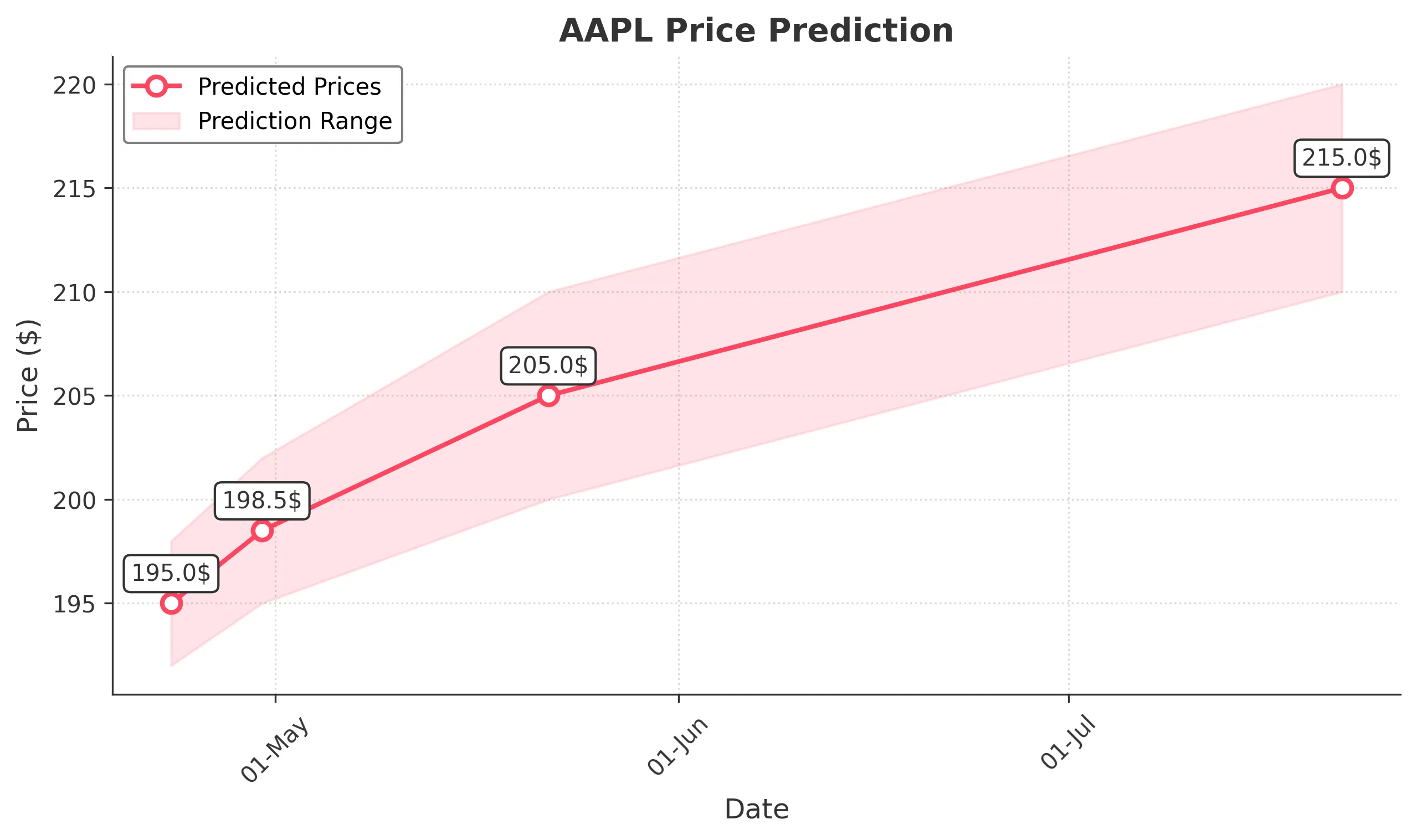

3 Months Prediction

Target: July 22, 2025$215

$214

$220

$210

Description

Assuming a recovery in market sentiment, AAPL could trend upwards towards $215. The long-term moving averages suggest potential bullish momentum if the stock can break above resistance levels.

Analysis

AAPL's long-term outlook remains uncertain due to recent volatility. The stock is at a critical juncture, with potential for recovery if it can maintain above key support levels. Market sentiment and external factors will play a significant role.

Confidence Level

Potential Risks

Long-term predictions are subject to macroeconomic changes and company performance, which could lead to unexpected fluctuations.