AAPL Trading Predictions

1 Day Prediction

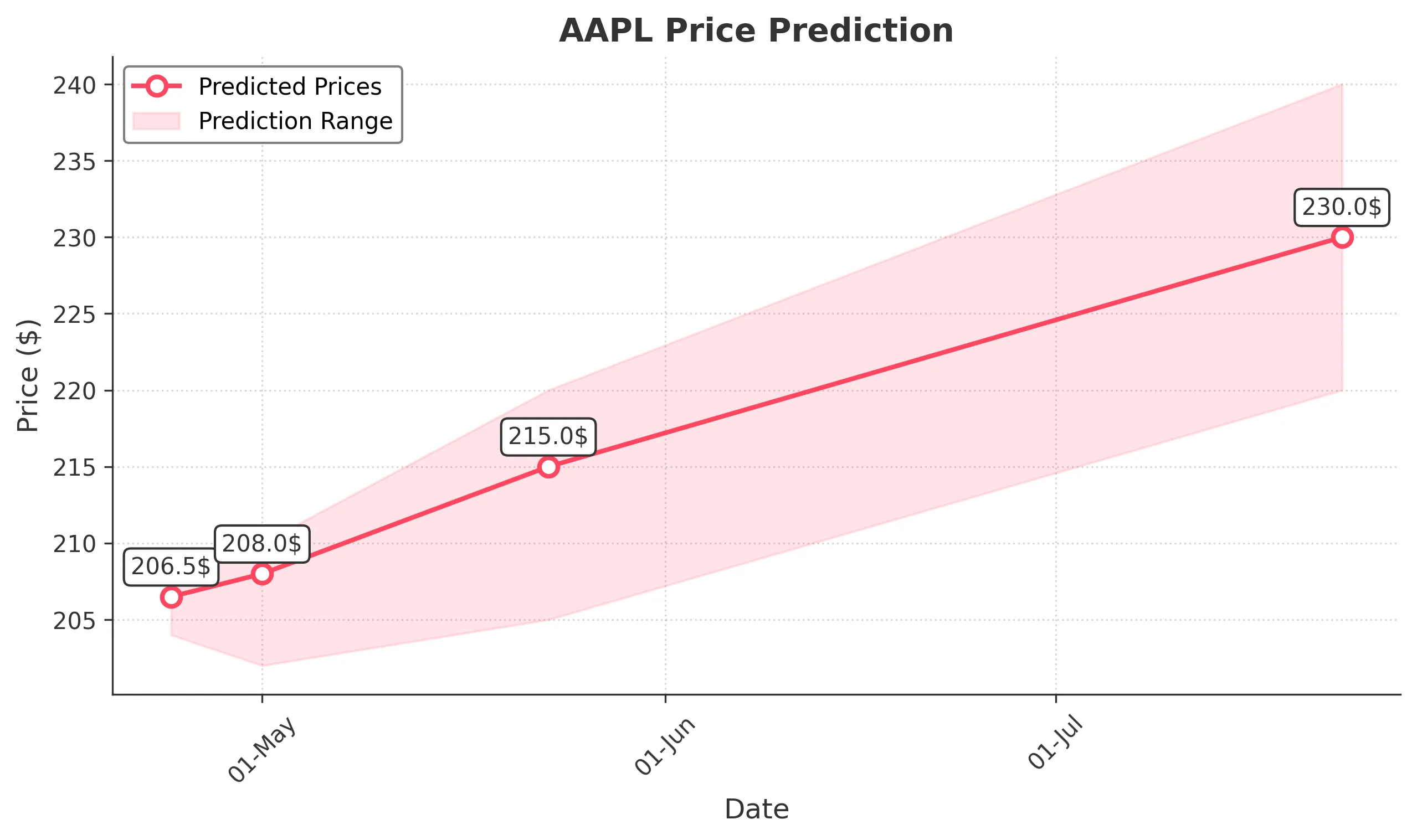

Target: April 24, 2025$206.5

$205.5

$208.5

$204

Description

AAPL shows a slight bullish trend with a potential close around 206.500. The recent candlestick patterns indicate indecision, but the RSI is neutral, suggesting a possible bounce. Volume is expected to be lower as the market digests recent volatility.

Analysis

Over the past 3 months, AAPL has experienced significant volatility, with a bearish trend recently. Key support is around 190, while resistance is near 210. The MACD shows a bearish crossover, and the ATR indicates high volatility. Volume spikes were noted during sell-offs, suggesting caution.

Confidence Level

Potential Risks

Market sentiment is mixed, and external factors like earnings reports could impact the price significantly.

1 Week Prediction

Target: May 1, 2025$208

$206.5

$210

$202

Description

AAPL is expected to close around 208.000 next week, supported by a potential recovery from recent lows. The Bollinger Bands indicate a squeeze, suggesting a breakout could occur. However, the MACD remains bearish, indicating caution.

Analysis

The stock has shown a bearish trend recently, with significant support at 200. The RSI is approaching oversold levels, indicating a possible rebound. However, the overall market sentiment remains cautious, and external factors could influence price movements.

Confidence Level

Potential Risks

The potential for further downside exists if market sentiment shifts negatively due to macroeconomic news.

1 Month Prediction

Target: May 23, 2025$215

$210

$220

$205

Description

In a month, AAPL may recover to around 215.000 as it tests resistance levels. The Fibonacci retracement levels suggest a potential bounce back. However, the MACD remains bearish, indicating that upward momentum may be limited.

Analysis

AAPL has been in a bearish phase, with key support at 200 and resistance at 220. The ATR indicates high volatility, and recent volume spikes suggest traders are reacting to news. The market sentiment is cautious, and external factors could influence the stock's recovery.

Confidence Level

Potential Risks

Unforeseen market events or earnings surprises could lead to volatility and impact the prediction.

3 Months Prediction

Target: July 23, 2025$230

$225

$240

$220

Description

Three months from now, AAPL could reach around 230.000 if it breaks through resistance levels. The overall trend may shift bullish if the market stabilizes. However, the MACD and RSI indicate potential resistance at higher levels.

Analysis

The stock has shown significant volatility, with a bearish trend recently. Key support is at 200, while resistance is at 240. The MACD indicates bearish momentum, and the ATR suggests high volatility. Market sentiment remains cautious, and external factors could influence future performance.

Confidence Level

Potential Risks

Market volatility and economic conditions could significantly affect this prediction, leading to potential price declines.