AAPL Trading Predictions

1 Day Prediction

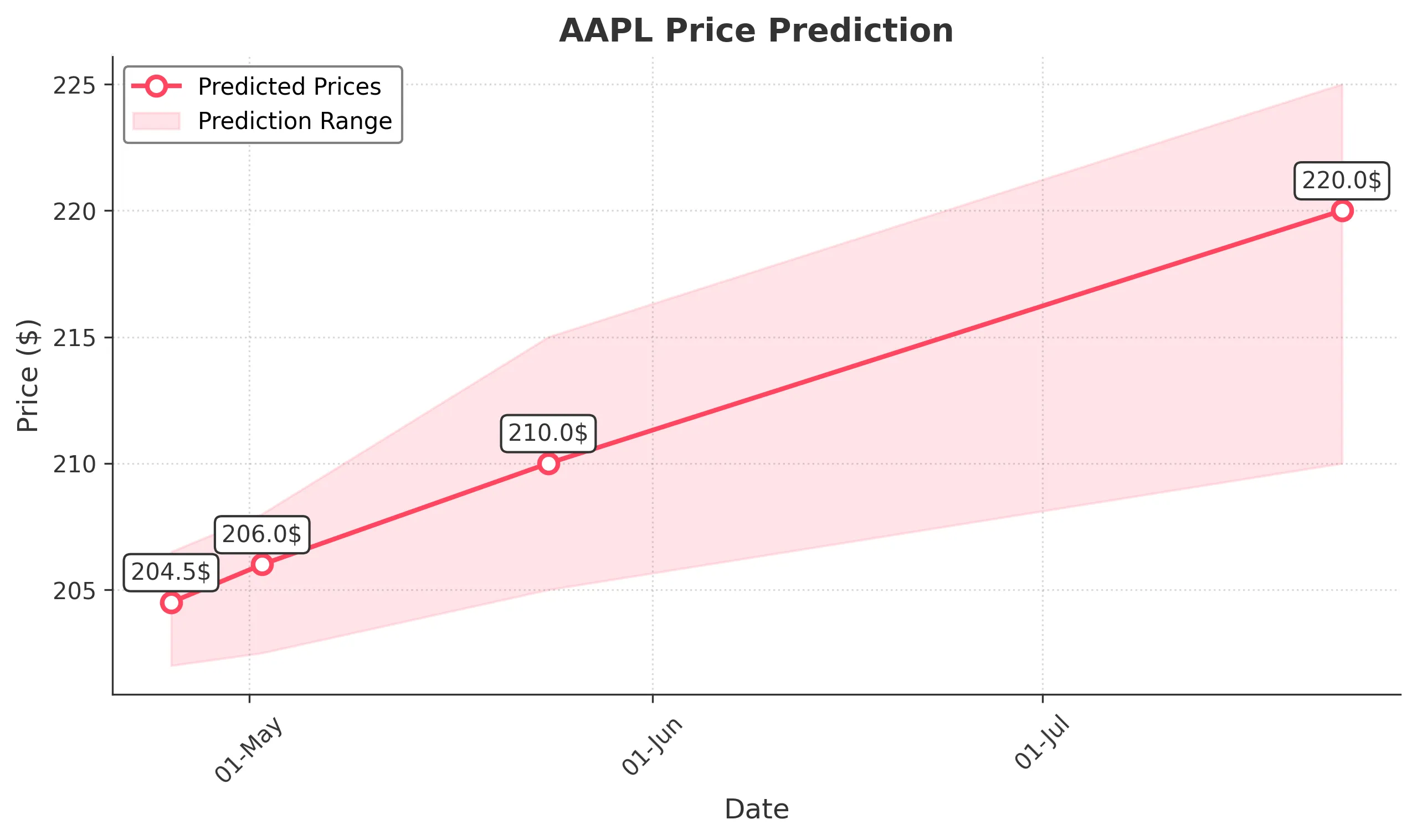

Target: April 25, 2025$204.5

$203.5

$206.5

$202

Description

AAPL shows a slight bearish trend with recent lower highs and lows. The RSI indicates oversold conditions, suggesting a potential bounce. However, the MACD is bearish, and volume has been declining, indicating caution.

Analysis

Over the past 3 months, AAPL has experienced significant volatility, with a bearish trend recently. Key support is around $200, while resistance is near $210. The MACD and RSI suggest potential for a short-term bounce, but overall sentiment remains cautious.

Confidence Level

Potential Risks

Market volatility and external news could impact the price significantly.

1 Week Prediction

Target: May 2, 2025$206

$204.5

$208

$202.5

Description

The price may stabilize as it approaches support levels. The Bollinger Bands indicate potential for a rebound, but the overall trend remains bearish. Watch for volume spikes that could signal a reversal.

Analysis

AAPL has shown a bearish trend with significant price drops. Support at $200 is critical, while resistance is at $210. The ATR indicates high volatility, and recent volume patterns suggest traders are cautious. A potential reversal could occur if bullish sentiment returns.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could lead to further declines.

1 Month Prediction

Target: May 24, 2025$210

$206.5

$215

$205

Description

If the bearish trend continues to stabilize, AAPL could see a gradual recovery. The Fibonacci retracement levels suggest a potential bounce back towards $210, but caution is advised due to overall market sentiment.

Analysis

AAPL's performance has been volatile, with a bearish trend dominating. Key support at $200 and resistance at $210 are critical. The RSI indicates potential for recovery, but external factors and market sentiment remain uncertain.

Confidence Level

Potential Risks

Continued bearish sentiment and macroeconomic factors could hinder recovery.

3 Months Prediction

Target: July 24, 2025$220

$215

$225

$210

Description

Assuming a recovery in market sentiment and stabilization of the stock, AAPL could reach $220. The technical indicators suggest a potential bullish reversal if the price holds above $210.

Analysis

AAPL has faced significant challenges, with a bearish trend recently. Key support at $200 and resistance at $210 are crucial. The overall market sentiment is cautious, and while a recovery is possible, external factors could heavily influence the stock's trajectory.

Confidence Level

Potential Risks

Long-term predictions are highly uncertain due to market volatility and potential economic downturns.