AAPL Trading Predictions

1 Day Prediction

Target: April 29, 2025$210.5

$209.5

$212

$208

Description

AAPL shows a slight bullish trend with recent support at 208.00. The RSI is neutral, and MACD indicates potential upward momentum. However, volatility remains high, suggesting caution. Volume is expected to be moderate as traders react to market sentiment.

Analysis

Over the past 3 months, AAPL has experienced significant volatility, with a bearish trend recently. Key support is at 208.00, while resistance is around 212.00. The MACD shows potential bullish divergence, but the RSI indicates overbought conditions. Volume spikes during sell-offs suggest caution.

Confidence Level

Potential Risks

Market volatility and external news could impact price direction. A bearish reversal is possible if support levels fail.

1 Week Prediction

Target: May 6, 2025$212

$210.5

$215

$207.5

Description

AAPL may see a recovery towards 212.00, supported by recent bullish candlestick patterns. The MACD is turning positive, indicating potential upward momentum. However, the market remains sensitive to macroeconomic news, which could affect trading volume.

Analysis

AAPL has shown a bearish trend recently, with significant price drops. The stock is currently testing support levels around 208.00. The MACD indicates a potential reversal, but the RSI suggests caution. Volume patterns indicate traders are hesitant, reflecting market uncertainty.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or earnings reports could lead to volatility, impacting the predicted price range.

1 Month Prediction

Target: May 28, 2025$220

$215

$225

$210

Description

AAPL is expected to recover towards 220.00 as bullish sentiment builds. The MACD shows a positive crossover, and the RSI is improving. However, external factors like interest rates and tech sector performance could influence the stock's trajectory.

Analysis

The stock has been volatile, with a recent bearish trend. However, signs of recovery are emerging, with support at 210.00. The MACD indicates bullish momentum, while the RSI is improving. Volume analysis shows increased interest, suggesting a potential upward trend.

Confidence Level

Potential Risks

Potential market corrections or negative news could hinder upward momentum, leading to price fluctuations.

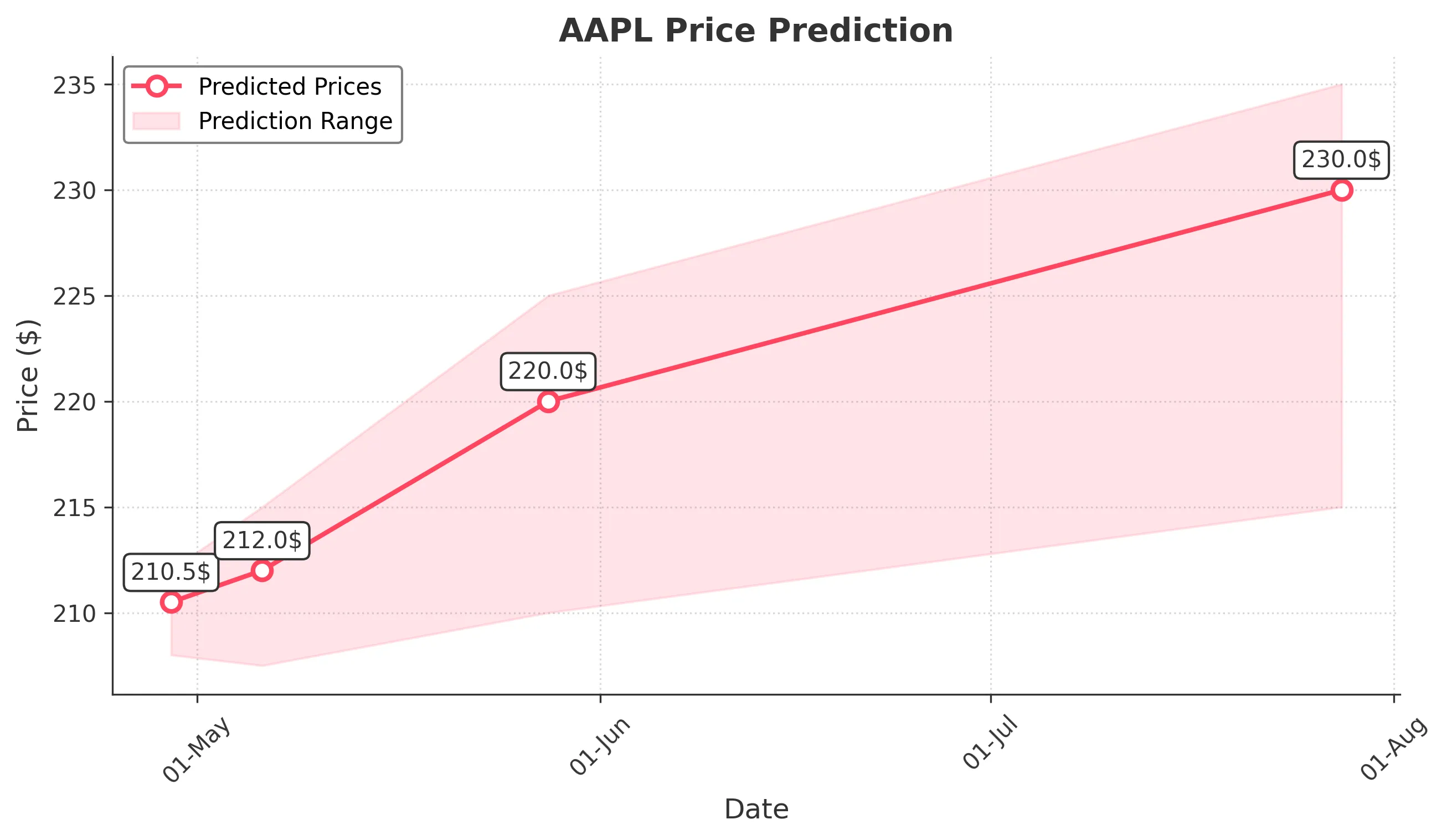

3 Months Prediction

Target: July 28, 2025$230

$225

$235

$215

Description

AAPL is projected to reach 230.00 as market conditions stabilize. The MACD indicates sustained bullish momentum, and the RSI is expected to remain healthy. However, macroeconomic factors and tech sector performance will be critical in determining price stability.

Analysis

AAPL has faced significant volatility, with a bearish trend recently. However, potential recovery signals are emerging. Key support is at 215.00, while resistance is at 235.00. The MACD shows bullish divergence, and volume patterns indicate growing interest, but caution is warranted.

Confidence Level

Potential Risks

Economic downturns or sector-specific issues could lead to unexpected price drops, affecting the forecast.