AAPL Trading Predictions

1 Day Prediction

Target: May 29, 2025$202.5

$201

$205

$200

Description

AAPL shows signs of consolidation around the 200-202 range. RSI indicates oversold conditions, suggesting a potential bounce. However, recent bearish candlestick patterns and high volatility may limit upside. Expect a slight recovery.

Analysis

Over the past 3 months, AAPL has experienced significant volatility, with a bearish trend recently. Key support at 200.00 has held, but resistance at 205.00 remains strong. Volume spikes indicate heightened trading activity, reflecting market uncertainty.

Confidence Level

Potential Risks

Market sentiment remains cautious due to macroeconomic uncertainties, which could lead to further declines.

1 Week Prediction

Target: June 5, 2025$205

$202.5

$210

$198

Description

AAPL may see a recovery towards 205.00 as it approaches key Fibonacci retracement levels. However, bearish momentum persists, and any negative news could trigger further declines.

Analysis

The stock has been in a bearish phase, with significant resistance at 210.00. Recent volume trends suggest traders are cautious, and the RSI indicates potential for a short-term bounce, but overall sentiment remains bearish.

Confidence Level

Potential Risks

Potential for market volatility and external economic factors could impact the stock's performance.

1 Month Prediction

Target: June 28, 2025$210

$205

$215

$195

Description

AAPL may stabilize around 210.00 as it tests resistance levels. The MACD shows signs of potential bullish divergence, but overall market conditions remain uncertain.

Analysis

The stock has shown a bearish trend with significant support at 200.00. Recent candlestick patterns suggest indecision, and while there is potential for a recovery, external factors could lead to further declines.

Confidence Level

Potential Risks

Economic indicators and earnings reports could sway market sentiment, leading to unexpected price movements.

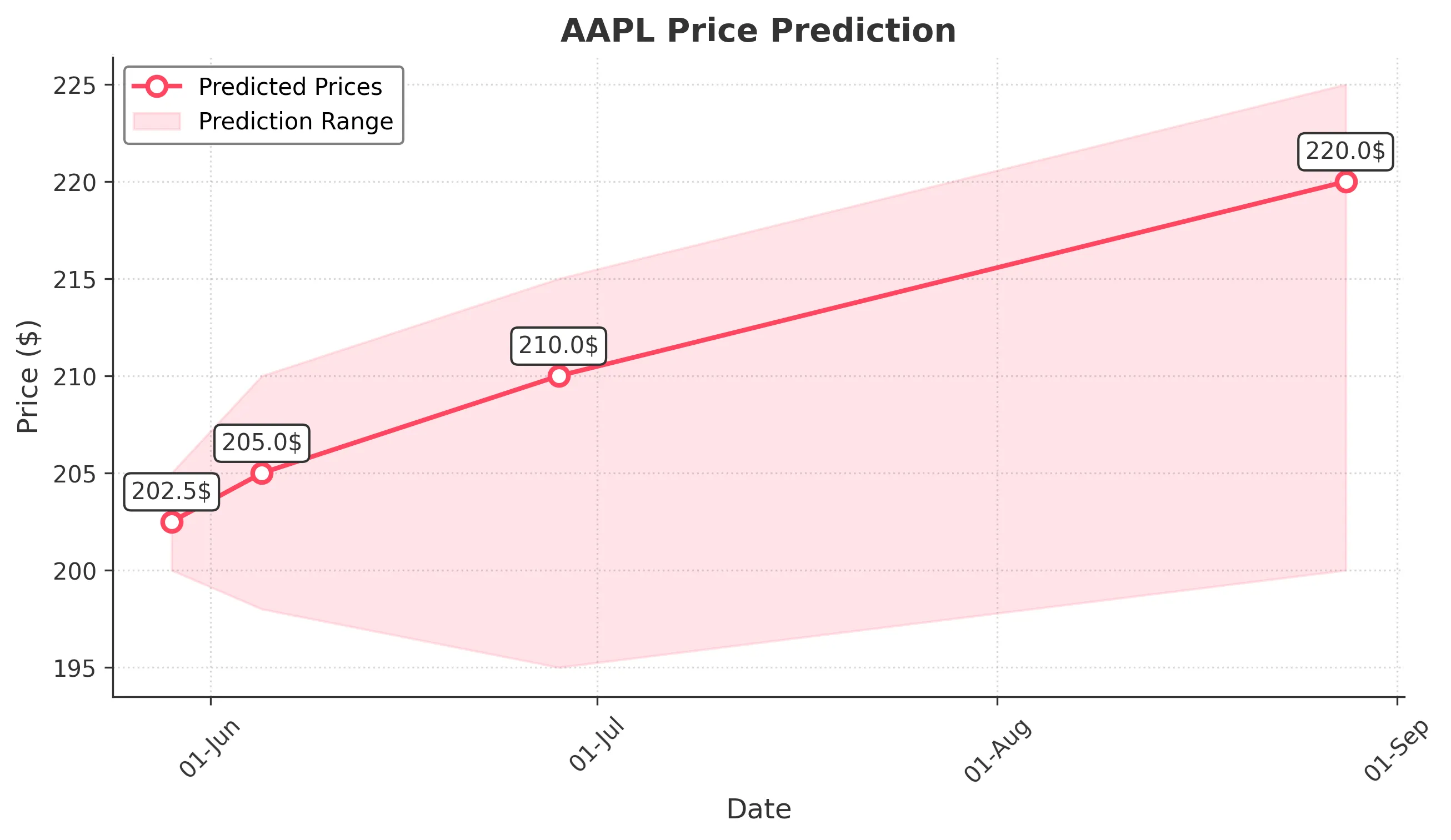

3 Months Prediction

Target: August 28, 2025$220

$215

$225

$200

Description

If market conditions improve, AAPL could reach 220.00, supported by potential positive earnings and recovery in tech stocks. However, risks remain due to macroeconomic factors.

Analysis

AAPL has faced a challenging environment with bearish trends dominating. Key resistance at 225.00 and support at 200.00 will be critical. The overall market sentiment is cautious, and any positive news could lead to a recovery.

Confidence Level

Potential Risks

Unforeseen economic events or changes in market sentiment could significantly impact the stock's trajectory.