AAPL Trading Predictions

1 Day Prediction

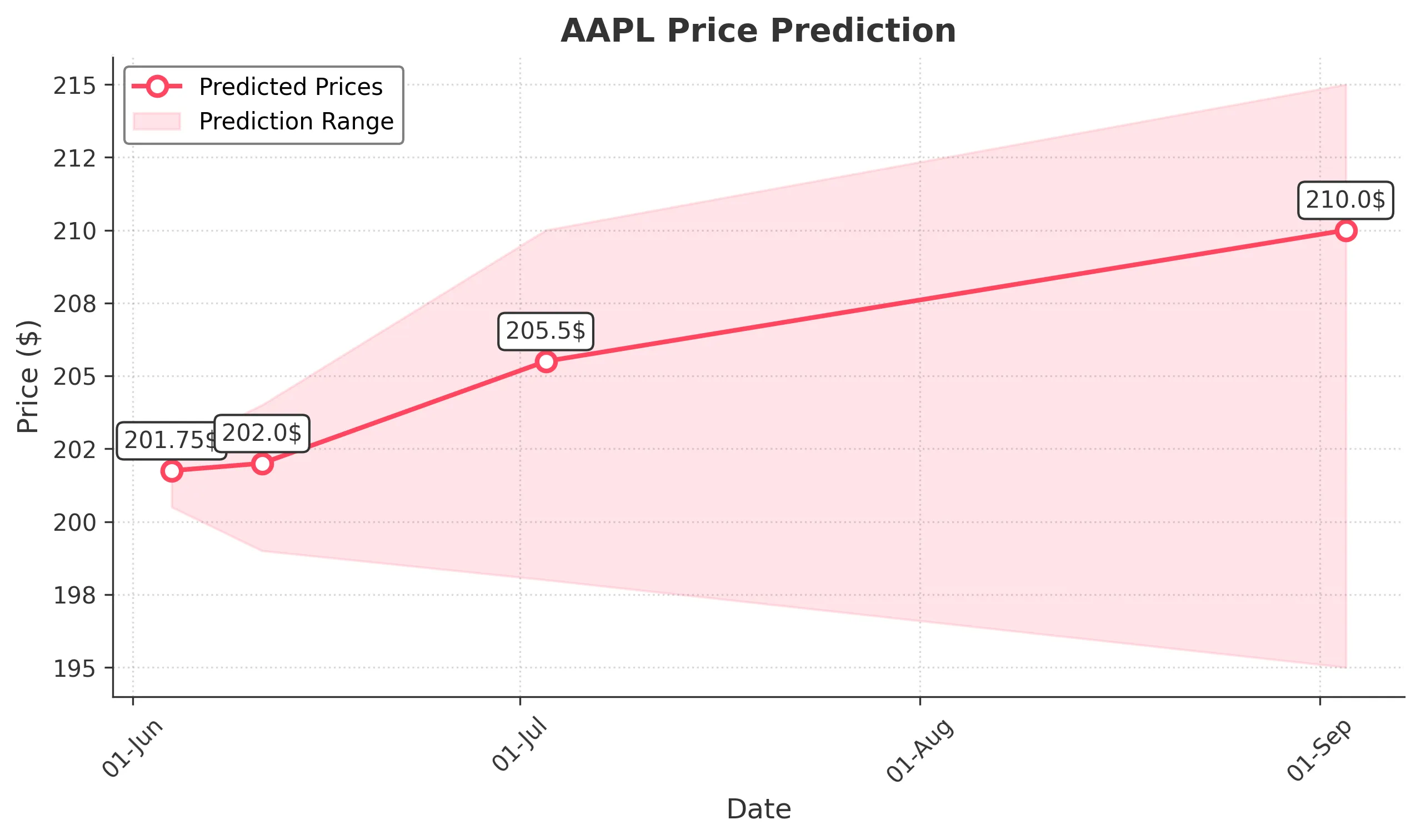

Target: June 4, 2025$201.75

$201.25

$202.5

$200.5

Description

AAPL shows a slight bullish trend with a recent Doji candlestick indicating indecision. The RSI is near neutral, suggesting potential for upward movement. However, recent volatility and lower volume may limit gains.

Analysis

Over the past 3 months, AAPL has experienced significant volatility, with a bearish trend recently. Key support at $200 has held, but resistance at $220 remains strong. The MACD shows a bearish crossover, indicating potential further declines.

Confidence Level

Potential Risks

Market sentiment is mixed, and external factors could lead to sudden price changes.

1 Week Prediction

Target: June 11, 2025$202

$201.5

$204

$199

Description

AAPL may stabilize around $202 as it tests support levels. The Bollinger Bands indicate potential for a bounce, but the MACD remains bearish. Volume trends suggest cautious trading ahead.

Analysis

The stock has shown a bearish trend with significant volume spikes during sell-offs. Support at $200 is critical, while resistance at $220 looms. The ATR indicates increased volatility, suggesting potential for sharp price movements.

Confidence Level

Potential Risks

Unforeseen market news or earnings reports could impact stock performance significantly.

1 Month Prediction

Target: July 3, 2025$205.5

$204

$210

$198

Description

AAPL may recover slightly as it approaches key Fibonacci retracement levels. The RSI indicates oversold conditions, suggesting a potential rebound. However, macroeconomic factors could hinder growth.

Analysis

The stock has been in a bearish phase, with significant resistance at $210. Recent trading patterns show a potential for recovery, but the overall market sentiment remains cautious. Volume analysis indicates a lack of strong buying interest.

Confidence Level

Potential Risks

Economic indicators and market sentiment could lead to unexpected volatility.

3 Months Prediction

Target: September 3, 2025$210

$208

$215

$195

Description

AAPL may trend upwards as it approaches the end of Q3, supported by seasonal trends. However, the MACD indicates potential bearish divergence, suggesting caution. Market conditions will be crucial.

Analysis

The stock has shown a bearish trend recently, with significant support at $200. The overall market sentiment is mixed, and while there are signs of recovery, external factors could lead to further declines. Key resistance remains at $215.

Confidence Level

Potential Risks

Potential economic downturns or changes in consumer sentiment could adversely affect stock performance.