AAPL Trading Predictions

1 Day Prediction

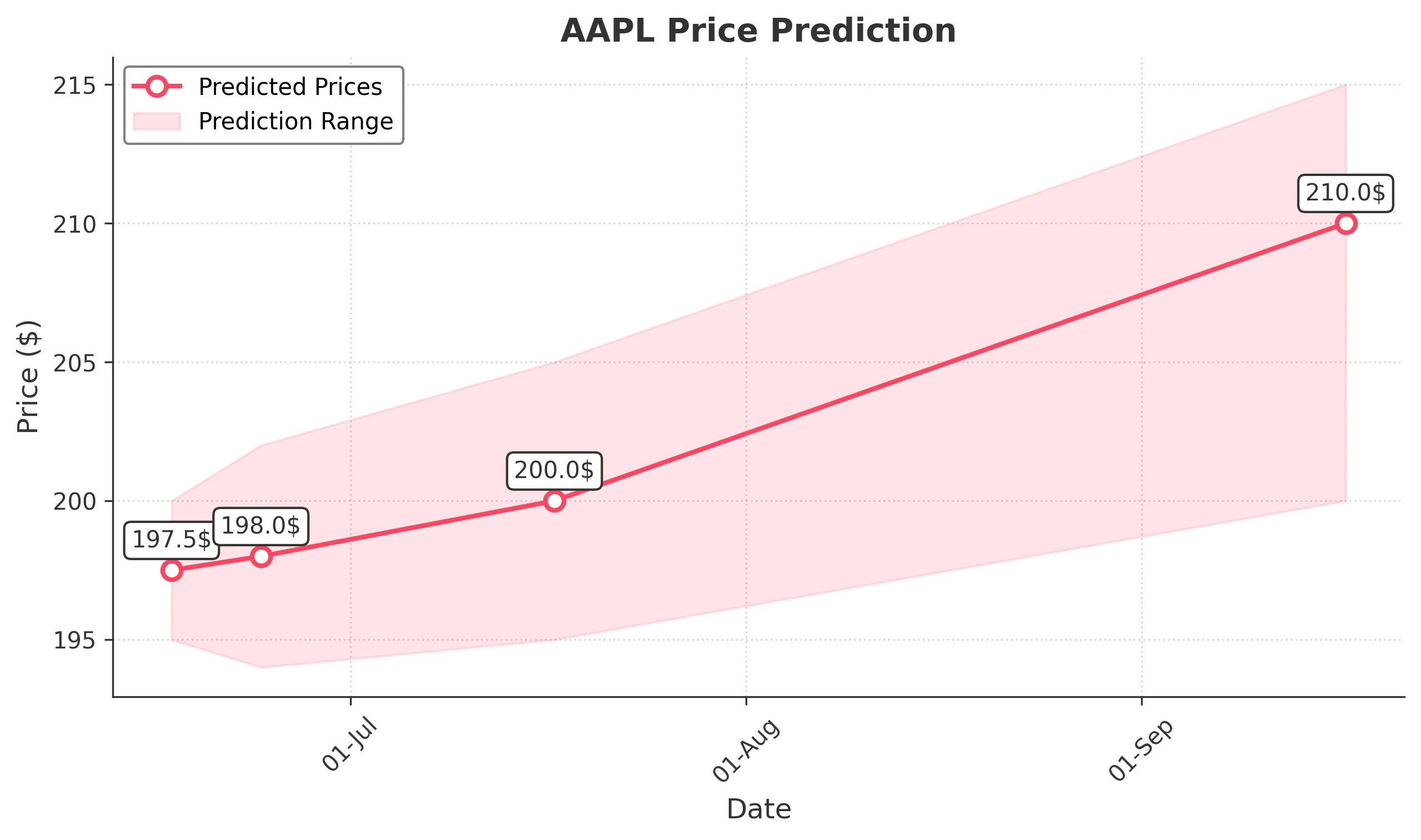

Target: June 17, 2025$197.5

$197

$200

$195

Description

AAPL shows a slight bearish trend with recent lower highs and lows. RSI indicates oversold conditions, suggesting a potential bounce. However, MACD is bearish, and volume has been declining, indicating caution.

Analysis

Over the past 3 months, AAPL has experienced significant volatility, with a bearish trend recently. Key support at $195 and resistance at $200. Technical indicators show mixed signals, with RSI indicating oversold conditions but MACD remaining bearish. Volume patterns suggest declining interest.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. AAPL's recent performance shows uncertainty.

1 Week Prediction

Target: June 24, 2025$198

$197.5

$202

$194

Description

Expect a slight recovery as AAPL approaches key support levels. The RSI may rebound from oversold territory, but MACD remains bearish. Watch for volume spikes that could indicate a reversal.

Analysis

AAPL's performance has been bearish, with significant price drops. Support at $195 is critical, while resistance is at $202. Technical indicators show mixed signals, with declining volume and bearish MACD. Market sentiment remains cautious.

Confidence Level

Potential Risks

Potential for further declines if market sentiment worsens or if macroeconomic factors negatively impact tech stocks.

1 Month Prediction

Target: July 17, 2025$200

$198.5

$205

$195

Description

AAPL may stabilize around $200 as it tests resistance levels. A potential bullish reversal could occur if volume increases and RSI improves. However, macroeconomic factors could still pose risks.

Analysis

The stock has shown bearish trends recently, with significant volatility. Key support at $195 and resistance at $205. Technical indicators suggest a potential stabilization, but overall market sentiment remains cautious.

Confidence Level

Potential Risks

Uncertainty in market conditions and potential negative news could hinder recovery. Watch for earnings reports and economic indicators.

3 Months Prediction

Target: September 17, 2025$210

$205

$215

$200

Description

If AAPL can break through resistance at $205, a bullish trend may develop. Positive earnings and market sentiment could drive prices higher, but caution is warranted due to potential macroeconomic headwinds.

Analysis

AAPL has faced significant challenges in the past months, with bearish trends dominating. Key resistance at $205 and support at $200. Technical indicators show potential for recovery, but external factors could influence performance.

Confidence Level

Potential Risks

Market volatility and external economic factors could impact the prediction. AAPL's performance is sensitive to broader market trends.