AAPL Trading Predictions

1 Day Prediction

Target: June 24, 2025$201.5

$200.8

$203

$199.5

Description

AAPL shows a slight bullish trend with a potential close around 201.50. The RSI is neutral, and MACD indicates a potential upward momentum. However, recent volatility suggests caution.

Analysis

Over the past 3 months, AAPL has experienced significant volatility, with a bearish trend recently. Key support at 195 and resistance at 210. The MACD is showing signs of recovery, but the RSI indicates potential overbought conditions.

Confidence Level

Potential Risks

Market sentiment could shift due to external news or earnings reports, impacting the prediction.

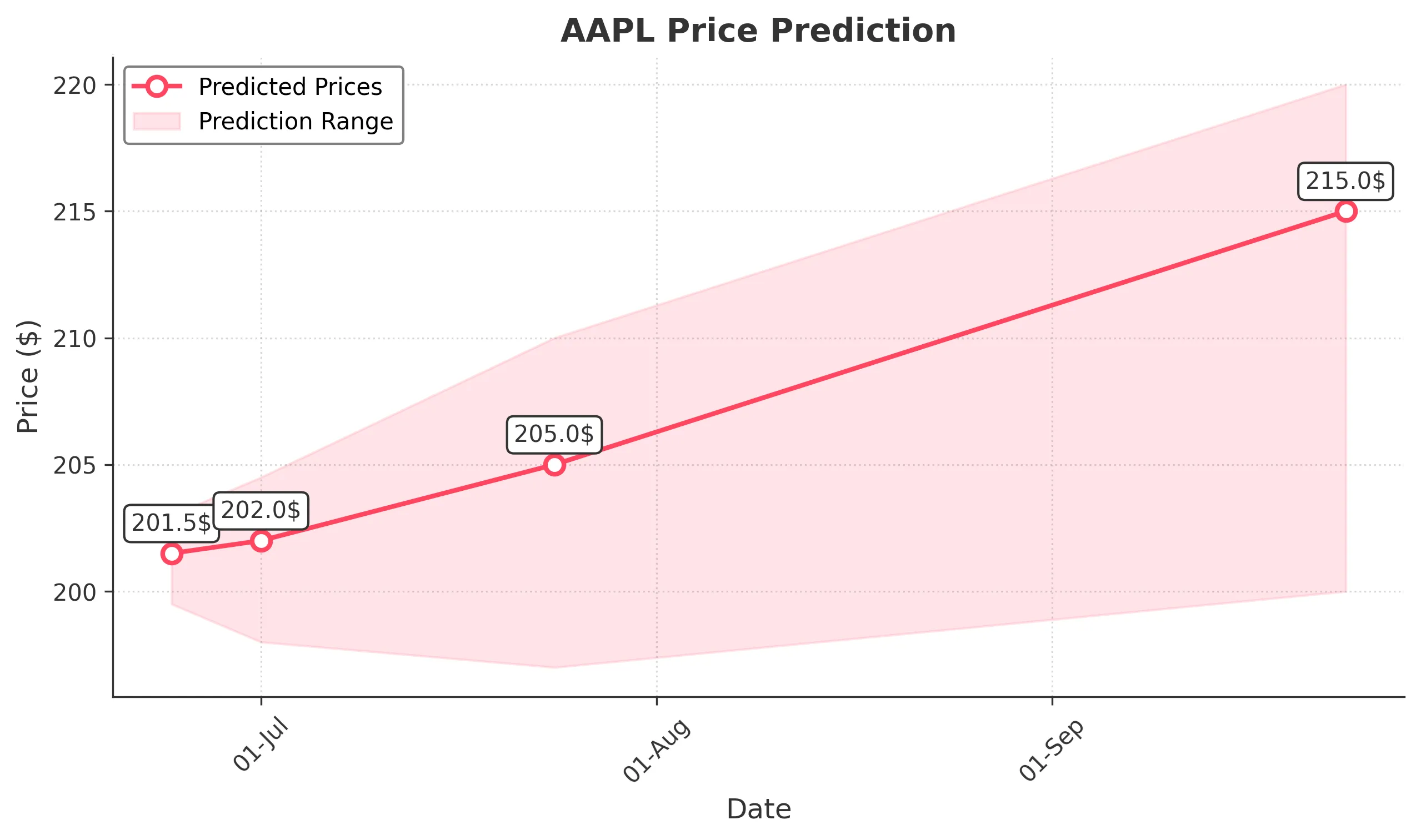

1 Week Prediction

Target: July 1, 2025$202

$201

$204.5

$198

Description

Expecting a close around 202.00 as AAPL stabilizes. The Bollinger Bands suggest a tightening range, indicating potential for a breakout. Volume trends are increasing, supporting this prediction.

Analysis

AAPL has shown a mix of bullish and bearish signals. The recent price action indicates a potential reversal, but the overall trend remains uncertain. Key levels to watch are 198 (support) and 204 (resistance).

Confidence Level

Potential Risks

Unforeseen macroeconomic events could lead to sudden price changes.

1 Month Prediction

Target: July 24, 2025$205

$202.5

$210

$197

Description

AAPL is expected to close around 205.00, reflecting a gradual recovery. The Fibonacci retracement levels suggest a potential bounce back towards 210. However, market sentiment remains mixed.

Analysis

The stock has been in a bearish phase but shows signs of stabilization. Key support at 197 and resistance at 210. The ATR indicates increased volatility, and the MACD is approaching a bullish crossover.

Confidence Level

Potential Risks

Continued volatility and external market factors could hinder recovery.

3 Months Prediction

Target: September 24, 2025$215

$210

$220

$200

Description

AAPL may reach 215.00 as it attempts to recover from recent lows. The long-term trend suggests a bullish reversal, but macroeconomic factors could impact this trajectory.

Analysis

The stock has fluctuated significantly, with a bearish trend recently. Key resistance at 220 and support at 200. The overall market sentiment is cautious, and external factors could heavily influence future performance.

Confidence Level

Potential Risks

Potential economic downturns or earnings misses could lead to significant price drops.