AAPL Trading Predictions

1 Day Prediction

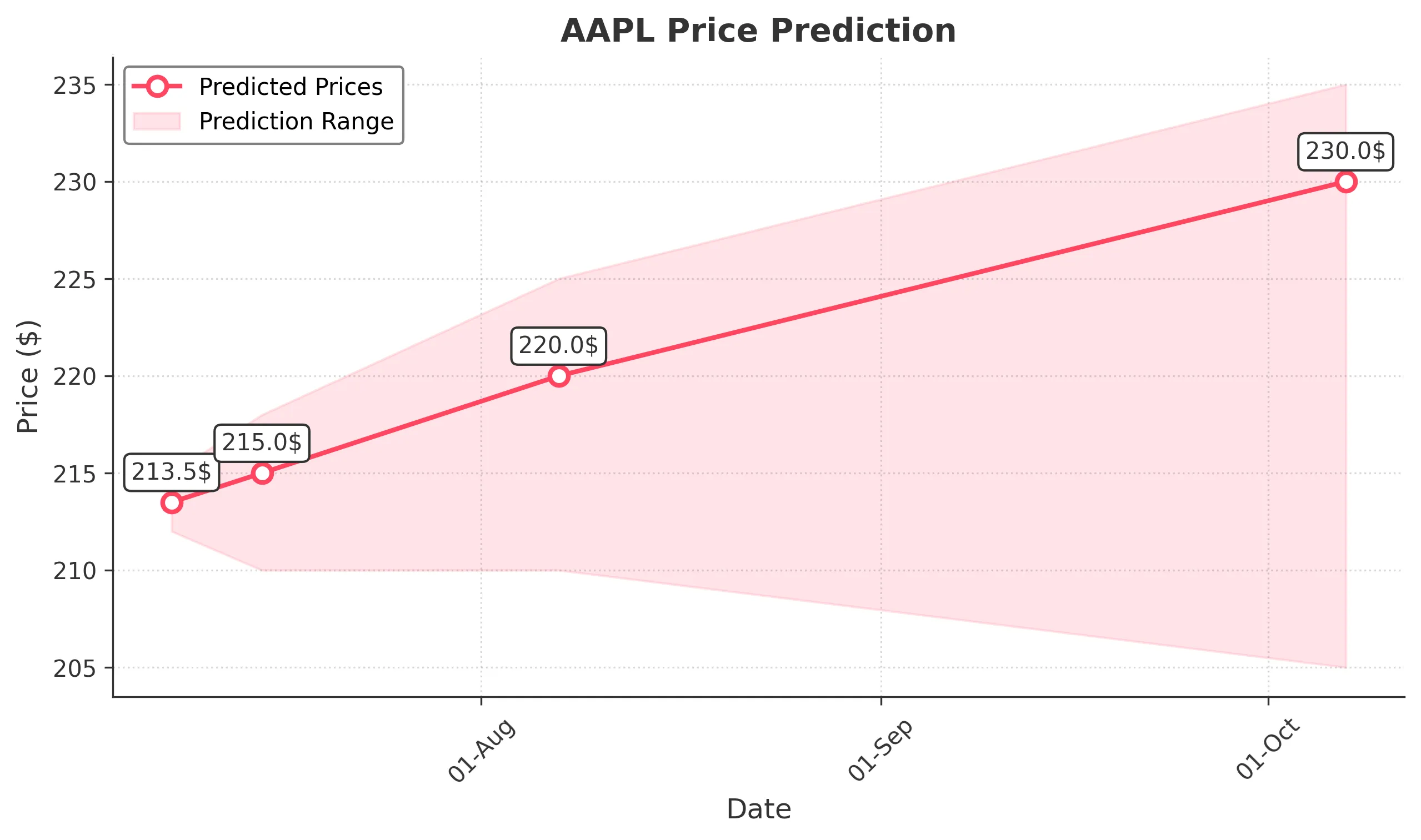

Target: July 8, 2025$213.5

$213

$215

$212

Description

AAPL shows bullish momentum with a recent close at 213.22. The RSI is near 60, indicating strength, while MACD is positive. A potential breakout above 213.55 could lead to further gains. However, watch for resistance at 215.00.

Analysis

AAPL has been in a bullish trend, recently breaking above key resistance levels. The 50-day moving average supports upward momentum. Volume has been stable, indicating healthy buying interest. However, the market sentiment remains cautious due to macroeconomic factors.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction.

1 Week Prediction

Target: July 15, 2025$215

$214.5

$218

$210

Description

The bullish trend is expected to continue, with potential resistance at 218.00. The MACD remains positive, and the RSI is healthy. However, a pullback could occur if the price fails to hold above 215.00.

Analysis

AAPL has shown strong performance, with recent highs indicating bullish sentiment. The stock is above its 50-day moving average, and volume spikes suggest increased interest. However, external economic factors may pose risks.

Confidence Level

Potential Risks

Potential market corrections and earnings reports could introduce volatility.

1 Month Prediction

Target: August 7, 2025$220

$215

$225

$210

Description

AAPL is likely to reach 220.00 as it continues its upward trajectory. The bullish trend is supported by strong fundamentals and positive market sentiment. Watch for potential resistance at 225.00.

Analysis

The stock has been trending upward, with significant support at 210.00. Technical indicators suggest continued bullish momentum, but external factors could lead to volatility. Volume patterns indicate strong buying interest.

Confidence Level

Potential Risks

Economic data releases and geopolitical events could affect market stability.

3 Months Prediction

Target: October 7, 2025$230

$220

$235

$205

Description

AAPL may reach 230.00 in three months, driven by strong earnings and product launches. However, resistance at 235.00 could limit gains. Monitor for any bearish signals in the market.

Analysis

AAPL has shown resilience, but the market is facing potential headwinds. The stock is above key moving averages, but external economic conditions could impact performance. Volume trends suggest cautious optimism.

Confidence Level

Potential Risks

Long-term predictions are uncertain due to market fluctuations and potential economic downturns.