AAPL Trading Predictions

1 Day Prediction

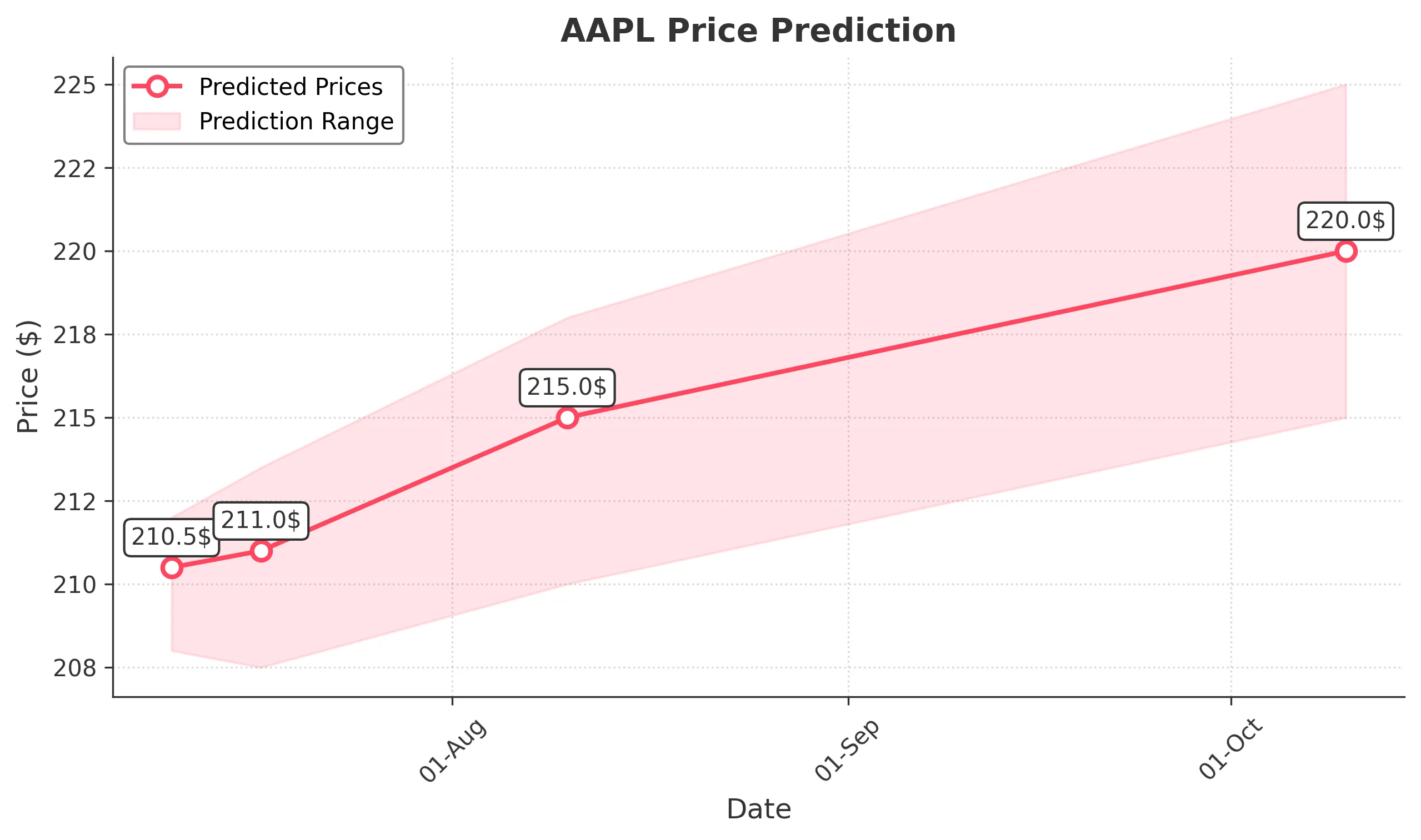

Target: July 10, 2025$210.5

$210

$212

$208

Description

AAPL shows a slight bullish trend with recent support at 209.5. The RSI is neutral, and MACD indicates potential upward momentum. However, volatility remains, and external market factors could influence price.

Analysis

Over the past 3 months, AAPL has shown a bullish trend with significant resistance around 212. Recent volume spikes indicate strong interest. However, the stock has faced volatility, and the RSI suggests caution as it approaches overbought territory.

Confidence Level

Potential Risks

Market sentiment could shift due to macroeconomic news or earnings reports, which may impact the prediction.

1 Week Prediction

Target: July 17, 2025$211

$210.5

$213.5

$207.5

Description

The stock is expected to maintain its upward trajectory, supported by recent bullish candlestick patterns. However, resistance at 213.5 may limit gains. Watch for volume trends to confirm direction.

Analysis

AAPL has been in a bullish phase, with key support at 208. Recent price action shows a series of higher lows. The MACD is bullish, but the stock is nearing overbought levels, suggesting a possible pullback.

Confidence Level

Potential Risks

Potential market corrections or negative news could reverse the trend, impacting the accuracy of this prediction.

1 Month Prediction

Target: August 10, 2025$215

$211.5

$218

$210

Description

AAPL is likely to continue its upward trend, driven by strong earnings expectations and positive market sentiment. However, resistance at 218 could pose challenges. Monitor for any shifts in macroeconomic conditions.

Analysis

The stock has shown resilience with a bullish trend, supported by strong volume and positive technical indicators. Key resistance levels are at 218, while support remains at 210. The overall market sentiment is cautiously optimistic.

Confidence Level

Potential Risks

Unexpected earnings results or economic data could lead to volatility, affecting the stock's performance.

3 Months Prediction

Target: October 10, 2025$220

$219

$225

$215

Description

Long-term outlook remains bullish as AAPL is expected to benefit from product launches and strong sales. However, potential market corrections and economic uncertainties could impact growth.

Analysis

AAPL has maintained a strong performance over the past three months, with bullish momentum and increasing volume. Key support is at 215, while resistance is at 225. The market sentiment is generally positive, but external factors could introduce risks.

Confidence Level

Potential Risks

Macroeconomic factors, including interest rates and inflation, could create volatility and affect the stock's trajectory.