AAPL Trading Predictions

1 Day Prediction

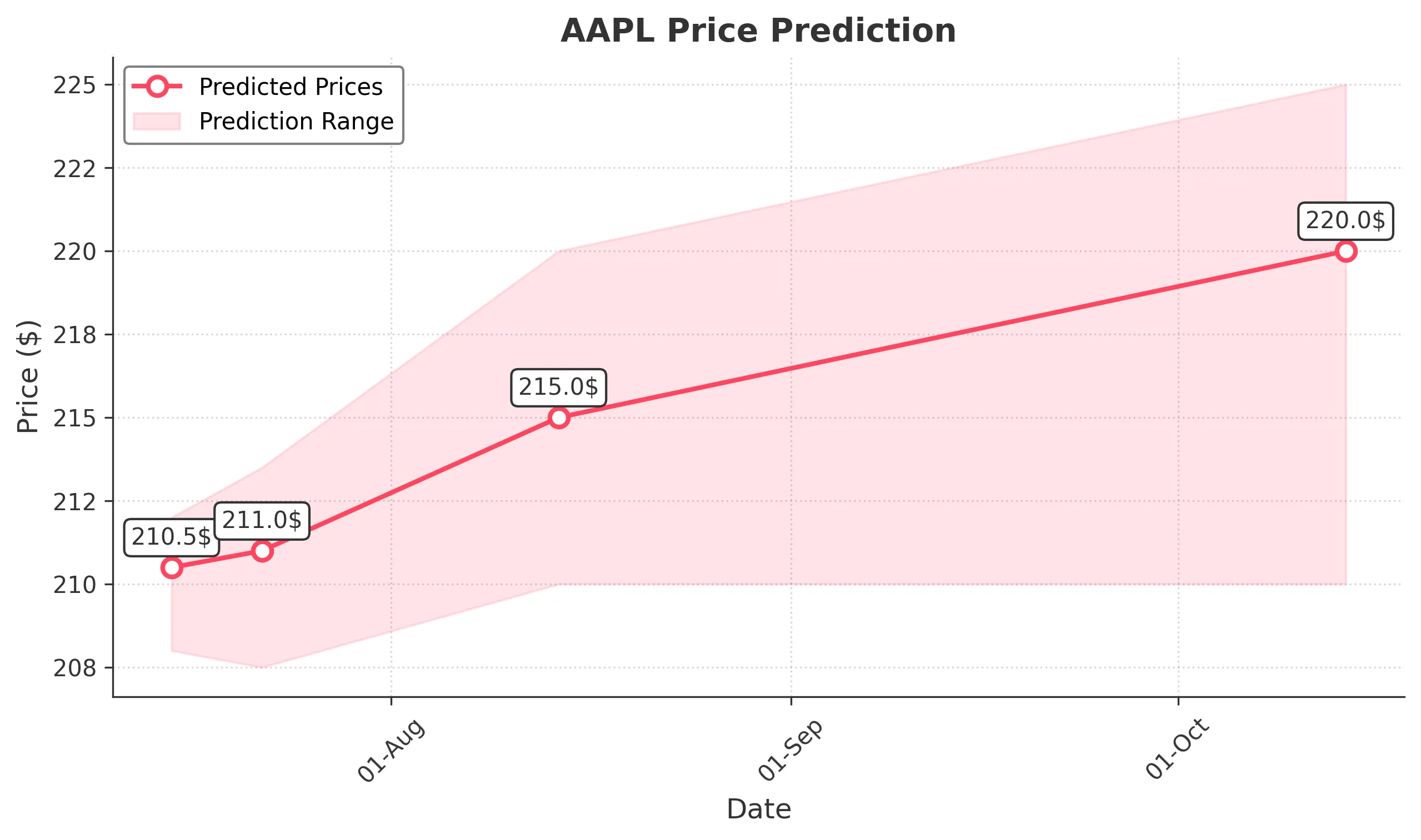

Target: July 15, 2025$210.5

$209.8

$212

$208

Description

AAPL shows a slight bullish trend with a recent Doji candlestick indicating indecision. The RSI is neutral, and MACD is close to crossing above the signal line, suggesting potential upward momentum. However, recent volatility may lead to fluctuations.

Analysis

Over the past 3 months, AAPL has experienced a mix of bullish and bearish trends, with significant support at $200 and resistance around $212. The recent price action shows a recovery from lows, but volatility remains high, indicating potential for both upward and downward movements.

Confidence Level

Potential Risks

Market sentiment could shift due to macroeconomic news or earnings reports, which may impact the stock's performance.

1 Week Prediction

Target: July 22, 2025$211

$210

$213.5

$207.5

Description

The stock is expected to maintain a bullish trend with potential resistance at $213. The MACD indicates a bullish crossover, and the RSI is approaching overbought territory, suggesting upward pressure. However, profit-taking could lead to pullbacks.

Analysis

AAPL has shown resilience with a recent upward trend, bouncing off support levels. The volume has been increasing, indicating strong interest. Key resistance at $213 may pose challenges, but overall sentiment remains positive.

Confidence Level

Potential Risks

External factors such as economic data releases or geopolitical events could introduce volatility and affect the stock's trajectory.

1 Month Prediction

Target: August 14, 2025$215

$212

$220

$210

Description

AAPL is projected to continue its upward trend, supported by strong earnings expectations and positive market sentiment. The Bollinger Bands suggest potential for price expansion, while the RSI indicates bullish momentum. Watch for any signs of reversal.

Analysis

The stock has been trending upward, with key support at $210 and resistance at $220. Technical indicators suggest bullish momentum, but caution is warranted as market conditions can change rapidly.

Confidence Level

Potential Risks

Earnings reports and broader market conditions could lead to unexpected volatility, impacting the stock's performance.

3 Months Prediction

Target: October 14, 2025$220

$215

$225

$210

Description

AAPL is expected to reach new highs as market conditions improve and product launches drive demand. The Fibonacci retracement levels indicate potential upward targets, but overbought conditions may lead to corrections.

Analysis

AAPL has shown strong performance with a bullish trend, but the market is susceptible to fluctuations. Key support at $210 and resistance at $225 will be critical in determining future price movements. Overall, the outlook remains cautiously optimistic.

Confidence Level

Potential Risks

Market corrections, economic downturns, or negative news could significantly impact the stock's trajectory, leading to potential declines.