AAPL Trading Predictions

1 Day Prediction

Target: July 16, 2025$209.5

$209

$211

$208

Description

AAPL shows a slight bullish trend with recent support at 208.00. The RSI is neutral, and MACD indicates potential upward momentum. However, recent volatility suggests caution. Expect a close around 209.50.

Analysis

Over the past 3 months, AAPL has shown a mix of bullish and bearish trends, with significant resistance around 213.50 and support near 208.00. The recent drop in volume indicates potential indecision among traders.

Confidence Level

Potential Risks

Market sentiment could shift due to external news or earnings reports, impacting the prediction.

1 Week Prediction

Target: July 23, 2025$210

$209.5

$212.5

$207.5

Description

AAPL is expected to stabilize around 210.00 as it tests resistance levels. The Bollinger Bands suggest a squeeze, indicating potential volatility. Watch for volume spikes that could signal a breakout.

Analysis

The stock has been trading sideways with a slight bullish bias. Key support at 208.00 and resistance at 213.50 remain critical. Volume patterns indicate a lack of strong conviction in either direction.

Confidence Level

Potential Risks

Potential market corrections or external economic factors could lead to unexpected price movements.

1 Month Prediction

Target: August 15, 2025$215

$210

$220

$205

Description

AAPL may rally towards 215.00 as it breaks through resistance levels. The MACD shows bullish divergence, and the RSI is approaching overbought territory, suggesting upward momentum.

Analysis

AAPL has shown resilience with a bullish trend, supported by strong fundamentals. The stock is approaching key Fibonacci retracement levels, indicating potential for further gains if momentum continues.

Confidence Level

Potential Risks

Earnings reports or macroeconomic changes could impact the stock's performance significantly.

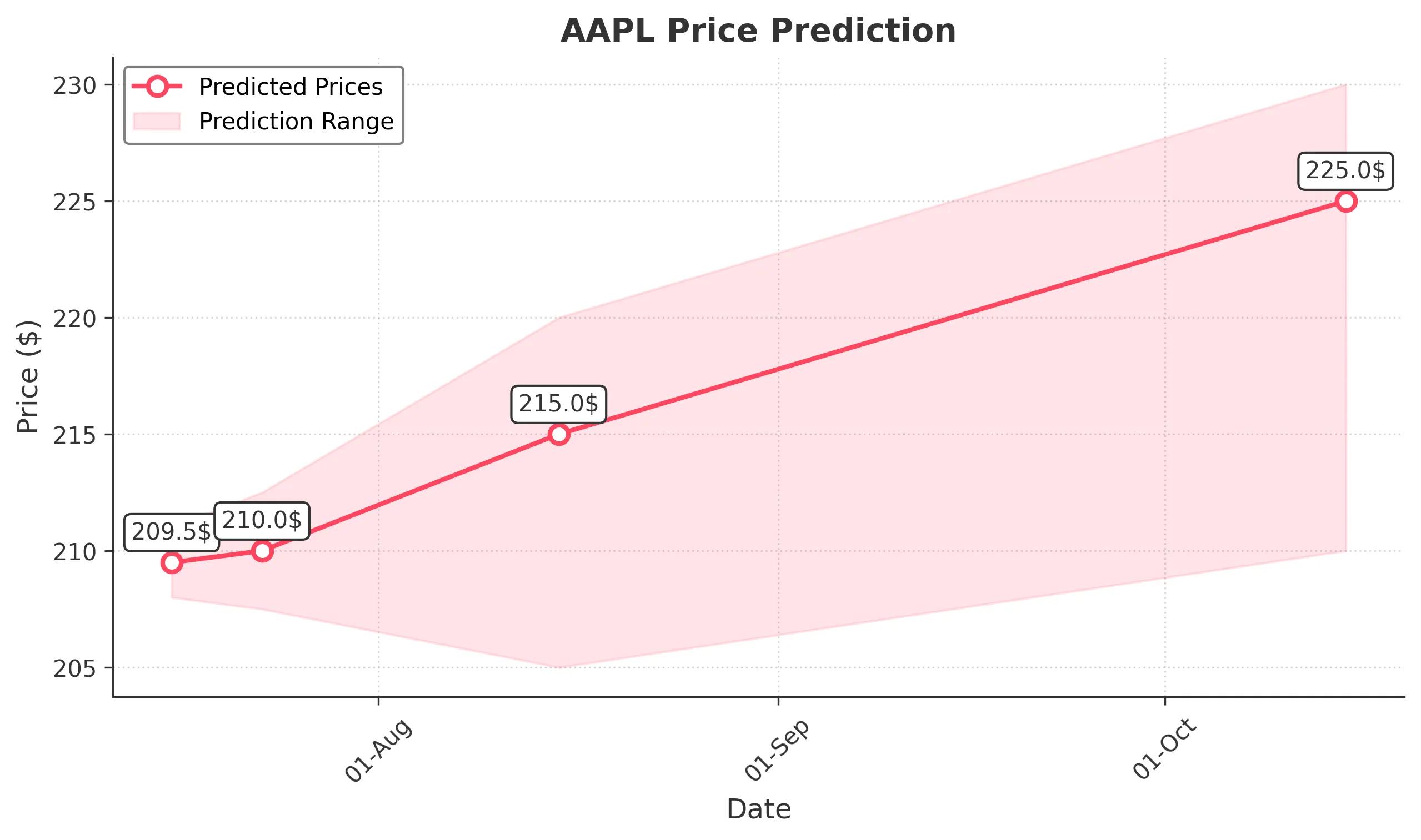

3 Months Prediction

Target: October 15, 2025$225

$220

$230

$210

Description

Long-term outlook for AAPL is bullish, targeting 225.00 as it breaks past previous highs. Continued strong earnings and product launches could drive the price higher, despite potential market corrections.

Analysis

The stock has been on a bullish trajectory, with significant support at 210.00. Technical indicators suggest a strong upward trend, but external factors could introduce volatility. Investors should remain cautious.

Confidence Level

Potential Risks

Global economic conditions and competitive pressures could pose risks to achieving this target.