AAPL Trading Predictions

1 Day Prediction

Target: July 19, 2025$210.5

$210.25

$212

$209

Description

AAPL shows a slight bullish trend with a recent Doji candlestick indicating indecision. The RSI is neutral, and MACD is close to crossing above the signal line, suggesting potential upward momentum. However, recent volatility may lead to fluctuations.

Analysis

Over the past 3 months, AAPL has shown a mix of bullish and bearish trends, with significant support around $200 and resistance near $213. The recent price action indicates a potential recovery, but volatility remains high, influenced by macroeconomic factors.

Confidence Level

Potential Risks

Market sentiment could shift due to external news or earnings reports, which may impact the stock's performance.

1 Week Prediction

Target: July 26, 2025$211

$210.75

$213.5

$208.5

Description

The bullish trend may continue as the stock approaches key Fibonacci retracement levels. The MACD shows a bullish crossover, and the RSI is nearing overbought territory, indicating potential upward pressure. However, watch for profit-taking.

Analysis

AAPL has been fluctuating around key support and resistance levels, with recent bullish momentum. The average volume has increased, indicating heightened interest. Technical indicators suggest a potential upward trend, but caution is warranted due to market volatility.

Confidence Level

Potential Risks

If market sentiment shifts negatively or if there are unexpected earnings results, the stock could face downward pressure.

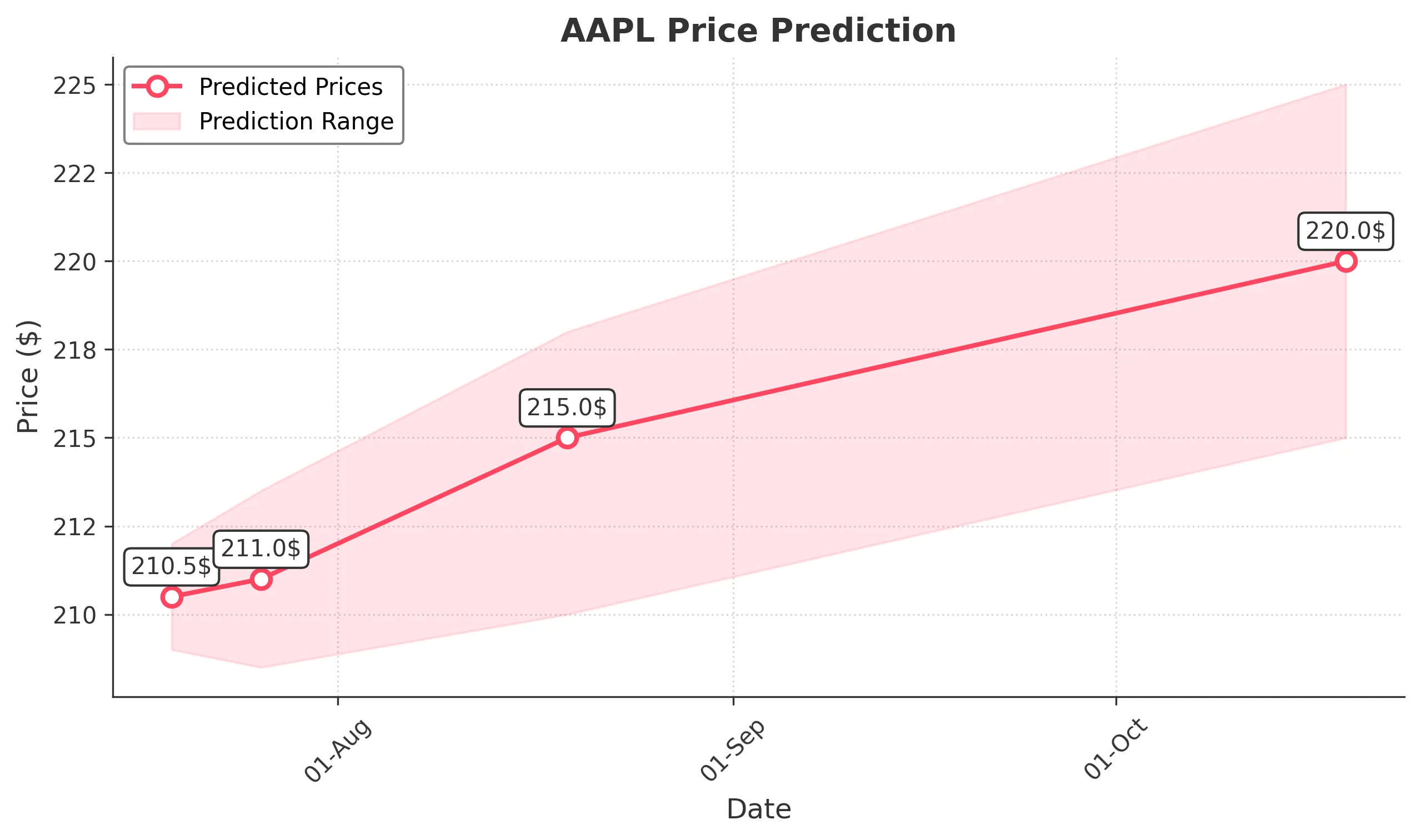

1 Month Prediction

Target: August 19, 2025$215

$214

$218

$210

Description

AAPL is likely to continue its upward trajectory as it breaks through resistance levels. The Bollinger Bands indicate potential for expansion, and the MACD remains bullish. However, the RSI suggests caution as it approaches overbought levels.

Analysis

The stock has shown resilience with a bullish trend, supported by strong volume. Key resistance levels are being tested, and while the outlook is positive, external factors could introduce volatility. The overall sentiment remains cautiously optimistic.

Confidence Level

Potential Risks

Economic data releases or geopolitical events could impact market sentiment and lead to volatility.

3 Months Prediction

Target: October 19, 2025$220

$219

$225

$215

Description

Long-term indicators suggest a bullish trend as AAPL approaches new highs. The MACD remains strong, and the stock is likely to benefit from seasonal trends. However, potential market corrections could occur, so caution is advised.

Analysis

AAPL has demonstrated a strong performance over the past three months, with bullish momentum and increasing volume. Key support levels are holding, but external economic factors and market sentiment could introduce risks. The outlook remains positive, but volatility is a concern.

Confidence Level

Potential Risks

Market corrections or negative news could lead to significant price adjustments, impacting the forecast.