AAPL Trading Predictions

1 Day Prediction

Target: July 22, 2025$214.5

$213.5

$215.5

$212

Description

AAPL shows bullish momentum with a recent close above the 50-day moving average. RSI indicates overbought conditions, suggesting a potential pullback. However, strong volume and positive market sentiment may drive prices higher in the short term.

Analysis

Over the past 3 months, AAPL has shown a bullish trend with significant support at $200 and resistance around $215. Recent volume spikes indicate strong buying interest. However, the RSI suggests overbought conditions, which could lead to short-term corrections.

Confidence Level

Potential Risks

Potential for a pullback due to overbought RSI and market volatility.

1 Week Prediction

Target: July 29, 2025$215

$214

$216.5

$210

Description

The bullish trend is expected to continue, supported by strong earnings reports and positive market sentiment. However, the MACD shows signs of divergence, indicating potential weakness. Watch for volume trends to confirm the bullish outlook.

Analysis

AAPL has maintained a bullish trend with key support at $210. The MACD is showing divergence, which could signal a weakening trend. Volume analysis indicates strong buying interest, but external factors could impact future performance.

Confidence Level

Potential Risks

Market sentiment could shift due to macroeconomic news or earnings surprises.

1 Month Prediction

Target: August 21, 2025$220

$215

$225

$210

Description

AAPL is expected to reach new highs as it breaks through resistance levels. Positive earnings and product launches may drive the price higher. However, watch for potential corrections as the stock approaches overbought territory.

Analysis

The stock has shown a strong upward trend with significant resistance at $220. The recent bullish candlestick patterns suggest continued upward momentum, but the RSI indicates potential overbought conditions, which could lead to corrections.

Confidence Level

Potential Risks

Possible corrections due to profit-taking or negative macroeconomic news.

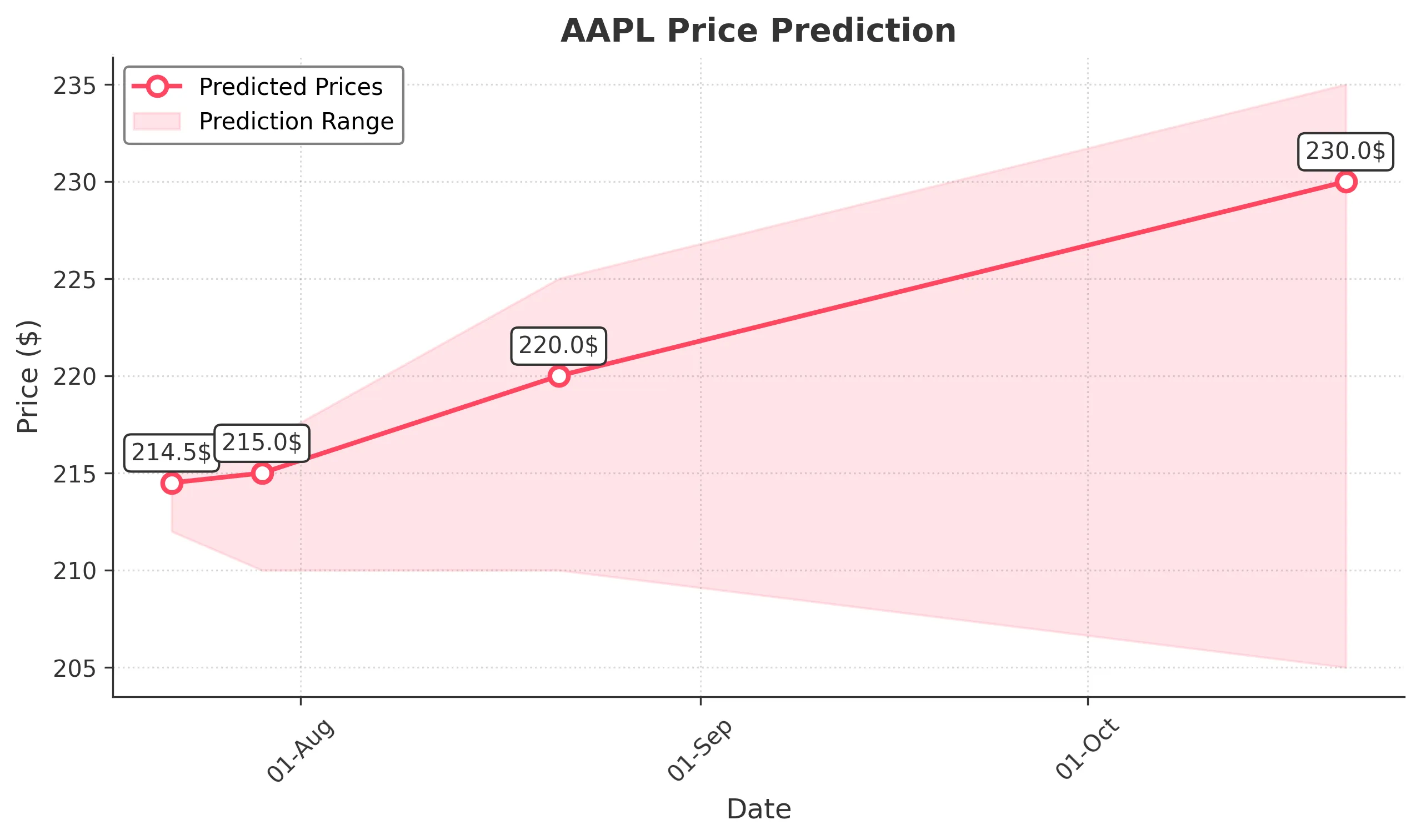

3 Months Prediction

Target: October 21, 2025$230

$225

$235

$205

Description

Long-term bullish sentiment is supported by strong fundamentals and market trends. However, potential economic downturns or competitive pressures could impact growth. Monitor for signs of market corrections.

Analysis

AAPL has shown resilience with a bullish trend over the past 3 months. Key support is at $205, while resistance is at $235. The stock's performance is influenced by macroeconomic factors, and while the outlook is positive, risks remain.

Confidence Level

Potential Risks

Economic uncertainties and competitive pressures could lead to volatility.