AAPL Trading Predictions

1 Day Prediction

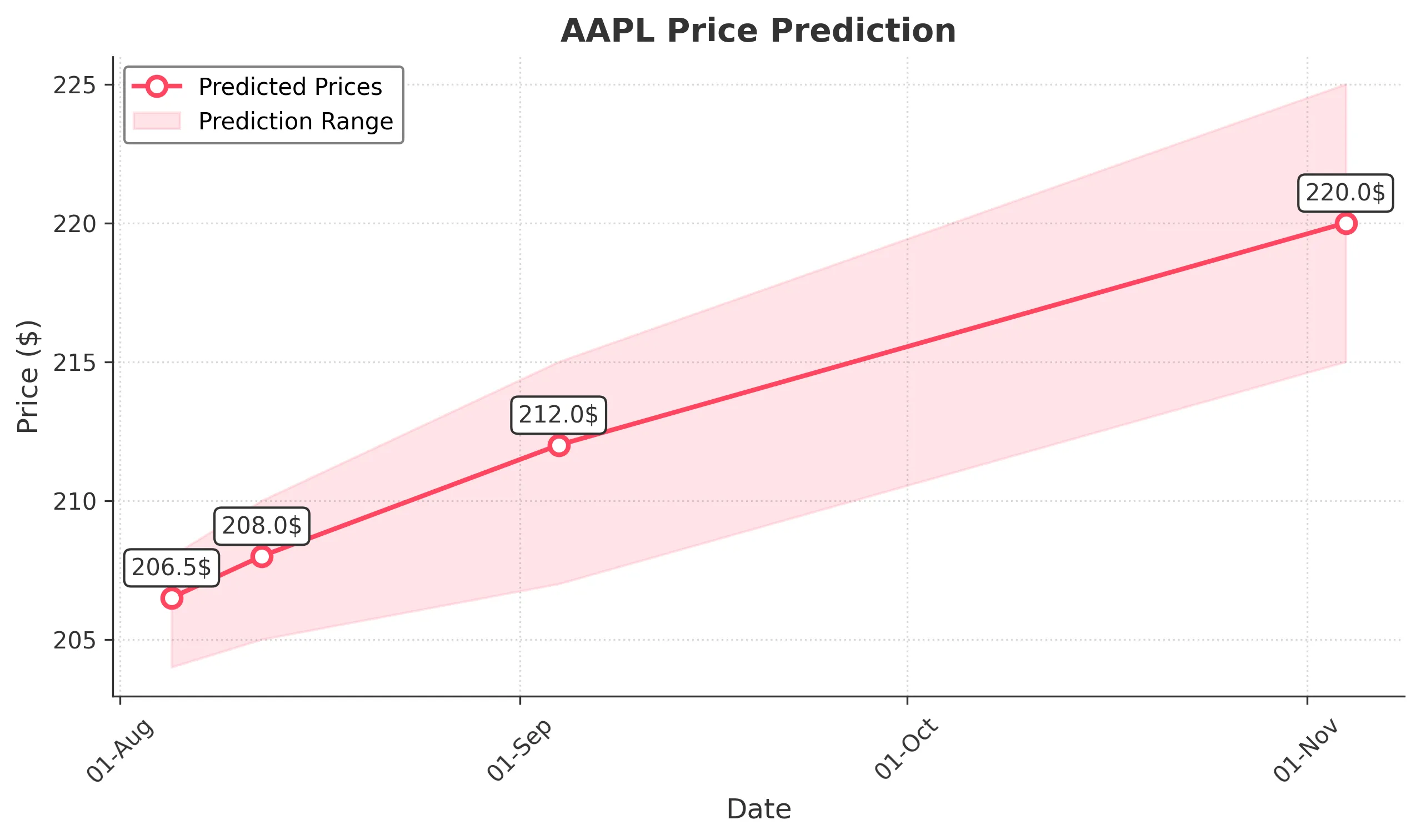

Target: August 5, 2025$206.5

$205.5

$208

$204

Description

AAPL shows a slight bullish trend with a potential recovery after recent declines. The RSI is approaching oversold levels, indicating a possible bounce. However, the recent high volume on the down days raises caution about further declines.

Analysis

Over the past 3 months, AAPL has experienced a bearish trend with significant support around $200. The recent price action shows a potential reversal, but the overall market sentiment is cautious. Key indicators like MACD are showing bearish divergence, while volume spikes suggest increased selling pressure.

Confidence Level

Potential Risks

Market sentiment remains volatile, and external news could impact the stock's performance unexpectedly.

1 Week Prediction

Target: August 12, 2025$208

$206.5

$210

$205

Description

AAPL may see a moderate recovery as it approaches key resistance levels. The Bollinger Bands indicate potential upward movement, but the MACD remains bearish. Watch for volume spikes that could signal a reversal.

Analysis

The stock has been in a bearish phase, with significant resistance at $210. Recent candlestick patterns suggest indecision, and the ATR indicates increased volatility. The RSI is recovering but still below neutral, indicating potential for further downside.

Confidence Level

Potential Risks

Uncertainty in macroeconomic conditions and potential earnings reports could lead to volatility.

1 Month Prediction

Target: September 4, 2025$212

$210

$215

$207

Description

AAPL is expected to stabilize and potentially rally as it approaches key Fibonacci retracement levels. The market sentiment may improve, but caution is advised due to recent bearish trends.

Analysis

The past three months have shown a bearish trend with significant support at $200. The stock is currently testing resistance levels, and the MACD indicates potential for a bullish crossover. However, the overall market sentiment remains mixed, and external factors could impact performance.

Confidence Level

Potential Risks

Market volatility and external economic factors could hinder recovery efforts.

3 Months Prediction

Target: November 4, 2025$220

$218

$225

$215

Description

AAPL may experience a bullish trend as it breaks through resistance levels. Positive market sentiment and potential product launches could drive prices higher, but caution is warranted due to potential market corrections.

Analysis

The stock has shown signs of recovery, with key resistance levels being tested. The MACD is showing bullish momentum, and the RSI is approaching overbought territory. However, the market remains sensitive to external news, which could lead to volatility.

Confidence Level

Potential Risks

Economic conditions and competitive pressures could impact growth expectations.