AMZN Trading Predictions

1 Day Prediction

Target: April 3, 2025$190

$189.5

$192

$188

Description

The stock shows a slight bearish trend with recent lower highs and lower lows. RSI indicates oversold conditions, suggesting a potential bounce. However, MACD is bearish, and volume is declining, indicating weak buying interest.

Analysis

AMZN has been in a bearish trend over the past three months, with significant support around $190. Technical indicators show mixed signals, with RSI nearing oversold levels but MACD indicating continued bearish momentum. Volume has been inconsistent, suggesting uncertainty.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. A sudden positive catalyst could reverse the trend.

1 Week Prediction

Target: April 10, 2025$192.5

$190.5

$195

$189

Description

A potential short-term recovery is expected as the stock approaches key support levels. The RSI may recover from oversold conditions, and a bullish divergence could form if prices stabilize. However, MACD remains bearish.

Analysis

The stock has shown a bearish trend with significant resistance at $195. Recent candlestick patterns indicate indecision, and volume spikes suggest potential reversals. Overall, the market sentiment remains cautious amid macroeconomic uncertainties.

Confidence Level

Potential Risks

Unforeseen market events or earnings reports could lead to volatility. The bearish trend may continue if selling pressure persists.

1 Month Prediction

Target: May 2, 2025$195

$192

$200

$190

Description

The stock may stabilize around $195 as it tests previous support levels. A potential bullish reversal could occur if buying volume increases. However, the overall trend remains bearish, and macroeconomic factors could weigh heavily.

Analysis

AMZN's performance has been characterized by volatility and bearish trends. Key support at $190 is critical, while resistance remains at $200. Technical indicators suggest potential for a bounce, but overall market sentiment is cautious.

Confidence Level

Potential Risks

Continued bearish sentiment and external economic pressures could hinder recovery. Earnings reports may also impact stock performance.

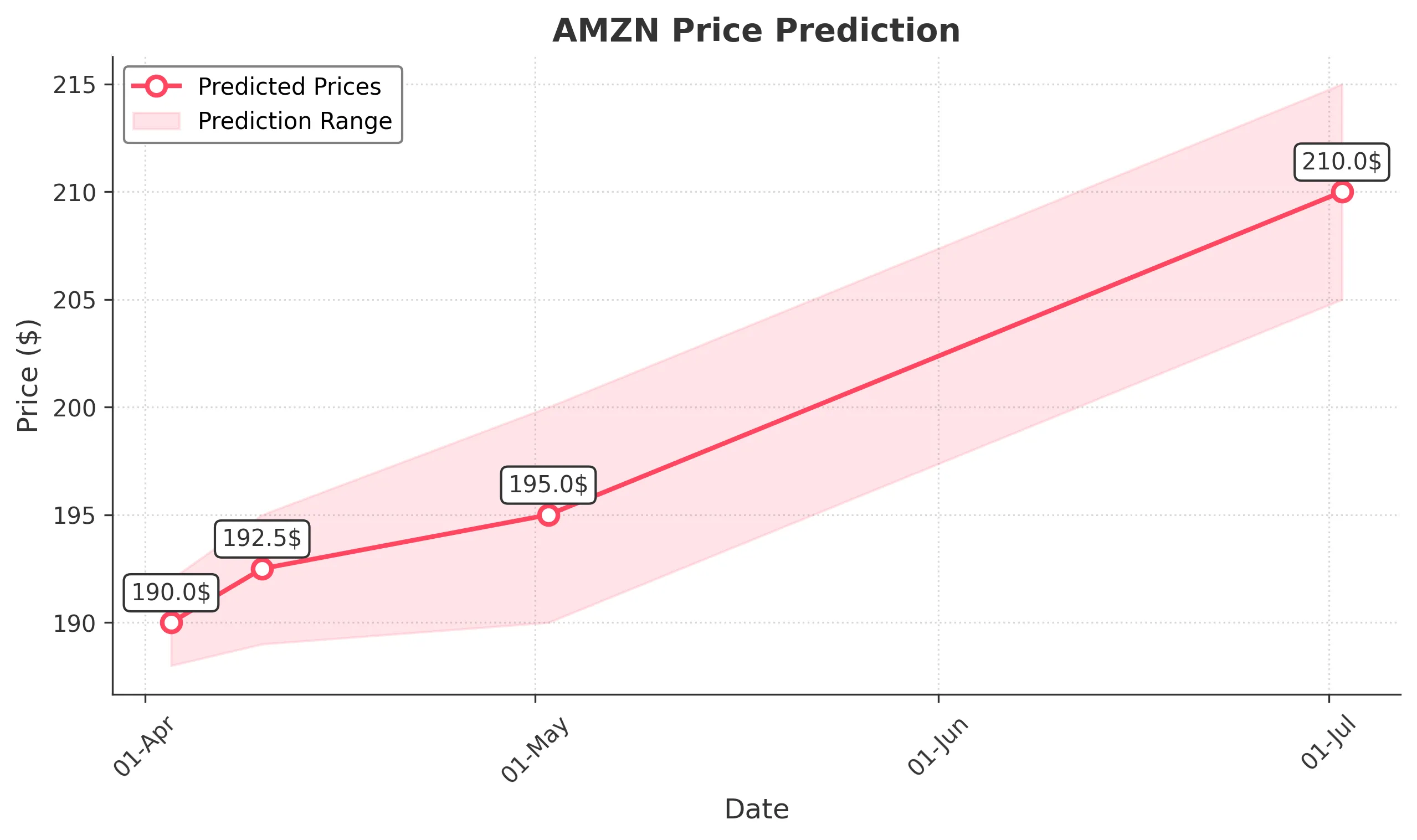

3 Months Prediction

Target: July 2, 2025$210

$208

$215

$205

Description

If the stock can break above resistance at $200, a gradual recovery towards $210 is possible. Positive market sentiment and improved earnings could support this move, but risks remain due to macroeconomic factors.

Analysis

Over the past three months, AMZN has faced significant selling pressure, with key support at $190. Technical indicators show potential for recovery, but bearish sentiment persists. Volume patterns indicate uncertainty, and macroeconomic factors could influence future performance.

Confidence Level

Potential Risks

Market volatility and economic conditions could impact the recovery. A failure to break resistance may lead to further declines.