AMZN Trading Predictions

1 Day Prediction

Target: April 4, 2025$185.5

$184.5

$188

$182

Description

The stock shows bearish momentum with a recent downtrend. The RSI indicates oversold conditions, but a potential bounce could occur. MACD is negative, suggesting continued weakness. Volume spikes on down days indicate selling pressure.

Analysis

AMZN has been in a bearish trend over the past three months, with significant support around $182. Recent candlestick patterns show indecision, and the ATR indicates increased volatility. The overall sentiment is cautious, influenced by macroeconomic factors.

Confidence Level

Potential Risks

Market volatility and potential news could impact the prediction. A reversal pattern could emerge if buying interest increases.

1 Week Prediction

Target: April 11, 2025$187

$185

$190

$180

Description

The stock may see a slight recovery as it approaches key support levels. However, bearish signals persist with MACD and RSI still indicating weakness. A potential reversal could occur if buying volume increases significantly.

Analysis

AMZN's performance has been characterized by a downward trend, with resistance at $190. The recent increase in volume on down days suggests persistent selling. Technical indicators show bearish momentum, but a potential bounce could occur if support holds.

Confidence Level

Potential Risks

Unforeseen market events or earnings reports could lead to volatility. The bearish trend may continue if selling pressure remains strong.

1 Month Prediction

Target: May 3, 2025$190

$185.5

$195

$178

Description

A potential recovery could materialize as the stock approaches historical support levels. However, bearish indicators remain, and the market sentiment is cautious. A sustained rally would require increased buying volume.

Analysis

Over the past three months, AMZN has faced significant selling pressure, with key support around $178. The stock's volatility is high, and technical indicators suggest a bearish outlook. A balanced view indicates potential for both recovery and further declines.

Confidence Level

Potential Risks

Market conditions and external economic factors could hinder recovery. The bearish trend may persist if selling pressure continues.

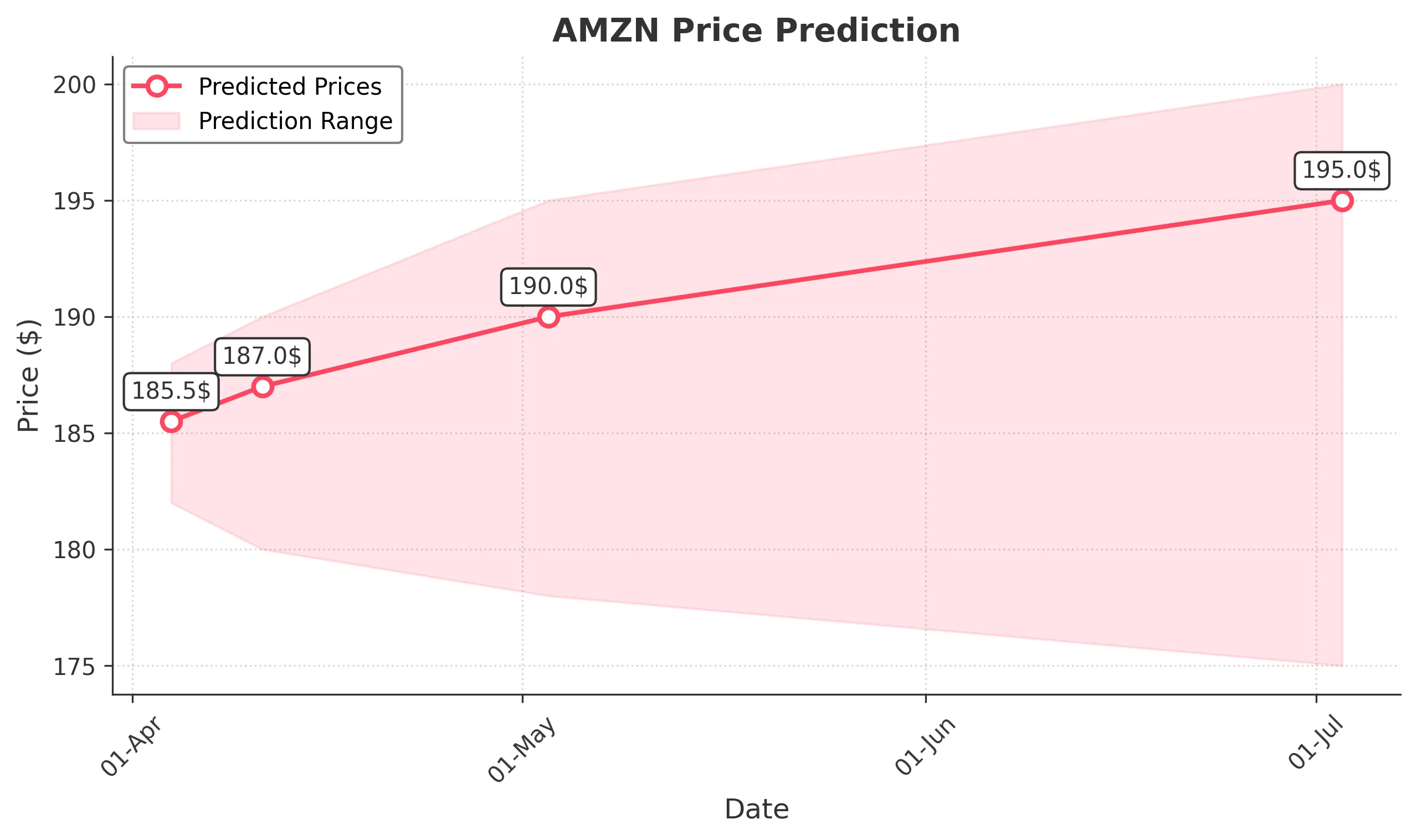

3 Months Prediction

Target: July 3, 2025$195

$190

$200

$175

Description

If the stock can stabilize above key support levels, a gradual recovery may occur. However, bearish trends persist, and external factors could impact performance. A cautious approach is advised.

Analysis

AMZN's performance has been bearish, with significant resistance at $200. The stock's volatility is concerning, and technical indicators suggest a lack of bullish momentum. A balanced view indicates risks of further declines alongside potential recovery.

Confidence Level

Potential Risks

Economic conditions and market sentiment could lead to further declines. The potential for a bearish continuation remains high.