AMZN Trading Predictions

1 Day Prediction

Target: April 8, 2025$162.5

$163

$165

$160

Description

Given the recent bearish trend and significant volume spikes, AMZN may continue to face downward pressure. The RSI indicates oversold conditions, but a potential bounce could occur. Watch for support around 160.

Analysis

AMZN has shown a bearish trend over the past three months, with significant support at 160. Technical indicators like the MACD are bearish, and the ATR suggests increased volatility. Volume spikes indicate selling pressure, and recent candlestick patterns show weakness.

Confidence Level

Potential Risks

Market sentiment remains weak, and any negative news could exacerbate declines.

1 Week Prediction

Target: April 15, 2025$165

$162.5

$170

$158

Description

A potential short-term recovery could occur as the stock approaches key support levels. However, bearish sentiment persists, and any rally may be limited. Watch for resistance at 170.

Analysis

The stock has been in a downtrend, with key support at 160. The RSI is approaching oversold levels, suggesting a possible bounce. However, the overall market sentiment remains cautious, and any recovery may be short-lived.

Confidence Level

Potential Risks

Continued bearish sentiment and macroeconomic factors could hinder recovery efforts.

1 Month Prediction

Target: May 7, 2025$170

$165

$175

$155

Description

If the stock can stabilize above 160, a gradual recovery towards 170 is possible. However, macroeconomic pressures and earnings reports could impact performance significantly.

Analysis

AMZN's performance has been bearish, with significant resistance at 175. The stock is currently testing support levels, and while a recovery is possible, external factors could lead to volatility. The market remains cautious.

Confidence Level

Potential Risks

Uncertainty in the broader market and potential earnings misses could lead to further declines.

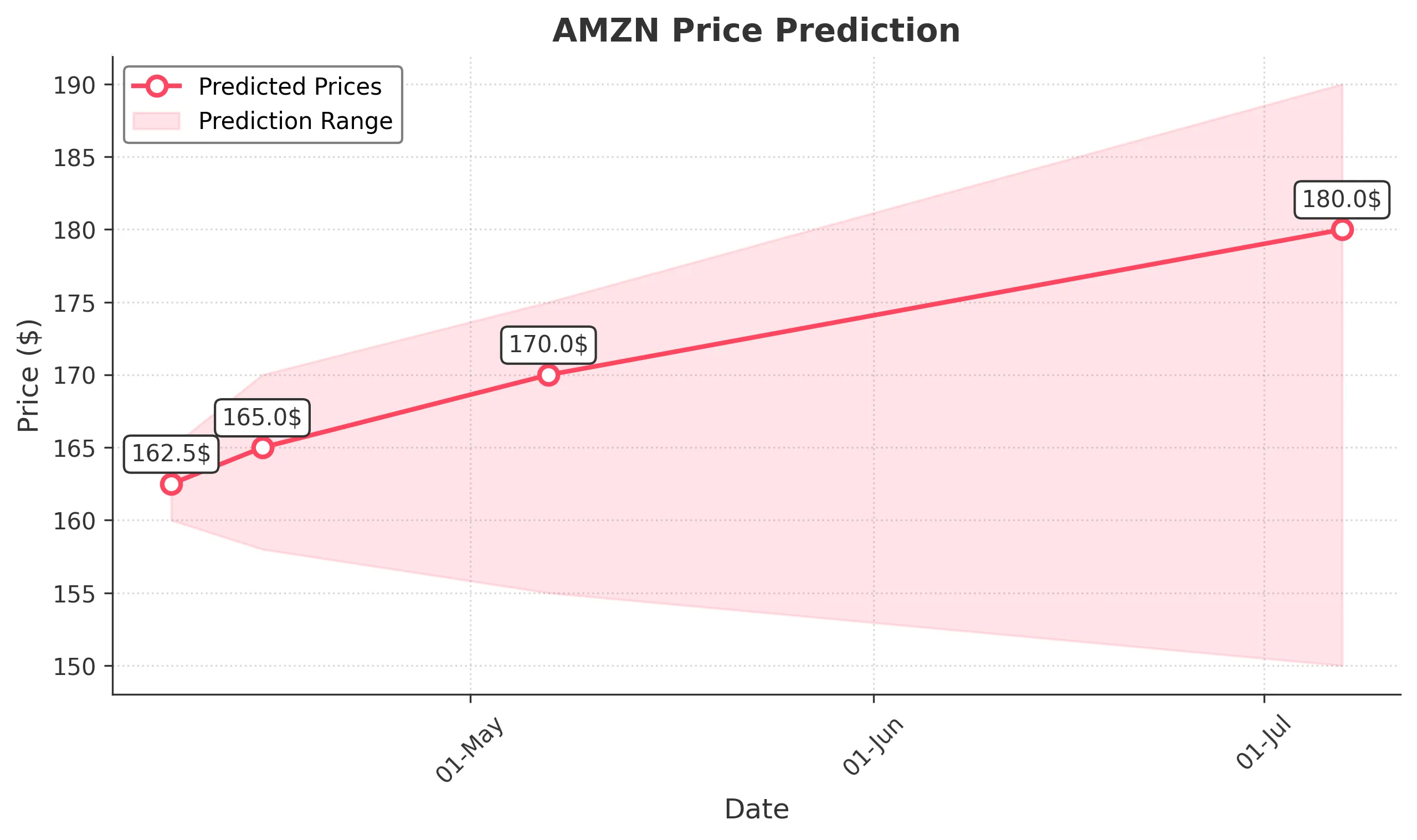

3 Months Prediction

Target: July 7, 2025$180

$175

$190

$150

Description

If the stock can break above 175 and maintain momentum, a gradual recovery towards 180 is feasible. However, macroeconomic conditions and competition could pose risks.

Analysis

The stock has been in a bearish trend, with significant resistance at 175. The overall market sentiment is cautious, and while a recovery is possible, external factors such as economic conditions and competition could impact performance.

Confidence Level

Potential Risks

Potential economic downturns and competitive pressures could hinder recovery efforts.