AMZN Trading Predictions

1 Day Prediction

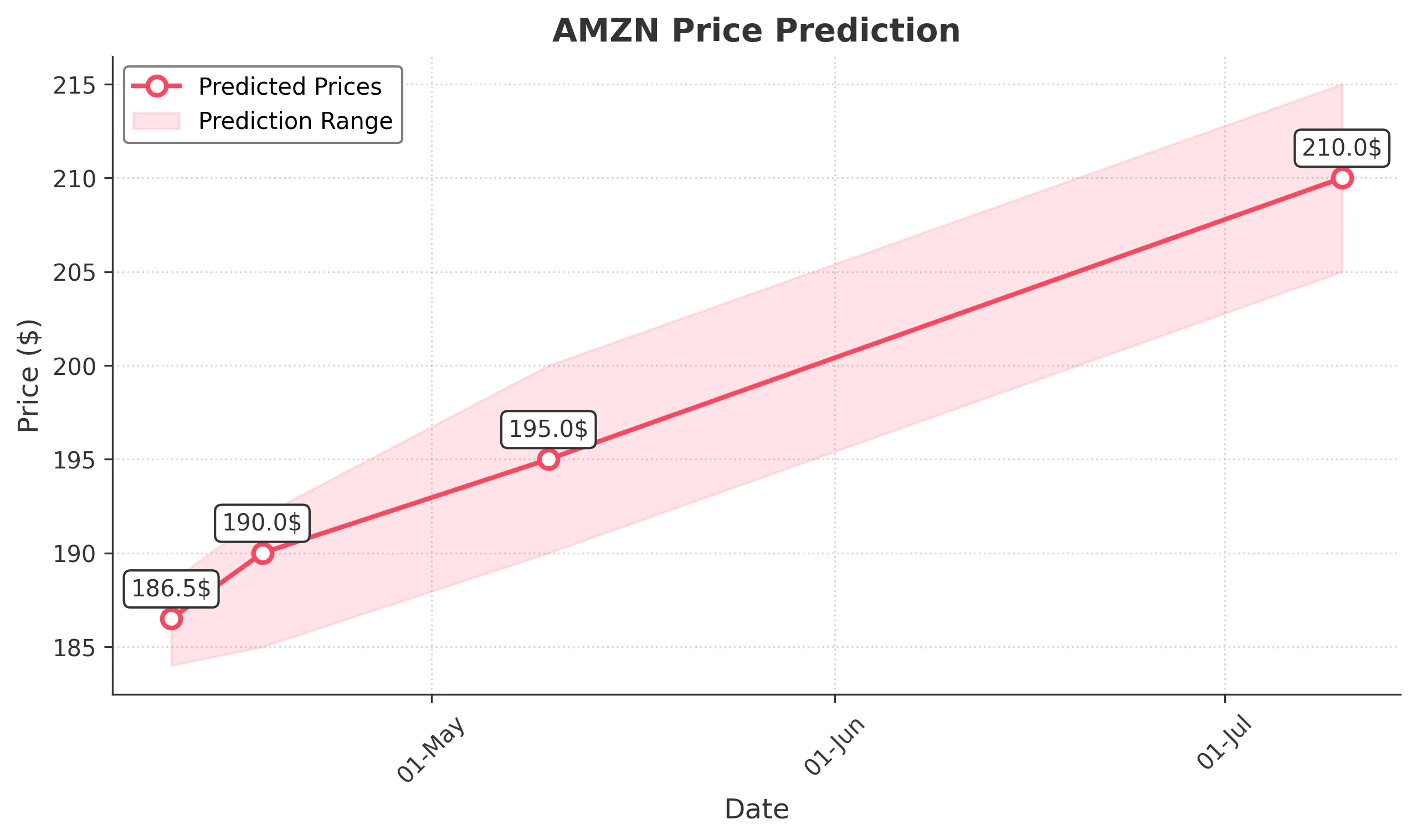

Target: April 11, 2025$186.5

$185.5

$188.5

$184

Description

The stock shows a slight bullish trend with a potential recovery after recent declines. RSI indicates oversold conditions, suggesting a bounce. However, volatility remains high, and market sentiment is cautious.

Analysis

AMZN has experienced significant volatility, with a bearish trend recently. Key support at $170 and resistance at $200. RSI indicates oversold conditions, while MACD shows potential bullish divergence. Volume spikes suggest increased interest, but caution is warranted.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. A reversal is possible if bearish sentiment persists.

1 Week Prediction

Target: April 18, 2025$190

$186.5

$192

$185

Description

A potential recovery is expected as the stock may find support around $185. The RSI is improving, indicating a possible upward momentum. However, macroeconomic factors could still weigh on performance.

Analysis

The stock has been in a bearish phase, with significant price drops. Support at $170 is critical, while resistance at $200 looms. Technical indicators show mixed signals, with potential for recovery but also risks of further declines.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or earnings reports could lead to volatility. The bearish trend may still influence price action.

1 Month Prediction

Target: May 10, 2025$195

$192

$200

$190

Description

Expect a gradual recovery as the stock stabilizes. The MACD may cross bullish, and RSI could indicate a return to neutral. However, external market conditions remain a concern.

Analysis

AMZN's performance has been volatile, with a bearish trend recently. Key support at $170 and resistance at $200. Technical indicators suggest potential for recovery, but external factors could hinder progress.

Confidence Level

Potential Risks

Market sentiment and economic indicators could shift, impacting the recovery. A bearish trend could resume if negative news arises.

3 Months Prediction

Target: July 10, 2025$210

$208

$215

$205

Description

Long-term recovery is anticipated as the stock may stabilize above $200. Positive earnings reports and improved market sentiment could drive prices higher, but caution is advised.

Analysis

The stock has faced significant challenges, with a bearish trend dominating. Key support at $170 and resistance at $200. Technical indicators show potential for recovery, but external factors could influence future performance.

Confidence Level

Potential Risks

Economic conditions and competitive pressures could impact growth. A bearish reversal remains a risk if market sentiment shifts.