AMZN Trading Predictions

1 Day Prediction

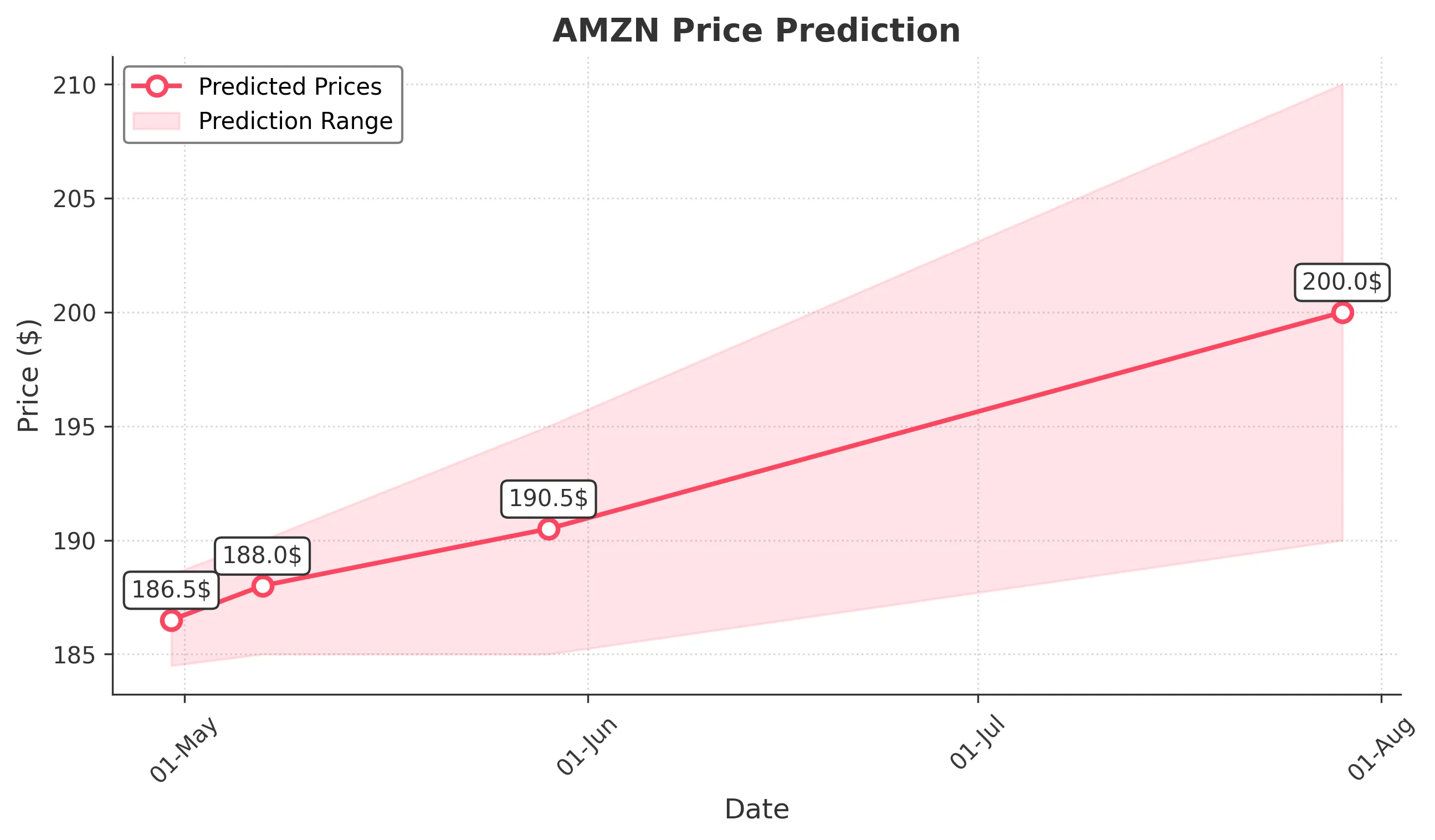

Target: April 30, 2025$186.5

$185.5

$188.5

$184.5

Description

The stock shows a slight bullish trend with a potential bounce from recent lows. RSI indicates oversold conditions, while MACD is showing a bullish crossover. However, volatility remains high, suggesting caution.

Analysis

Over the past 3 months, AMZN has experienced significant volatility, with a bearish trend dominating recently. Key support at $180 has held, but resistance at $190 remains strong. Volume spikes indicate heightened trading activity, suggesting uncertainty.

Confidence Level

Potential Risks

Market sentiment is mixed, and external factors could lead to sudden price changes. A bearish reversal is possible if selling pressure increases.

1 Week Prediction

Target: May 7, 2025$188

$186.5

$190

$185

Description

Expect a slight recovery as the stock approaches resistance levels. The recent bullish candlestick patterns suggest potential upward momentum, but the overall trend remains bearish.

Analysis

AMZN has been in a bearish phase, with significant price drops. The stock is currently testing support levels, and while there are signs of recovery, the overall market sentiment remains cautious. Key resistance at $190 could limit upside potential.

Confidence Level

Potential Risks

Continued bearish sentiment could lead to further declines. Economic news or earnings reports may impact stock performance significantly.

1 Month Prediction

Target: May 29, 2025$190.5

$188

$195

$185

Description

A potential recovery is anticipated as the stock approaches key Fibonacci retracement levels. However, bearish trends may still dominate if market conditions do not improve.

Analysis

The stock has shown signs of recovery but remains in a bearish trend overall. Key support levels are being tested, and while there are bullish signals, the market remains uncertain. Volume patterns indicate mixed sentiment among investors.

Confidence Level

Potential Risks

Market volatility and external economic factors could hinder recovery. A lack of positive catalysts may lead to further declines.

3 Months Prediction

Target: July 29, 2025$200

$195

$210

$190

Description

If the current recovery trend continues, AMZN could reach $200. However, macroeconomic factors and market sentiment will play a crucial role in determining the stock's trajectory.

Analysis

AMZN's performance over the past three months has been characterized by high volatility and a bearish trend. Key support levels are being tested, and while there are signs of potential recovery, the overall market sentiment remains cautious. Investors should be aware of external factors that could impact stock performance.

Confidence Level

Potential Risks

Unforeseen economic events or changes in market sentiment could lead to significant price fluctuations. The bearish trend may resume if no positive developments occur.