AMZN Trading Predictions

1 Day Prediction

Target: May 7, 2025$185.5

$185

$187

$183

Description

The stock shows a slight bearish trend with recent lower closes. RSI indicates oversold conditions, suggesting a potential bounce. However, MACD is bearish, and volume is declining, indicating caution.

Analysis

AMZN has been in a bearish trend over the past three months, with significant support around $180. Recent candlestick patterns show indecision, and volume has been inconsistent. The overall sentiment is cautious, influenced by macroeconomic factors.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. A sudden market shift could lead to unexpected price movements.

1 Week Prediction

Target: May 14, 2025$186

$185.5

$190

$182

Description

Expect a slight recovery as the stock may find support near $180. The RSI is improving, indicating potential upward momentum. However, MACD remains bearish, suggesting caution in bullish expectations.

Analysis

The stock has shown a bearish trend with significant resistance at $190. Volume spikes on down days indicate selling pressure. The market sentiment remains cautious, influenced by broader economic conditions.

Confidence Level

Potential Risks

Potential for further declines exists if market sentiment worsens or if economic indicators are unfavorable.

1 Month Prediction

Target: June 6, 2025$190

$186.5

$195

$185

Description

A potential recovery is anticipated as the stock approaches key Fibonacci retracement levels. The RSI may stabilize, indicating a possible reversal. However, macroeconomic factors could still weigh heavily.

Analysis

AMZN has been trading in a bearish channel, with key support at $180. The stock's volatility remains high, and recent candlestick patterns suggest indecision. Market sentiment is mixed, with external factors influencing investor behavior.

Confidence Level

Potential Risks

Unforeseen economic events or earnings reports could significantly impact the stock's performance.

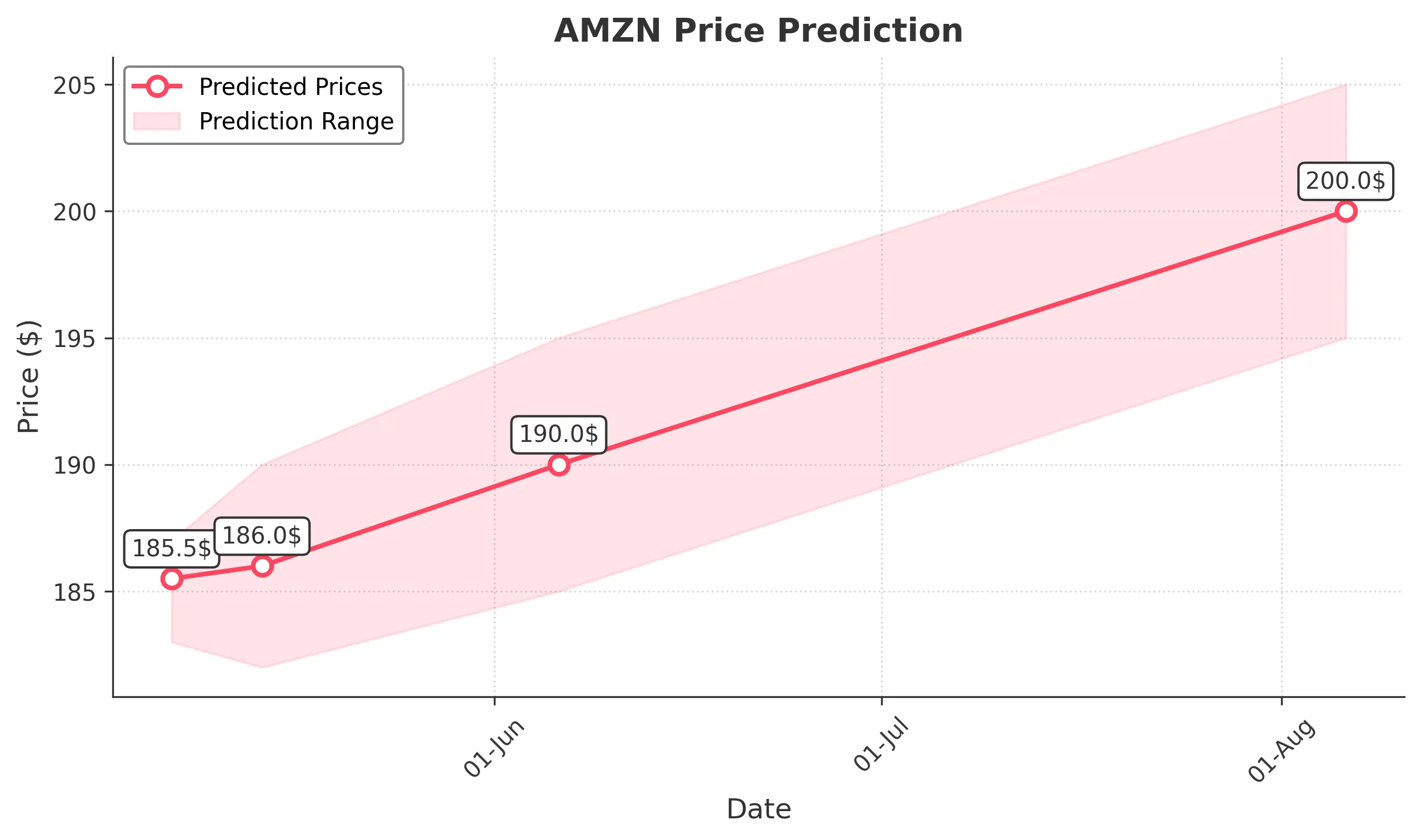

3 Months Prediction

Target: August 6, 2025$200

$198

$205

$195

Description

If the stock can break above resistance levels, a bullish trend may develop. The MACD could turn positive, and RSI may indicate strength. However, economic conditions remain a significant risk.

Analysis

The stock has shown a bearish trend but may find support at $180. Key resistance levels are around $200. The overall market sentiment is cautious, with external economic factors influencing trading behavior.

Confidence Level

Potential Risks

Long-term predictions are uncertain due to potential market shifts and economic instability.