AMZN Trading Predictions

1 Day Prediction

Target: May 28, 2025$203.5

$202.5

$205

$201

Description

The stock shows a slight bullish trend with a recent Doji pattern indicating indecision. RSI is neutral, and MACD is close to crossing above the signal line. Volume is expected to be moderate, reflecting cautious optimism.

Analysis

AMZN has shown a bearish trend over the past three months, with significant support around $200. Recent price action indicates a potential reversal, but the overall sentiment remains cautious. Technical indicators suggest a sideways movement with potential for slight recovery.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. A sudden downturn in sentiment may lead to lower prices.

1 Week Prediction

Target: June 4, 2025$205

$203.5

$210

$200

Description

The stock is expected to recover slightly as it approaches key Fibonacci retracement levels. The MACD shows potential bullish momentum, while the RSI indicates a slight upward trend. Volume may increase as traders react to market sentiment.

Analysis

AMZN's performance has been characterized by volatility, with significant price swings. The stock is currently testing resistance levels around $210. Technical indicators suggest a potential for recovery, but the overall trend remains uncertain.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or earnings reports could lead to volatility. The bearish trend may still dominate if resistance levels hold.

1 Month Prediction

Target: June 27, 2025$210

$205

$215

$198

Description

A gradual recovery is anticipated as the stock approaches key support levels. The RSI is expected to trend upwards, and MACD may confirm bullish momentum. Volume is likely to increase as traders gain confidence.

Analysis

Over the past three months, AMZN has faced significant selling pressure, with key support around $200. The stock's volatility has been high, and while there are signs of recovery, the overall trend remains bearish. Technical indicators suggest cautious optimism.

Confidence Level

Potential Risks

Market sentiment remains fragile, and any negative news could reverse the trend. The potential for a bearish continuation exists if resistance levels are not broken.

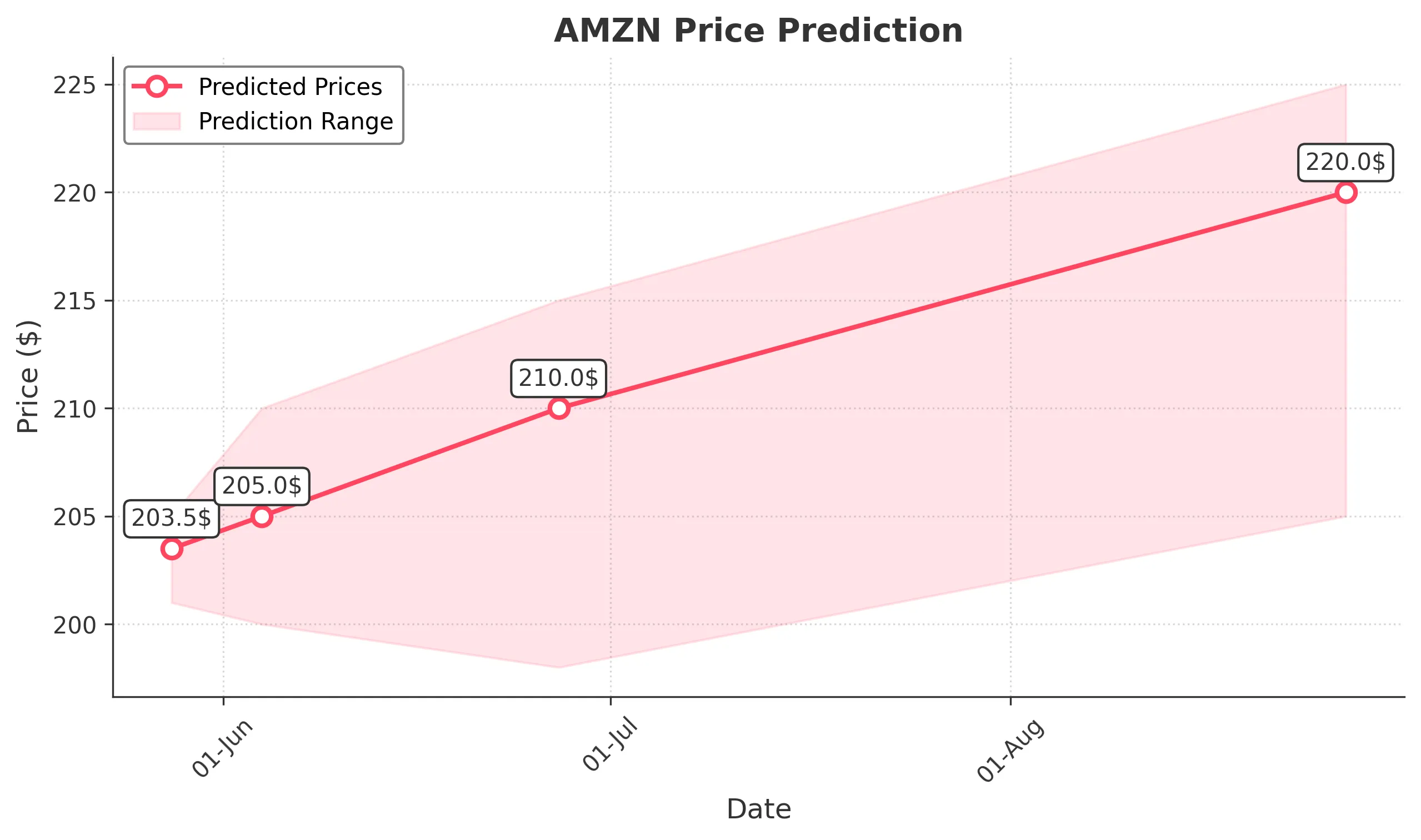

3 Months Prediction

Target: August 27, 2025$220

$215

$225

$205

Description

If the bullish trend continues, AMZN could reach $220 as it breaks through resistance levels. Positive market sentiment and improved earnings could drive prices higher. Volume is expected to support this upward movement.

Analysis

AMZN's long-term performance shows a bearish trend, but recent price action suggests a potential recovery. Key resistance levels will need to be overcome for sustained upward movement. The overall market sentiment remains cautious, with external factors influencing price action.

Confidence Level

Potential Risks

The potential for market corrections and economic downturns could hinder growth. Unforeseen events may lead to increased volatility.