AMZN Trading Predictions

1 Day Prediction

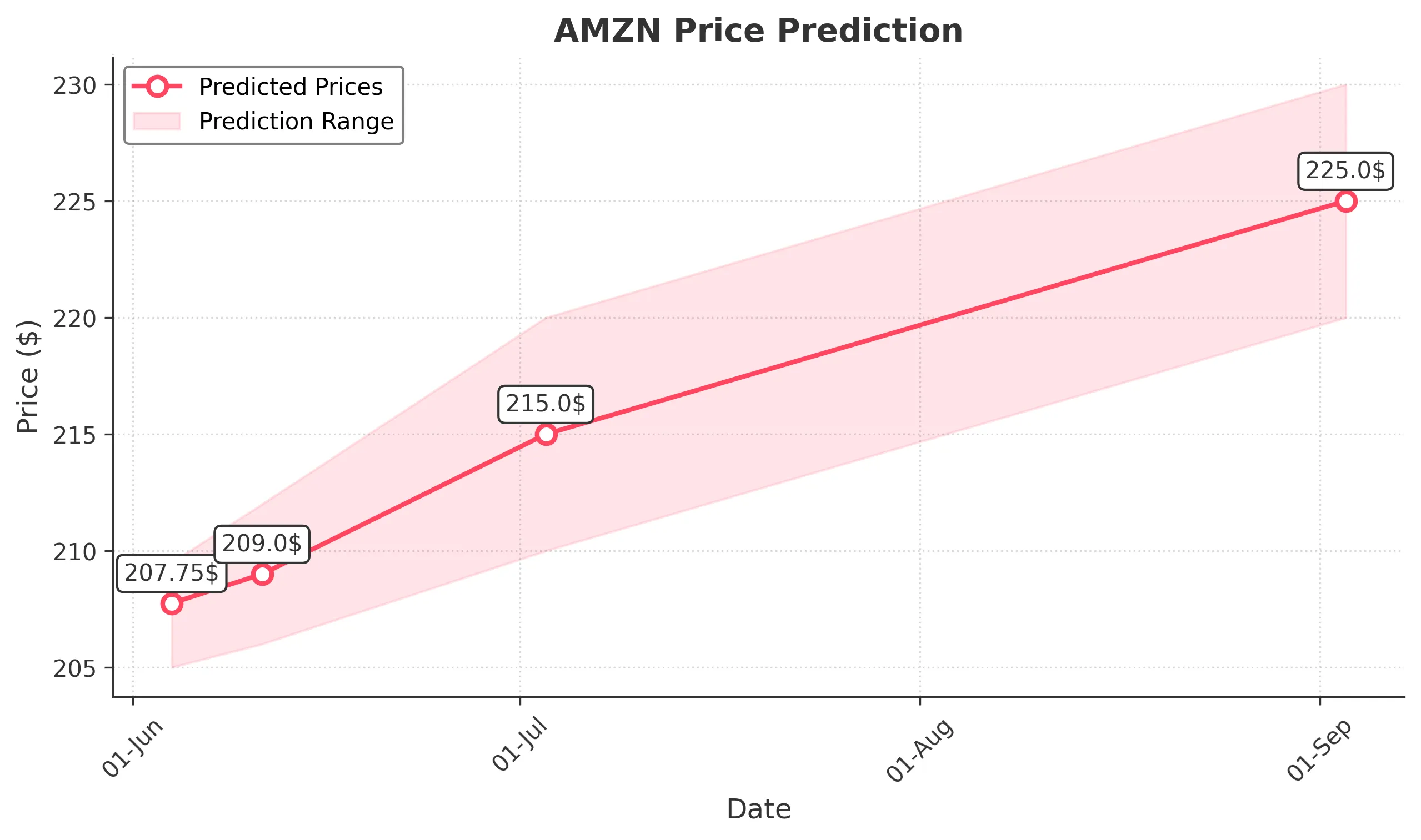

Target: June 4, 2025$207.75

$207

$209.5

$205

Description

The stock shows a slight bullish trend with a recent Doji candlestick indicating indecision. The RSI is neutral, and MACD is showing a potential bullish crossover. Volume is expected to be moderate, reflecting cautious optimism.

Analysis

Over the past 3 months, AMZN has shown a bearish trend with significant volatility. Key support at $200 and resistance at $210. Recent volume spikes suggest increased interest, but the overall sentiment remains cautious due to macroeconomic factors.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. A sudden downturn in sentiment could lead to a price drop.

1 Week Prediction

Target: June 11, 2025$209

$207.5

$212

$206

Description

The stock is expected to continue its upward momentum, supported by a bullish MACD and RSI nearing overbought territory. A breakout above $210 could trigger further buying, but caution is advised due to potential resistance.

Analysis

AMZN has been fluctuating with a recent recovery from lows. The stock is testing resistance levels, and while bullish signals are present, the market remains sensitive to external economic conditions.

Confidence Level

Potential Risks

Potential resistance at $210 may limit upward movement. Any negative news could reverse the trend.

1 Month Prediction

Target: July 3, 2025$215

$212

$220

$210

Description

A bullish trend is anticipated as the stock breaks above key resistance levels. The RSI indicates strong momentum, and the MACD supports further gains. However, watch for potential pullbacks as the stock approaches overbought conditions.

Analysis

The past three months show a recovery from significant lows, with AMZN testing higher resistance levels. The stock's performance is influenced by broader market trends and economic indicators, suggesting a cautious bullish outlook.

Confidence Level

Potential Risks

Market corrections could occur if the stock becomes overbought. Economic data releases may also impact sentiment.

3 Months Prediction

Target: September 3, 2025$225

$222

$230

$220

Description

Long-term bullish sentiment is expected as the stock continues to recover. Key support at $210 and resistance at $230 will be critical. The overall market sentiment and economic conditions will play a significant role in price movements.

Analysis

AMZN's performance over the last three months has shown recovery potential, with key technical indicators suggesting upward momentum. However, external factors and market sentiment remain critical in shaping future price action.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could lead to volatility. A bearish reversal is possible if resistance levels hold.