AMZN Trading Predictions

1 Day Prediction

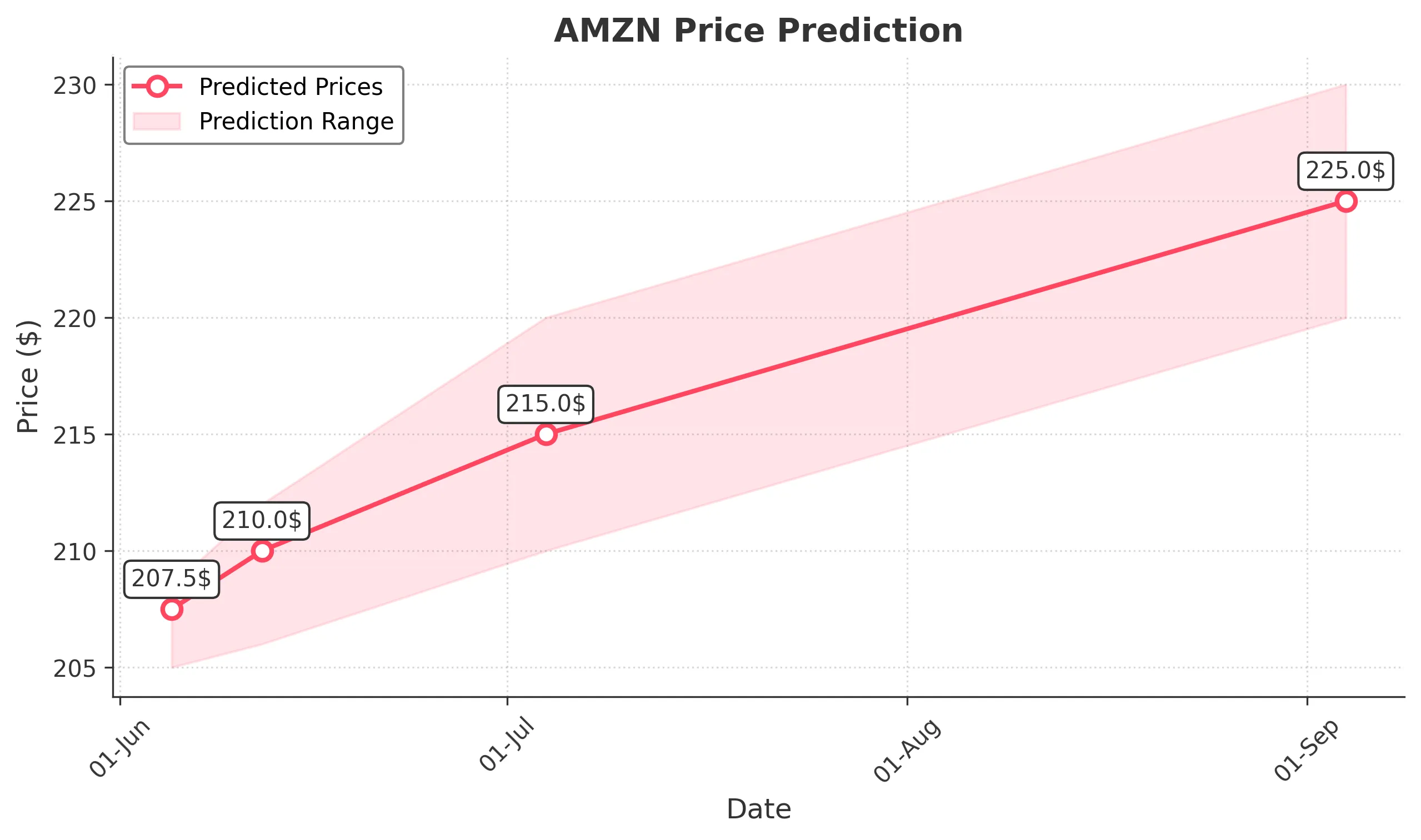

Target: June 5, 2025$207.5

$206.8

$208.5

$205

Description

The stock shows a slight bullish trend with a recent Doji candlestick indicating indecision. The RSI is near 50, suggesting a potential upward move. However, MACD is flat, indicating a lack of momentum. Volume is expected to be moderate.

Analysis

Over the past 3 months, AMZN has shown a bearish trend with significant fluctuations. Key support is around $200, while resistance is near $210. The RSI indicates neutral momentum, and recent volume spikes suggest increased interest. Overall, the market sentiment remains cautious.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. A sudden downturn is possible if bearish sentiment prevails.

1 Week Prediction

Target: June 12, 2025$210

$207.5

$212

$206

Description

A bullish reversal is anticipated as the stock approaches key Fibonacci retracement levels. The MACD shows a potential crossover, indicating upward momentum. However, the RSI is nearing overbought territory, suggesting caution.

Analysis

AMZN has been trading in a range with resistance at $210 and support at $200. The recent price action shows a recovery attempt, but the overall trend remains uncertain. Technical indicators suggest a possible upward move, but caution is warranted due to market volatility.

Confidence Level

Potential Risks

Potential market corrections and external economic factors could lead to unexpected price movements. Watch for any negative news that could impact sentiment.

1 Month Prediction

Target: July 4, 2025$215

$211.5

$220

$210

Description

Expect a gradual upward trend as the stock breaks through resistance levels. The MACD is likely to confirm bullish momentum, while the RSI may stabilize. Volume is expected to increase as investor sentiment improves.

Analysis

The stock has shown signs of recovery, with key support at $200 and resistance at $210. Technical indicators suggest a bullish outlook, but external factors could introduce volatility. Overall, the sentiment is cautiously optimistic.

Confidence Level

Potential Risks

Economic indicators and earnings reports could influence market sentiment. A sudden downturn in the broader market could also affect AMZN's performance.

3 Months Prediction

Target: September 4, 2025$225

$222

$230

$220

Description

A bullish trend is expected as the stock continues to recover. The MACD should confirm upward momentum, and the RSI may remain stable. Volume is likely to increase as market sentiment improves.

Analysis

AMZN has been recovering from recent lows, with key support at $200 and resistance at $210. The overall trend appears bullish, but external factors could introduce volatility. Technical indicators suggest a positive outlook, but caution is advised.

Confidence Level

Potential Risks

Macroeconomic factors and potential market corrections could impact the prediction. Watch for any significant news that could alter investor sentiment.