AMZN Trading Predictions

1 Day Prediction

Target: June 30, 2025$220.5

$221

$222

$218

Description

The stock shows bullish momentum with a recent upward trend. The RSI is approaching overbought levels, indicating potential for a pullback. However, MACD is positive, suggesting continued upward movement. Volume is expected to remain high as traders react to market sentiment.

Analysis

AMZN has shown a bullish trend over the past three months, with significant support at $210 and resistance around $222. The recent price action indicates strong buying interest, but the RSI nearing overbought levels raises concerns about a possible pullback.

Confidence Level

Potential Risks

Potential market volatility and profit-taking could lead to a price correction.

1 Week Prediction

Target: July 7, 2025$222

$220.5

$225

$219

Description

The bullish trend is expected to continue, supported by positive MACD and strong volume. However, the RSI indicates overbought conditions, which may lead to a short-term pullback. Market sentiment remains optimistic, but caution is advised.

Analysis

The stock has been trending upward, with key support at $210 and resistance at $225. The recent bullish candlestick patterns suggest strong buying pressure, but the high RSI indicates potential for a pullback, warranting a cautious approach.

Confidence Level

Potential Risks

Market corrections or negative news could impact the stock's performance.

1 Month Prediction

Target: August 7, 2025$225.5

$222

$230

$220

Description

The stock is expected to maintain its upward trajectory, driven by strong fundamentals and positive market sentiment. However, the RSI suggests potential overbought conditions, which could lead to volatility. Watch for any macroeconomic news that may impact sentiment.

Analysis

AMZN has shown resilience with a bullish trend, supported by strong volume and positive technical indicators. Key resistance at $230 may pose challenges, while support at $220 remains critical. Market sentiment is generally positive, but external factors could influence price movements.

Confidence Level

Potential Risks

Economic indicators or earnings reports could introduce volatility.

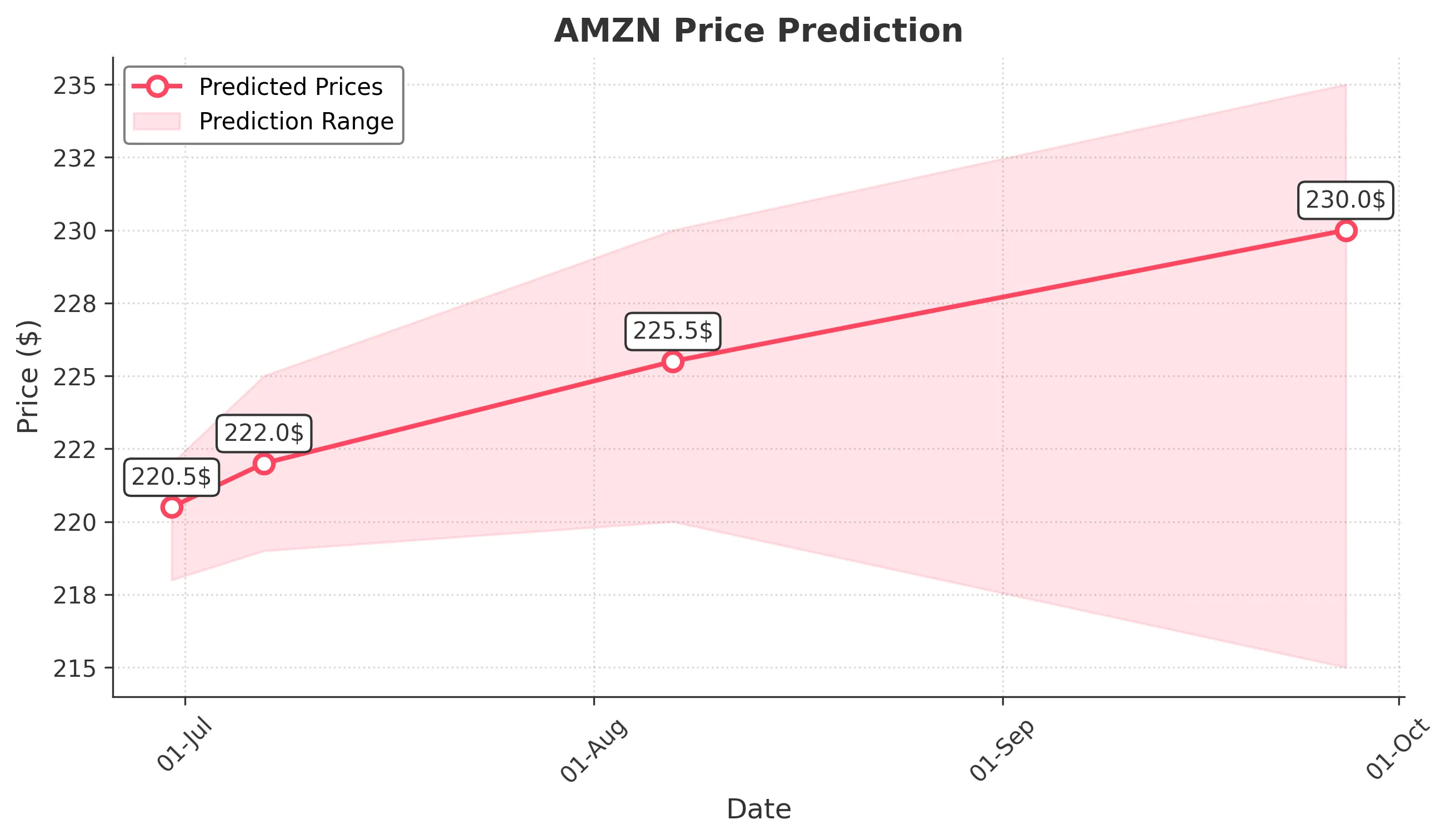

3 Months Prediction

Target: September 27, 2025$230

$225.5

$235

$215

Description

Long-term bullish outlook supported by strong fundamentals and market sentiment. However, potential economic headwinds and overbought conditions may lead to corrections. Watch for key earnings reports and macroeconomic data.

Analysis

Over the past three months, AMZN has shown a strong upward trend, with key support at $215 and resistance at $235. Technical indicators suggest bullish momentum, but the potential for market corrections exists, especially with high RSI levels indicating overbought conditions.

Confidence Level

Potential Risks

Unforeseen economic events or changes in market sentiment could lead to significant volatility.