AMZN Trading Predictions

1 Day Prediction

Target: July 1, 2025$224.5

$223.5

$226

$222

Description

The stock shows bullish momentum with a recent breakout above resistance at 223. The RSI is approaching overbought levels, indicating potential for a pullback. However, strong volume on the last trading day supports upward movement.

Analysis

AMZN has shown a bullish trend over the past three months, with significant support at 210 and resistance at 223. The recent price action indicates strong buying interest, but the RSI nearing overbought levels suggests caution.

Confidence Level

Potential Risks

Potential market volatility and profit-taking could lead to a reversal.

1 Week Prediction

Target: July 8, 2025$225

$224

$228

$220

Description

The bullish trend is expected to continue, supported by positive market sentiment and strong earnings reports. However, the MACD shows signs of potential divergence, indicating a possible slowdown in momentum.

Analysis

AMZN has been trending upward, with key support at 220. The MACD is bullish, but divergence suggests caution. Volume has been strong, indicating sustained interest, but external factors could introduce volatility.

Confidence Level

Potential Risks

Market corrections or negative news could impact the stock's performance.

1 Month Prediction

Target: August 1, 2025$230

$225

$235

$218

Description

Continued bullish sentiment is expected as AMZN capitalizes on seasonal trends and strong earnings. However, the RSI indicates potential overbought conditions, suggesting a correction could occur.

Analysis

The stock has shown a strong upward trend, with resistance at 235. The RSI is approaching overbought territory, indicating a potential pullback. Volume remains robust, but external economic factors could influence performance.

Confidence Level

Potential Risks

Economic indicators and market sentiment shifts could lead to unexpected volatility.

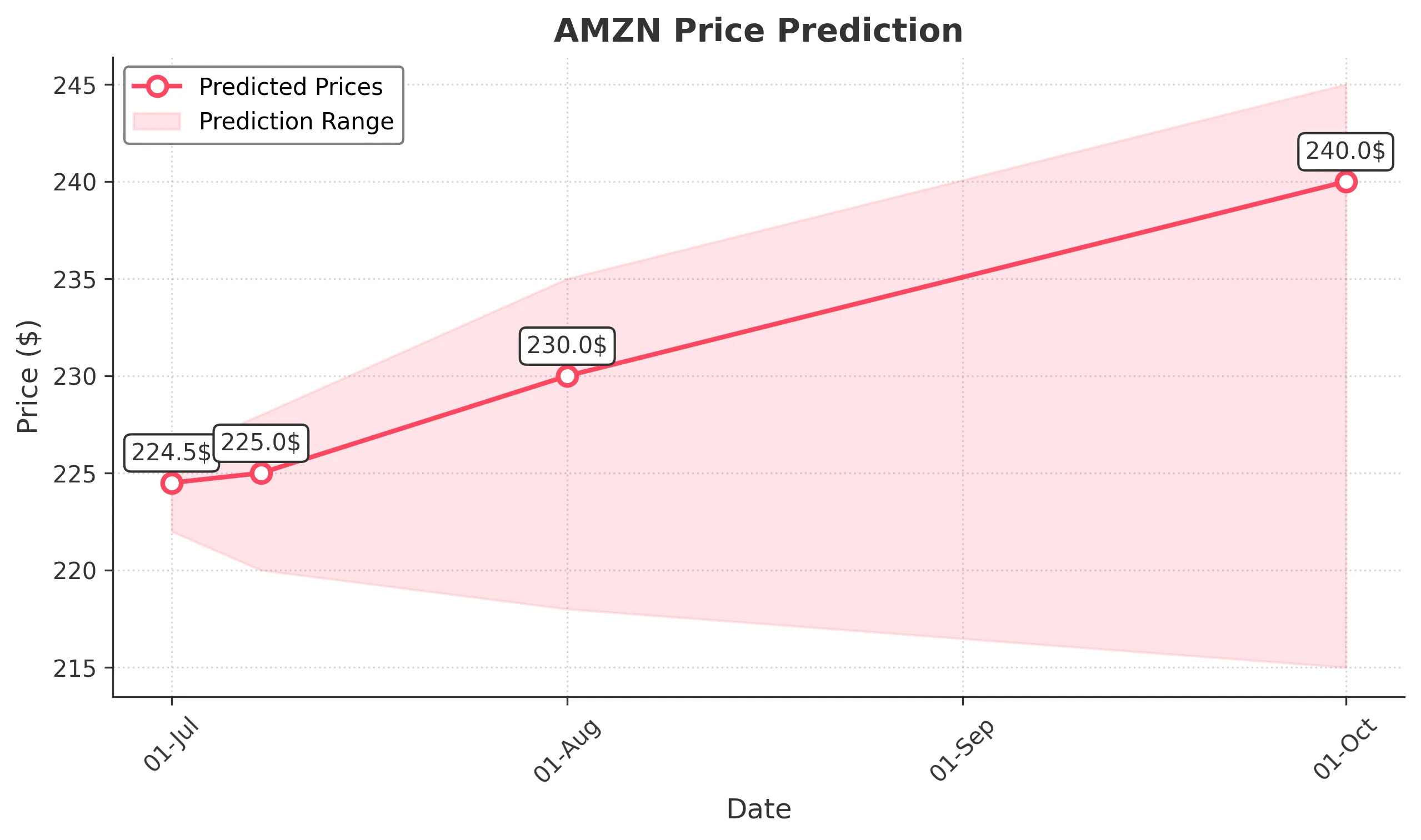

3 Months Prediction

Target: October 1, 2025$240

$230

$245

$215

Description

Long-term bullish outlook as AMZN continues to expand its market share. However, macroeconomic factors and potential regulatory scrutiny could pose risks to growth.

Analysis

AMZN has maintained a bullish trend, with key support at 215 and resistance at 245. The stock's performance is influenced by broader market conditions and potential regulatory challenges. A balanced view suggests both upward potential and risks.

Confidence Level

Potential Risks

Unforeseen economic downturns or regulatory changes could negatively impact stock performance.