AMZN Trading Predictions

1 Day Prediction

Target: August 2, 2025$217.5

$218

$219

$216

Description

The stock shows a slight bearish trend after a significant drop. RSI indicates oversold conditions, suggesting a potential bounce. However, recent volume spikes indicate uncertainty. Expect a minor recovery but remain cautious.

Analysis

AMZN has shown a bearish trend recently, with significant support around 215. The RSI is approaching oversold levels, indicating a potential short-term bounce. However, the overall market sentiment remains cautious due to macroeconomic factors.

Confidence Level

Potential Risks

Market sentiment is volatile, and external news could impact the stock's performance.

1 Week Prediction

Target: August 9, 2025$220

$218.5

$222.5

$215.5

Description

A potential recovery is expected as the stock stabilizes. The MACD shows signs of a bullish crossover, and the Bollinger Bands indicate a tightening range, suggesting a breakout. Watch for volume confirmation.

Analysis

The stock has been in a corrective phase, but technical indicators suggest a possible reversal. Key resistance is at 222, while support remains at 215. Volume patterns indicate potential accumulation, which could support a bullish move.

Confidence Level

Potential Risks

If bearish sentiment persists, the recovery may be limited. External factors could also influence the market.

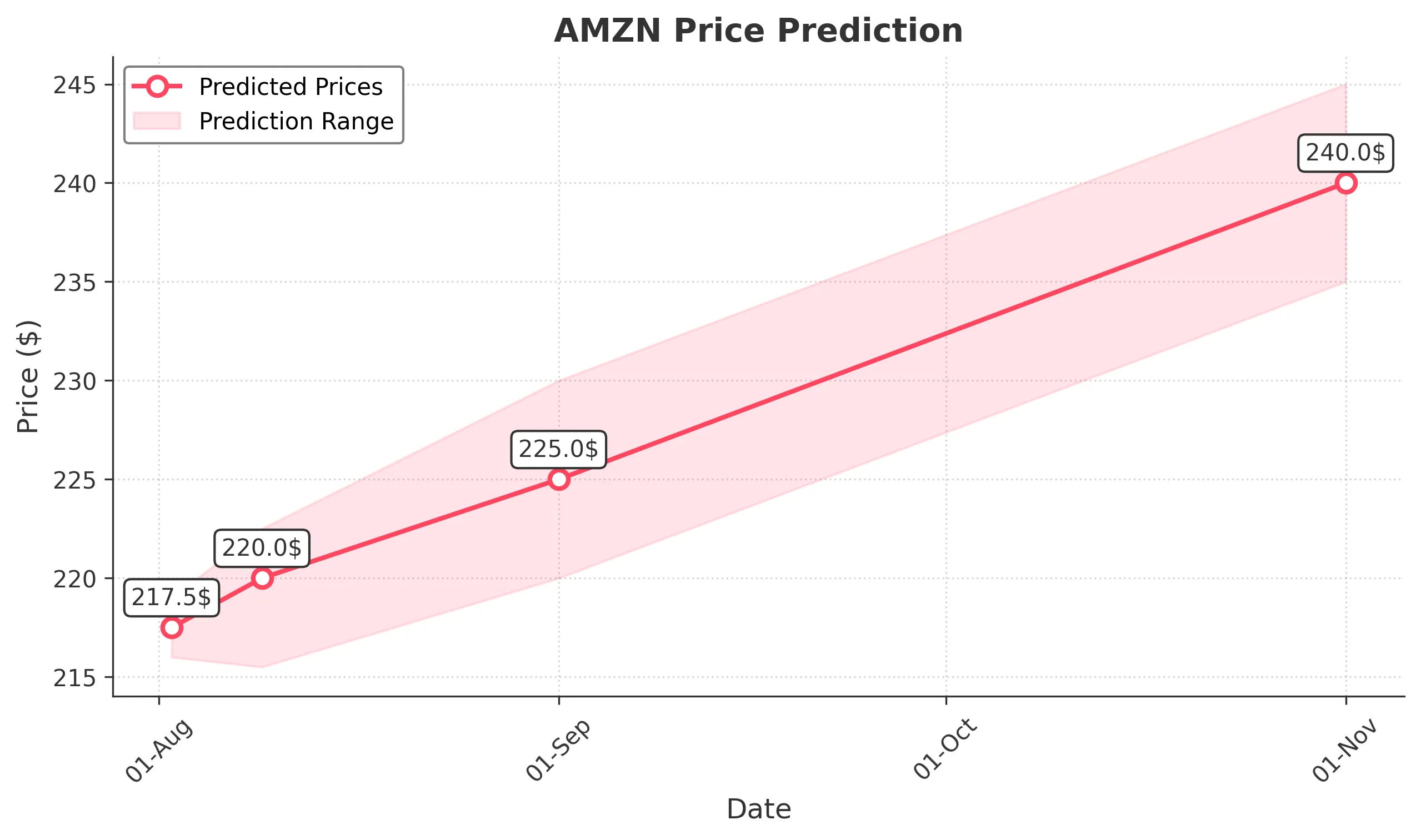

1 Month Prediction

Target: September 1, 2025$225

$222

$230

$220

Description

Expect a gradual recovery as the stock finds support. The Fibonacci retracement levels suggest a target around 225. Positive market sentiment could drive prices higher, but watch for resistance at 230.

Analysis

AMZN's performance over the past month has been mixed, with a bearish trend recently. However, technical indicators suggest a potential recovery. Key support at 215 and resistance at 230 will be crucial in determining the stock's direction.

Confidence Level

Potential Risks

Economic data releases and earnings reports could introduce volatility, impacting the stock's trajectory.

3 Months Prediction

Target: November 1, 2025$240

$238

$245

$235

Description

Long-term outlook appears bullish as the stock stabilizes and market sentiment improves. The MACD and RSI indicate potential upward momentum. However, external economic factors could pose risks.

Analysis

Over the past three months, AMZN has experienced significant volatility. The stock is currently in a corrective phase, but technical indicators suggest a potential recovery. Key resistance levels will need to be monitored closely.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or earnings surprises could derail the bullish outlook.