AUDUSDX Trading Predictions

1 Day Prediction

Target: April 6, 2025$0.6055

$0.605

$0.608

$0.603

Description

The recent bearish trend, indicated by the drop in price and the formation of a Doji candlestick, suggests a potential continuation of downward momentum. RSI is nearing oversold levels, which may lead to a slight rebound, but overall sentiment remains weak.

Analysis

Over the past 3 months, AUDUSD has shown a bearish trend with significant resistance around 0.6400. The recent price action indicates a struggle to maintain higher levels, with support around 0.6000. Technical indicators like MACD and RSI suggest bearish momentum, while volume has been low, indicating lack of strong buying interest.

Confidence Level

Potential Risks

Market volatility and potential news events could impact the price unexpectedly.

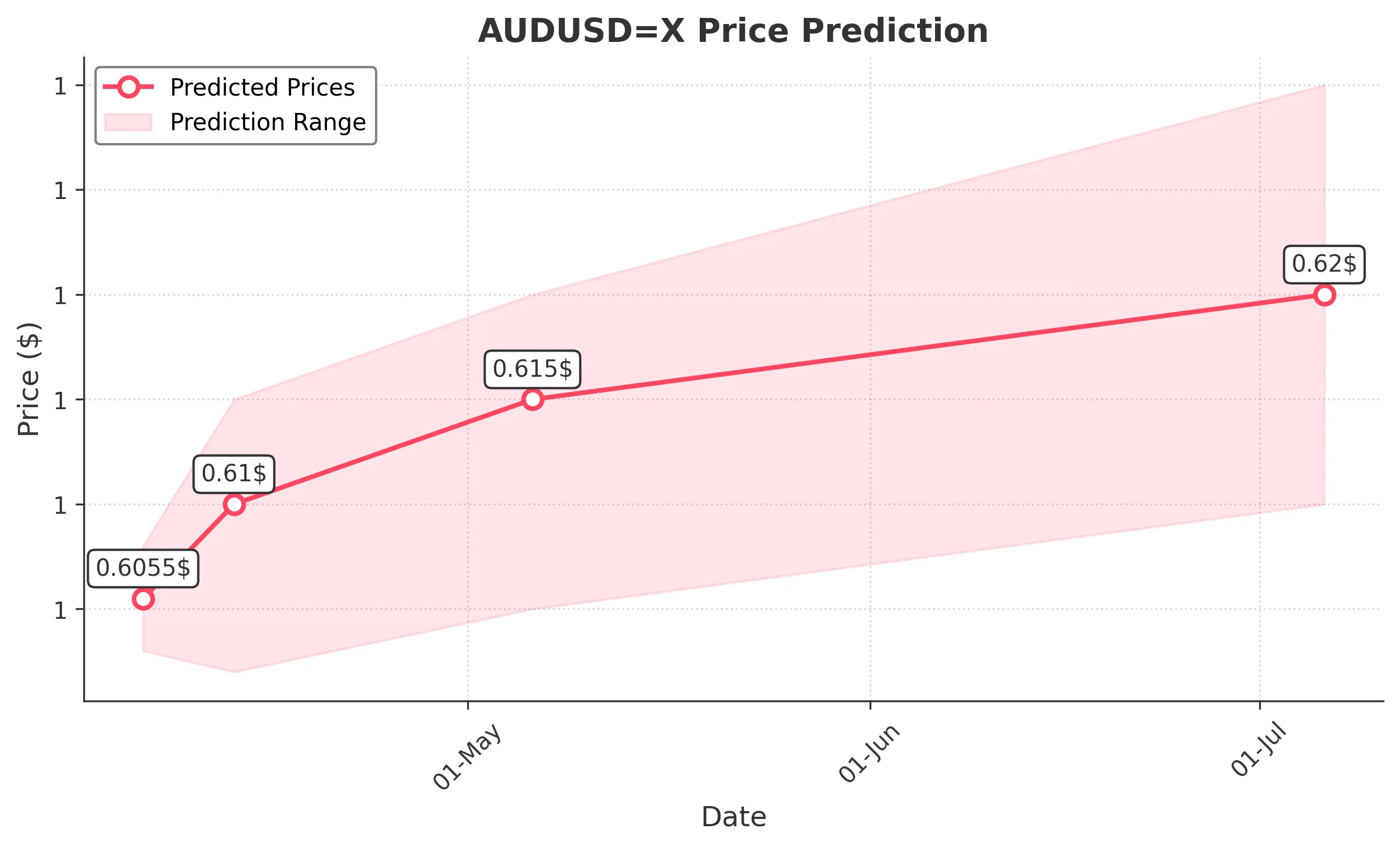

1 Week Prediction

Target: April 13, 2025$0.61

$0.6055

$0.615

$0.602

Description

A slight recovery is anticipated as the market may react to oversold conditions. However, resistance at 0.6150 could limit upward movement. The overall bearish sentiment persists, but a short-term bounce is possible.

Analysis

The stock has been in a bearish phase, with key support at 0.6000. The recent price action shows a potential for a short-term bounce, but overall market sentiment remains cautious. Technical indicators suggest a possible reversal, but the lack of strong volume raises concerns about sustainability.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could lead to further declines or volatility.

1 Month Prediction

Target: May 6, 2025$0.615

$0.61

$0.62

$0.605

Description

Expect a gradual recovery as the market adjusts to oversold conditions. Resistance at 0.6200 may pose challenges, but a bullish divergence in RSI could support upward movement. Overall, the trend remains cautious.

Analysis

The past three months have shown a bearish trend with significant resistance levels. The stock is currently testing support around 0.6000, and while a recovery is possible, the overall sentiment remains bearish. Technical indicators suggest potential for a bounce, but caution is warranted.

Confidence Level

Potential Risks

Economic data releases and geopolitical events could significantly alter market dynamics.

3 Months Prediction

Target: July 6, 2025$0.62

$0.615

$0.63

$0.61

Description

A potential stabilization around 0.6200 is expected as the market digests recent movements. However, the bearish trend may still influence price action, and resistance at 0.6300 could limit gains.

Analysis

The stock has been in a bearish trend, with significant resistance levels. The potential for a recovery exists, but the overall market sentiment remains cautious. Technical indicators suggest a possible stabilization, but external factors could heavily influence future price movements.

Confidence Level

Potential Risks

Long-term economic factors and market sentiment shifts could lead to unexpected volatility.