AUDUSDX Trading Predictions

1 Day Prediction

Target: April 25, 2025$0.635

$0.6355

$0.6365

$0.634

Description

The recent bullish trend suggests a slight upward movement. The RSI is neutral, and MACD shows a potential bullish crossover. However, the market sentiment remains cautious due to recent volatility.

Analysis

The past three months show a bearish trend with significant support around 0.6200. Recent price action indicates a possible recovery, but volatility remains high. Key resistance at 0.6400 could limit upward movement.

Confidence Level

Potential Risks

Potential for reversal exists if external news impacts market sentiment.

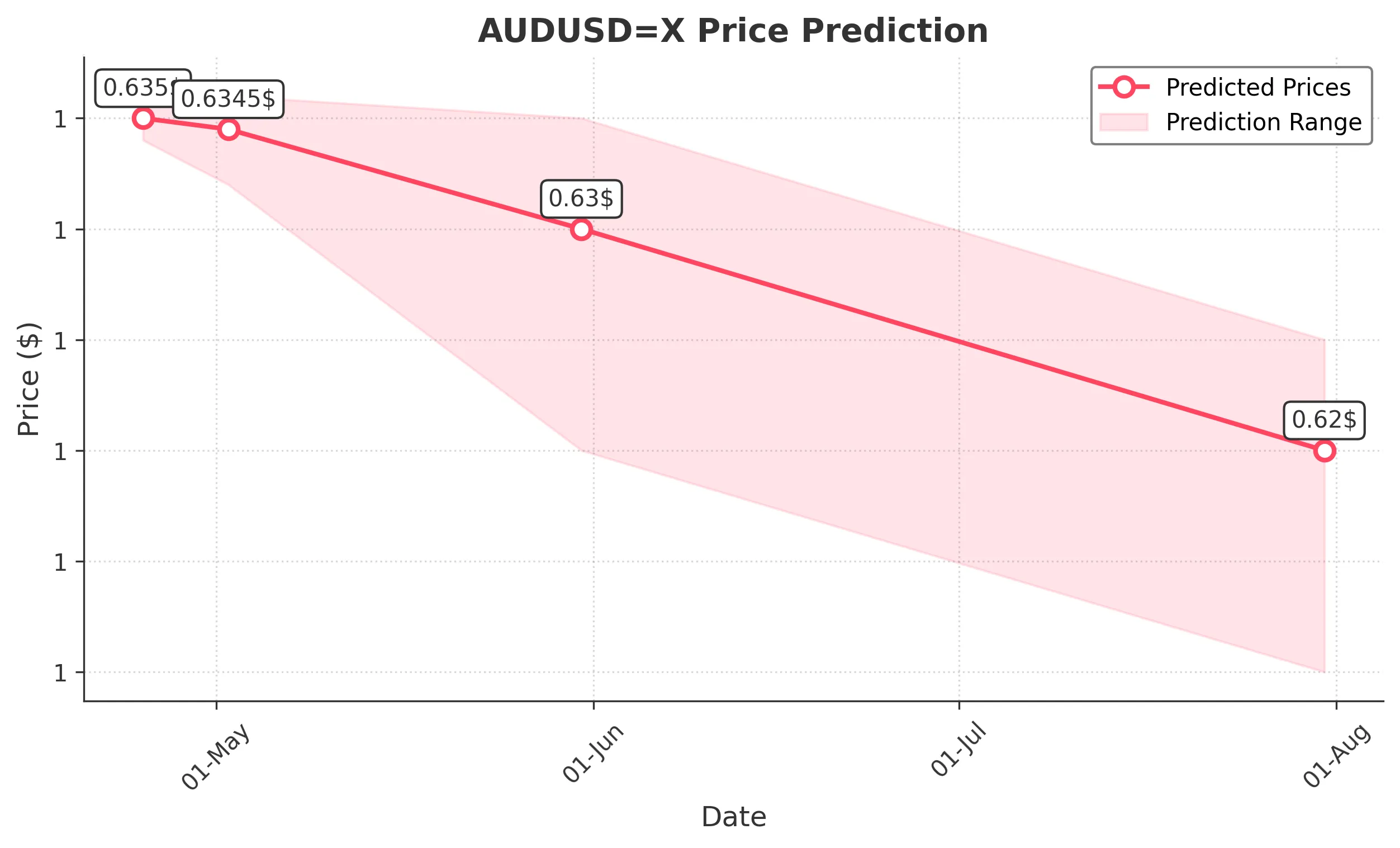

1 Week Prediction

Target: May 2, 2025$0.6345

$0.635

$0.636

$0.632

Description

Expecting a slight decline as the market may face resistance at 0.6400. The Bollinger Bands indicate potential consolidation, and volume analysis shows decreasing interest.

Analysis

The stock has shown a sideways trend recently, with resistance at 0.6400 and support at 0.6200. Technical indicators suggest a potential pullback, but overall market conditions remain uncertain.

Confidence Level

Potential Risks

Market sentiment could shift rapidly due to macroeconomic events.

1 Month Prediction

Target: May 31, 2025$0.63

$0.632

$0.635

$0.62

Description

Anticipating a bearish trend as the market may react to economic data releases. The MACD indicates weakening momentum, and RSI suggests overbought conditions.

Analysis

The overall trend has been bearish, with significant resistance at 0.6400. The stock is likely to test lower support levels, and macroeconomic factors could heavily influence price movements.

Confidence Level

Potential Risks

Economic indicators could lead to unexpected volatility.

3 Months Prediction

Target: July 31, 2025$0.62

$0.622

$0.625

$0.61

Description

Long-term outlook remains bearish due to persistent economic challenges. The ATR indicates high volatility, and the market sentiment is cautious.

Analysis

The stock has been in a downtrend, with key support at 0.6200. Technical indicators suggest continued weakness, and external economic factors may exacerbate the situation, leading to further declines.

Confidence Level

Potential Risks

Unforeseen economic events could drastically alter the market landscape.