AUDUSDX Trading Predictions

1 Day Prediction

Target: April 26, 2025$0.64

$0.639

$0.642

$0.638

Description

The recent bullish trend suggests a potential upward movement. The MACD is showing a bullish crossover, and RSI is near 60, indicating strength. However, resistance at 0.642 may limit gains.

Analysis

The past 3 months show a bullish trend with significant support at 0.630 and resistance at 0.642. The MACD and RSI indicate upward momentum, but recent price fluctuations suggest caution.

Confidence Level

Potential Risks

Market volatility and external economic news could impact this prediction.

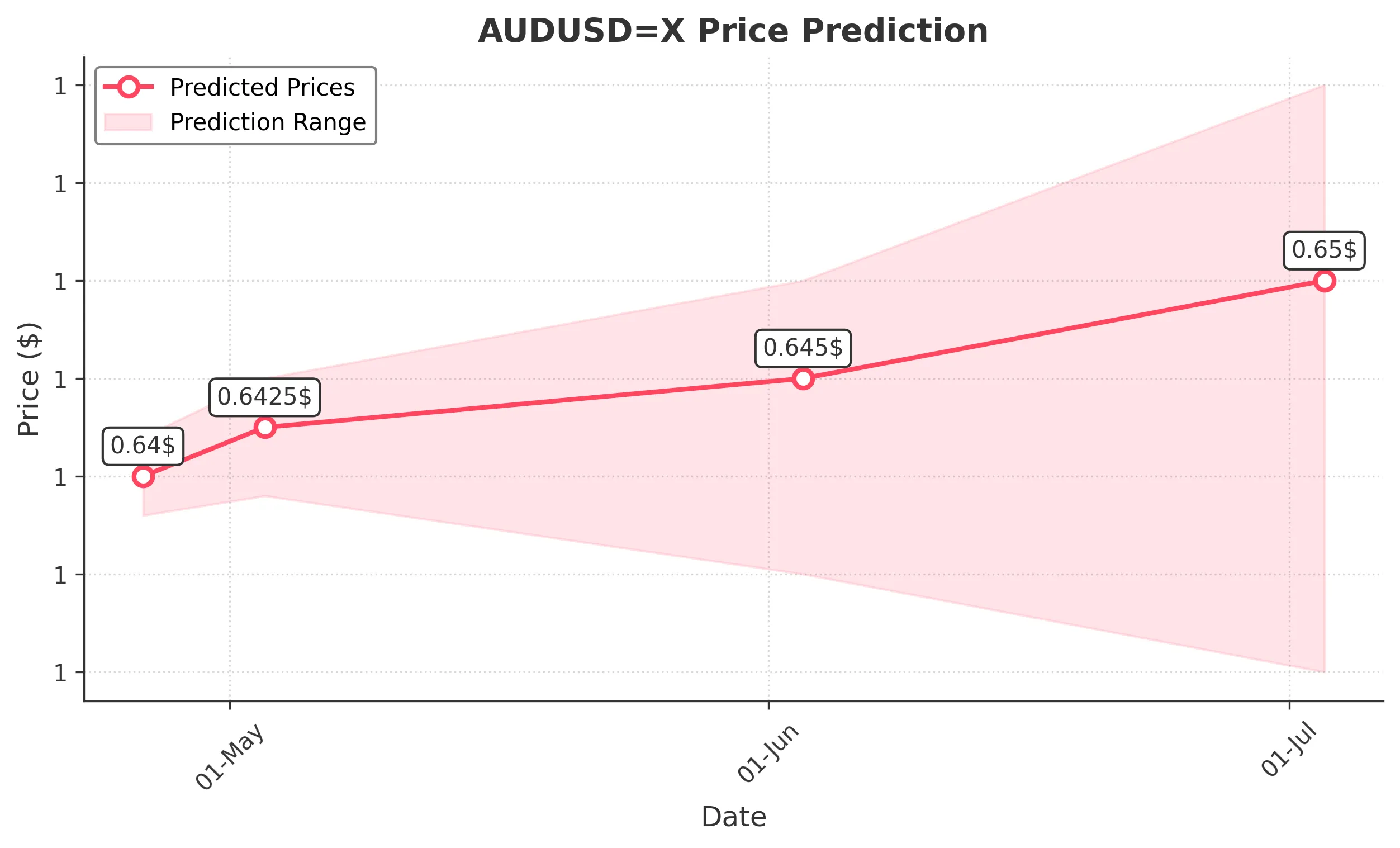

1 Week Prediction

Target: May 3, 2025$0.6425

$0.64

$0.645

$0.639

Description

The bullish momentum is expected to continue, supported by a recent breakout above 0.640. However, the RSI nearing overbought levels may lead to a pullback. Watch for volume spikes for confirmation.

Analysis

The stock has shown a consistent upward trend, with key support at 0.630. The MACD indicates bullish momentum, but the RSI suggests caution as it approaches overbought territory.

Confidence Level

Potential Risks

Potential market corrections and geopolitical events could affect price stability.

1 Month Prediction

Target: June 3, 2025$0.645

$0.64

$0.65

$0.635

Description

Expect continued bullish sentiment as the price approaches the Fibonacci retracement level of 0.650. However, watch for potential resistance at this level, which could trigger profit-taking.

Analysis

The stock has been in a bullish phase, with strong support at 0.630. The MACD and RSI indicate upward momentum, but the proximity to resistance levels suggests a cautious approach.

Confidence Level

Potential Risks

Economic data releases and central bank decisions could introduce volatility.

3 Months Prediction

Target: July 3, 2025$0.65

$0.645

$0.66

$0.63

Description

Long-term bullish outlook as the price may test the 0.660 resistance level. The overall trend remains positive, but market sentiment and external factors could lead to fluctuations.

Analysis

The stock has shown a strong upward trend, with key support at 0.630. The MACD indicates bullish momentum, but potential resistance at 0.660 may lead to volatility in the coming months.

Confidence Level

Potential Risks

Unforeseen economic events and market corrections could impact the forecast.