AUDUSDX Trading Predictions

1 Day Prediction

Target: April 29, 2025$0.64

$0.6398

$0.641

$0.639

Description

The recent drop in price suggests bearish momentum. The RSI indicates oversold conditions, but a potential bounce could occur. Watch for volume spikes as confirmation of any reversal.

Analysis

The past three months show a bearish trend with significant support around 0.639. The recent price drop indicates a potential reversal, but the overall sentiment remains cautious. Technical indicators suggest a possible short-term bounce.

Confidence Level

Potential Risks

Market volatility and external news could impact the price significantly.

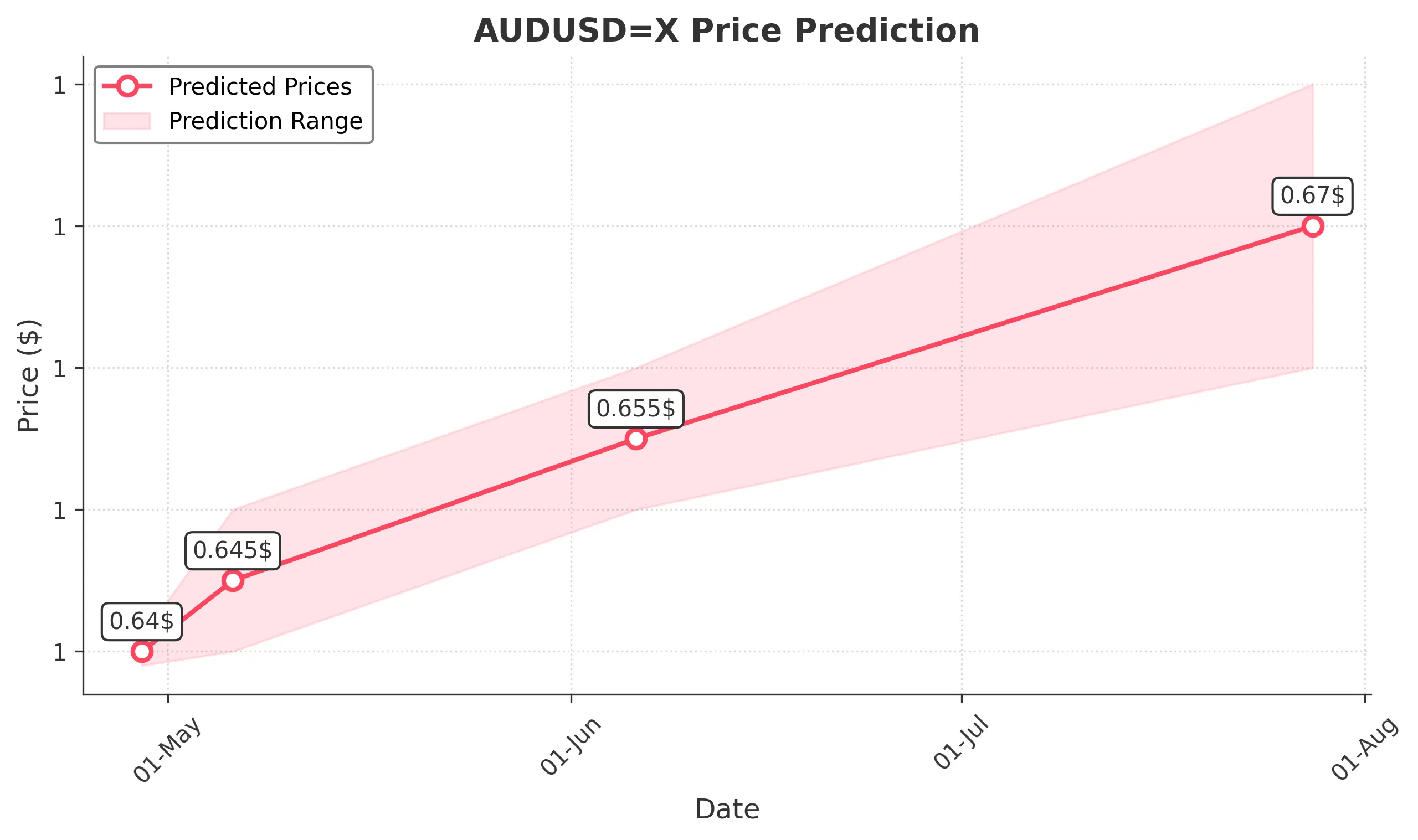

1 Week Prediction

Target: May 6, 2025$0.645

$0.6405

$0.65

$0.64

Description

Expect a slight recovery as the market may react to oversold conditions. The MACD shows potential bullish divergence, indicating a possible upward correction in the coming week.

Analysis

The stock has been in a bearish phase, but recent candlestick patterns suggest a potential reversal. Key resistance is at 0.650, and the market sentiment remains cautious due to external factors.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could lead to further declines.

1 Month Prediction

Target: June 6, 2025$0.655

$0.65

$0.66

$0.65

Description

A gradual recovery is anticipated as the market stabilizes. The Bollinger Bands suggest a potential breakout, and if the price holds above 0.650, bullish momentum may build.

Analysis

The stock has shown signs of recovery potential, but the overall trend remains bearish. Key support at 0.639 must hold for a bullish scenario. Watch for volume increases to confirm any upward movement.

Confidence Level

Potential Risks

Market sentiment could shift rapidly based on economic data releases.

3 Months Prediction

Target: July 28, 2025$0.67

$0.665

$0.68

$0.66

Description

If the current bearish trend reverses, a gradual climb towards 0.670 is possible. The market may react positively to macroeconomic improvements, but caution is advised.

Analysis

The stock has been volatile, with significant fluctuations. The overall trend is bearish, but if support levels hold, a recovery could occur. External economic factors will play a crucial role in future price movements.

Confidence Level

Potential Risks

Long-term predictions are uncertain due to potential economic shifts and geopolitical events.