AUDUSDX Trading Predictions

1 Day Prediction

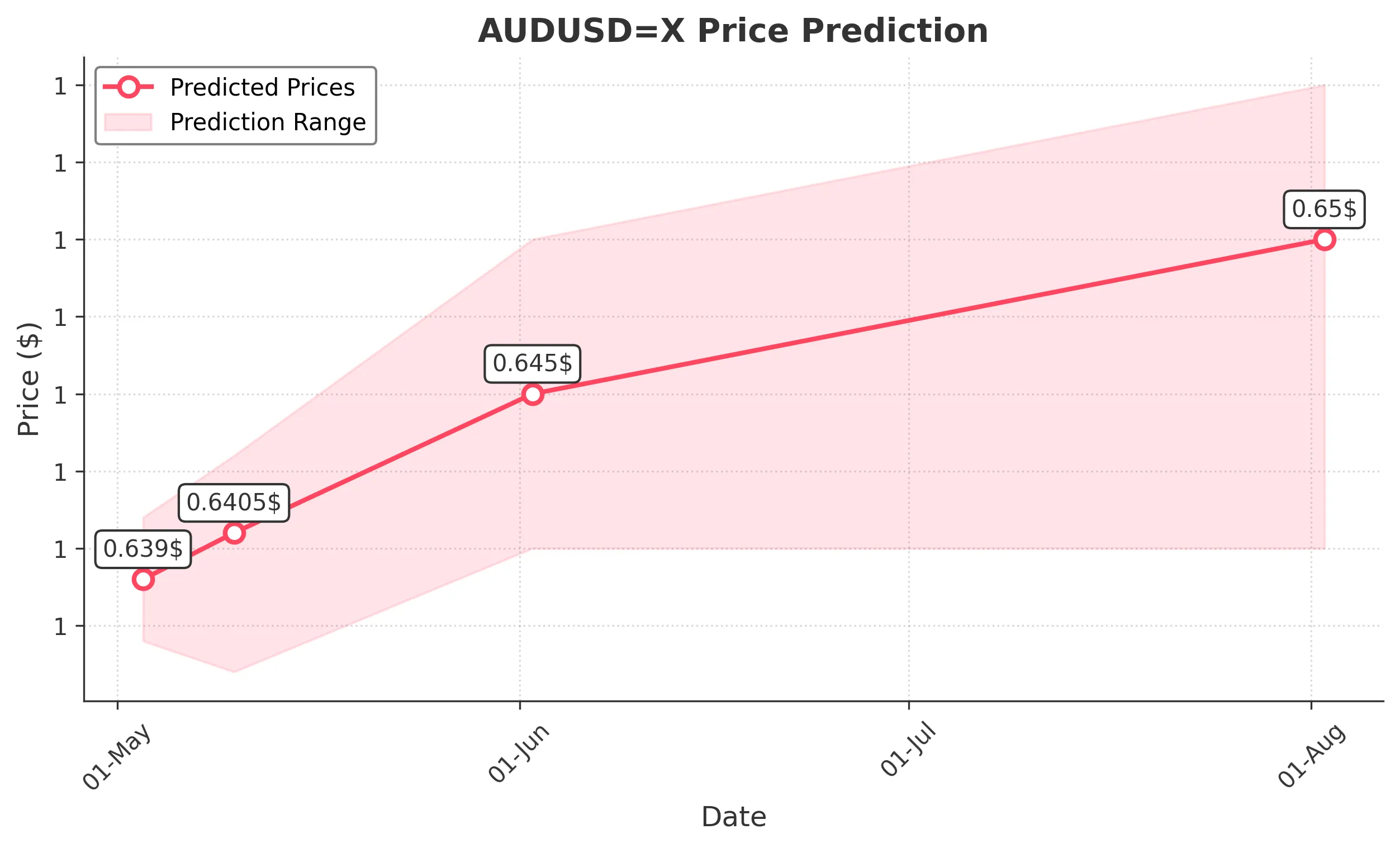

Target: May 3, 2025$0.639

$0.6395

$0.641

$0.637

Description

The price is expected to stabilize around 0.6390, supported by recent bullish momentum and a slight upward trend in the last few days. RSI indicates neutrality, suggesting potential for a small upward move.

Analysis

The past 3 months show a bullish trend with significant support at 0.6350. Recent price action indicates a consolidation phase, with RSI hovering around 50. Volume has been low, indicating cautious trading.

Confidence Level

Potential Risks

Market volatility and external economic news could impact this prediction.

1 Week Prediction

Target: May 10, 2025$0.6405

$0.6395

$0.643

$0.636

Description

Expect a slight upward trend as the market reacts positively to recent economic data. The MACD shows bullish divergence, indicating potential upward momentum in the coming week.

Analysis

The stock has shown resilience with a recent bounce off support at 0.6350. The MACD is bullish, and the price is above the 50-day moving average, suggesting a continuation of the upward trend.

Confidence Level

Potential Risks

Unexpected geopolitical events or economic reports could alter market sentiment.

1 Month Prediction

Target: June 2, 2025$0.645

$0.642

$0.65

$0.64

Description

A bullish outlook is anticipated as the market sentiment improves. Fibonacci retracement levels suggest a target around 0.6450, supported by recent bullish candlestick patterns.

Analysis

The stock has been in a bullish trend, with key resistance at 0.6450. The RSI is approaching overbought territory, indicating potential for a pullback. However, overall sentiment remains positive.

Confidence Level

Potential Risks

Economic indicators and central bank policies could lead to volatility.

3 Months Prediction

Target: August 2, 2025$0.65

$0.645

$0.655

$0.64

Description

Long-term bullish sentiment is expected as economic recovery continues. The price may reach 0.6500, supported by strong fundamentals and positive market sentiment.

Analysis

The overall trend is bullish, with significant support at 0.6400. The market has shown resilience, but potential economic downturns or policy changes could impact future performance.

Confidence Level

Potential Risks

Long-term predictions are subject to macroeconomic changes and market corrections.