AUDUSDX Trading Predictions

1 Day Prediction

Target: June 8, 2025$0.65

$0.6495

$0.652

$0.648

Description

The price is expected to rise slightly due to bullish momentum indicated by the recent upward trend and a potential breakout above resistance at 0.650. RSI is neutral, suggesting room for upward movement.

Analysis

The past 3 months show a bullish trend with significant support at 0.640 and resistance at 0.652. The MACD is positive, and the ATR indicates moderate volatility. Recent candlestick patterns suggest bullish sentiment.

Confidence Level

Potential Risks

Market volatility and external economic factors could impact this prediction.

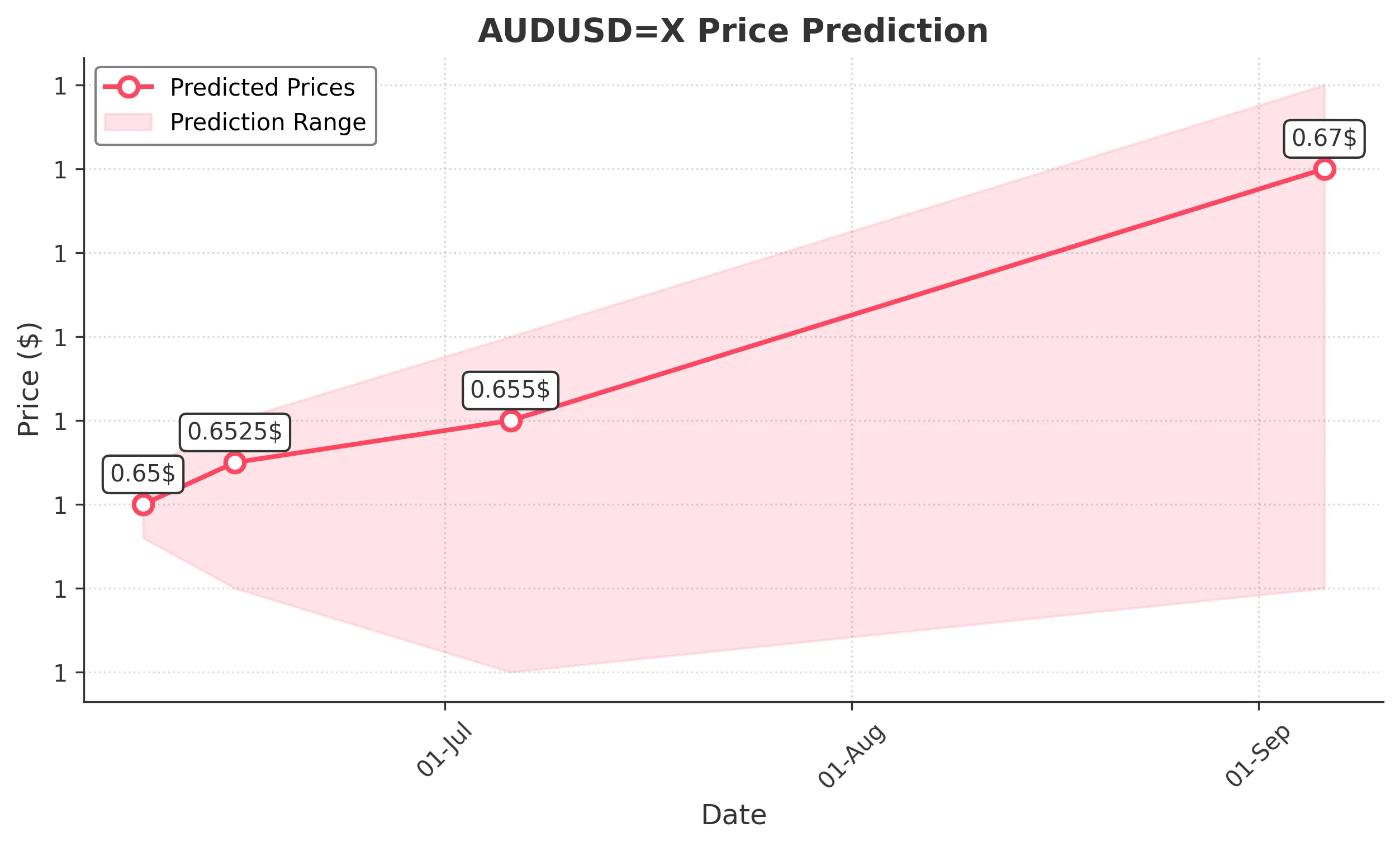

1 Week Prediction

Target: June 15, 2025$0.6525

$0.65

$0.655

$0.645

Description

The upward trend is expected to continue as the price approaches the resistance level at 0.655. The MACD remains bullish, and the RSI indicates potential overbought conditions, suggesting a pullback may occur.

Analysis

The stock has shown consistent upward movement, with key support at 0.640. The Bollinger Bands indicate tightening, suggesting a breakout is imminent. Volume has been increasing, supporting the bullish trend.

Confidence Level

Potential Risks

Potential market corrections and geopolitical events could lead to unexpected price movements.

1 Month Prediction

Target: July 6, 2025$0.655

$0.652

$0.66

$0.64

Description

The price is projected to reach 0.655 as bullish momentum persists. The Fibonacci retracement levels support this target, and the MACD remains in a bullish crossover. However, watch for potential resistance at 0.660.

Analysis

The overall trend is bullish, with significant support at 0.640. The RSI is approaching overbought territory, indicating a possible correction. Recent candlestick patterns show bullish engulfing signals, reinforcing the upward trend.

Confidence Level

Potential Risks

Economic data releases and changes in market sentiment could affect the price trajectory.

3 Months Prediction

Target: September 6, 2025$0.67

$0.66

$0.675

$0.645

Description

The price is expected to reach 0.670 as the bullish trend continues, supported by strong economic indicators and positive market sentiment. However, potential resistance at 0.675 may limit further gains.

Analysis

The stock has shown a strong bullish trend over the past months, with key support at 0.640. The MACD is bullish, and the ATR indicates increasing volatility. However, external economic factors could lead to fluctuations.

Confidence Level

Potential Risks

Long-term predictions are subject to higher uncertainty due to macroeconomic factors and potential market corrections.