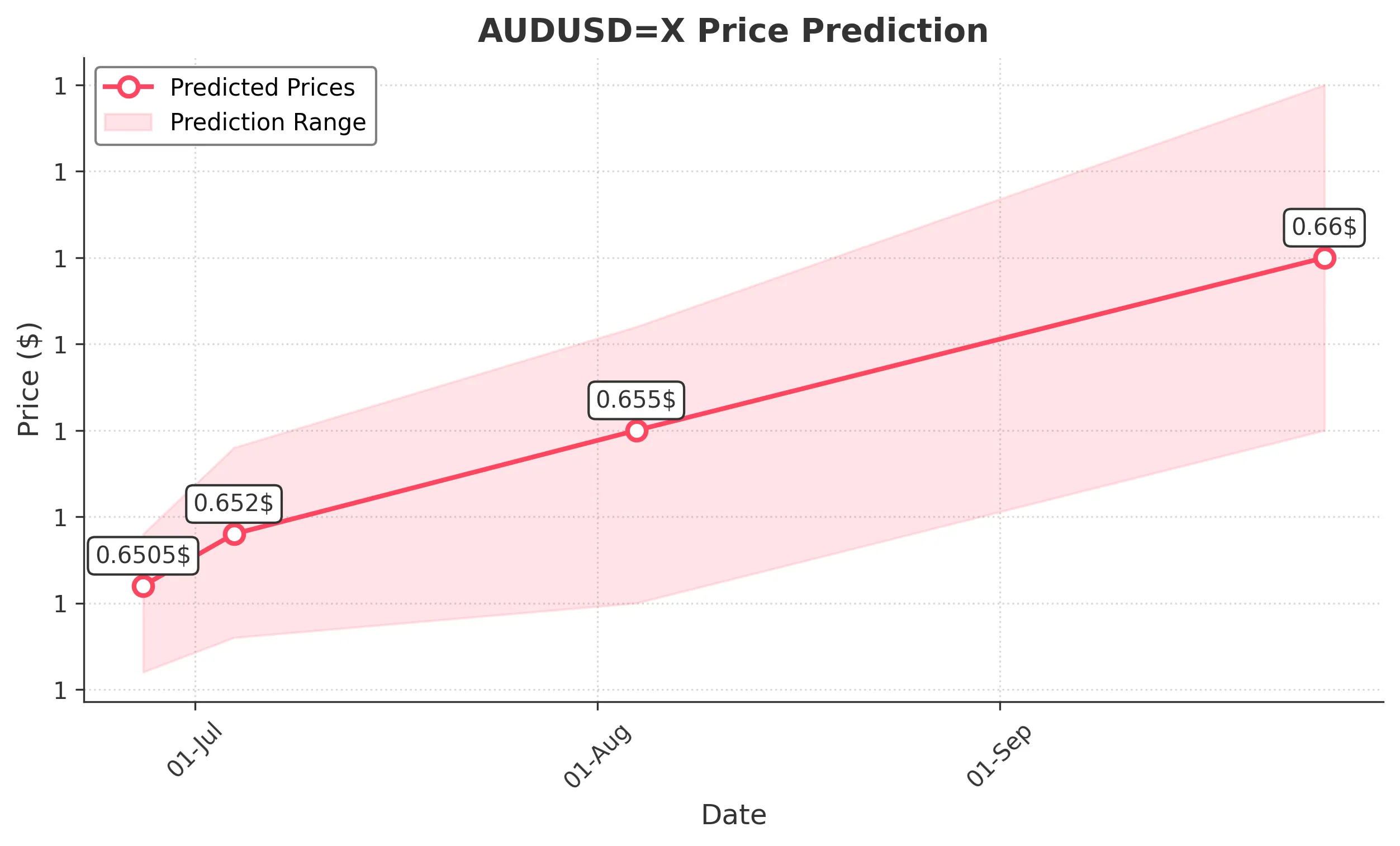

AUDUSDX Trading Predictions

1 Day Prediction

Target: June 27, 2025$0.6505

$0.65

$0.652

$0.648

Description

The price is expected to stabilize around 0.6505, supported by recent bullish momentum and a slight upward trend in the last few days. RSI indicates neutrality, while MACD shows a potential bullish crossover.

Analysis

The past three months show a bullish trend with significant support at 0.644 and resistance at 0.655. The MACD is bullish, and the RSI is neutral, indicating potential for upward movement. Volume has been stable, suggesting steady interest.

Confidence Level

Potential Risks

Market volatility and external economic news could impact this prediction.

1 Week Prediction

Target: July 4, 2025$0.652

$0.6505

$0.6545

$0.649

Description

Expect a gradual increase to 0.6520 as bullish sentiment persists. The recent candlestick patterns indicate a continuation of the upward trend, supported by positive MACD and RSI readings.

Analysis

The stock has shown resilience with a bullish trend, supported by a recent breakout above 0.650. Key resistance at 0.655 may limit upside potential. Volume patterns indicate healthy trading activity, but external factors could introduce volatility.

Confidence Level

Potential Risks

Potential market corrections or geopolitical events could reverse this trend.

1 Month Prediction

Target: August 4, 2025$0.655

$0.652

$0.658

$0.65

Description

Aiming for 0.6550 as the bullish trend continues, supported by strong momentum indicators. The market sentiment remains positive, but caution is advised as overbought conditions may arise.

Analysis

The stock has been in a bullish phase, with key support at 0.644 and resistance at 0.655. The RSI is approaching overbought territory, indicating a potential pullback. Volume trends are stable, but external economic factors could introduce uncertainty.

Confidence Level

Potential Risks

Market corrections or economic data releases could lead to unexpected price movements.

3 Months Prediction

Target: September 26, 2025$0.66

$0.655

$0.665

$0.655

Description

Forecasting a rise to 0.6600 as the overall trend remains bullish. However, potential resistance at 0.665 could limit further gains. Watch for any bearish signals in the coming weeks.

Analysis

The stock has shown a strong upward trend, with key resistance at 0.665. The MACD indicates bullish momentum, but the RSI suggests potential overbought conditions. Volume has been consistent, but external factors could lead to volatility.

Confidence Level

Potential Risks

Economic shifts or unexpected news could significantly alter market dynamics.