AUDUSDX Trading Predictions

1 Day Prediction

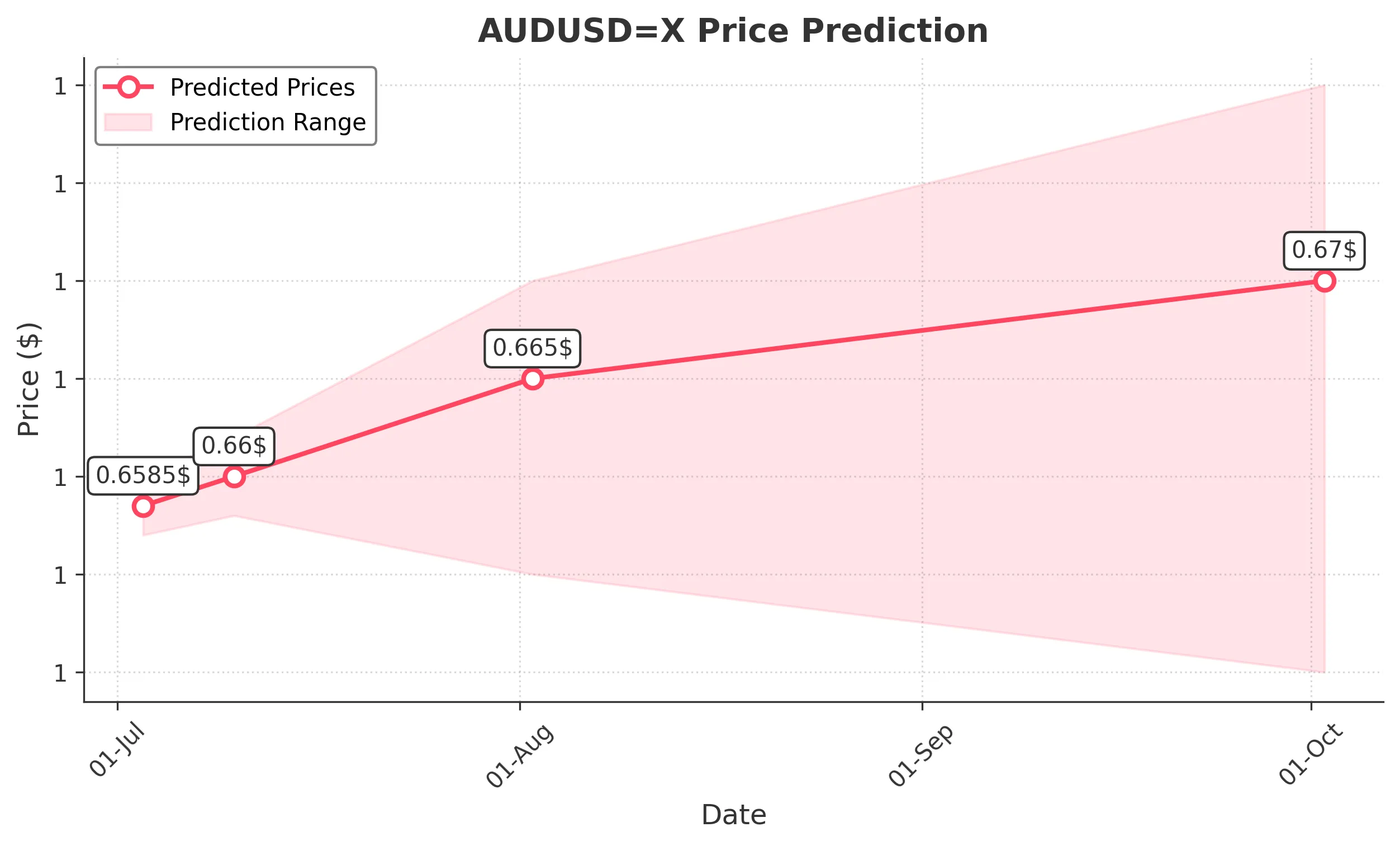

Target: July 3, 2025$0.6585

$0.658341

$0.66

$0.657

Description

The AUDUSD shows a bullish trend with recent higher highs and higher lows. The RSI is near 60, indicating strength. A potential breakout above 0.659 could lead to further gains. However, watch for resistance at 0.660.

Analysis

The past 3 months show a bullish trend with significant support at 0.644 and resistance at 0.660. The MACD is positive, and volume has been stable. Recent candlestick patterns indicate bullish sentiment, but external factors could introduce volatility.

Confidence Level

Potential Risks

Market volatility and external economic news could impact the prediction.

1 Week Prediction

Target: July 10, 2025$0.66

$0.6585

$0.662

$0.658

Description

The bullish momentum is expected to continue, with the price likely to test the 0.660 resistance level. The MACD remains positive, and the RSI indicates no overbought conditions yet. Watch for potential pullbacks.

Analysis

The stock has shown consistent upward movement, with key support at 0.644. The Bollinger Bands are widening, indicating increased volatility. The market sentiment remains bullish, but caution is advised as resistance levels are approached.

Confidence Level

Potential Risks

Potential geopolitical events or economic data releases could affect market sentiment.

1 Month Prediction

Target: August 2, 2025$0.665

$0.66

$0.67

$0.655

Description

If the bullish trend continues, the price could reach 0.665, supported by strong momentum indicators. The RSI is expected to remain healthy, but watch for any signs of exhaustion as the price approaches 0.670.

Analysis

The overall trend is bullish, with the price consistently making higher highs. Key resistance at 0.670 may pose challenges. The ATR indicates increasing volatility, and the market sentiment remains cautiously optimistic.

Confidence Level

Potential Risks

Market corrections or unexpected economic data could lead to a reversal.

3 Months Prediction

Target: October 2, 2025$0.67

$0.665

$0.68

$0.65

Description

In three months, the price could stabilize around 0.670 if the bullish trend persists. However, potential economic shifts could lead to volatility. Watch for any bearish signals that may emerge.

Analysis

The stock has shown a strong bullish trend, but the potential for market corrections exists. Key support at 0.650 and resistance at 0.680 will be critical. The market sentiment is mixed, with external factors likely influencing future movements.

Confidence Level

Potential Risks

Long-term predictions are uncertain due to potential economic changes and market sentiment shifts.