AUDUSDX Trading Predictions

1 Day Prediction

Target: July 11, 2025$0.6535

$0.6535

$0.655

$0.652

Description

The price is expected to stabilize around 0.6535, supported by recent bullish momentum. The RSI indicates neutrality, while MACD shows a slight bullish crossover. However, a bearish engulfing pattern suggests caution.

Analysis

The past three months show a bullish trend with significant support at 0.6500. The recent price action indicates consolidation around 0.6530-0.6550. Volume has been low, indicating a lack of strong conviction in the current trend.

Confidence Level

Potential Risks

Potential volatility due to external market news could impact the prediction.

1 Week Prediction

Target: July 18, 2025$0.655

$0.6545

$0.657

$0.653

Description

Expect a slight upward movement to 0.6550 as the market digests recent gains. The Bollinger Bands suggest a potential breakout, but the RSI nearing overbought territory raises caution.

Analysis

The stock has shown resilience with a recent upward trend. Key resistance is at 0.6570, while support remains at 0.6500. The MACD is bullish, but caution is warranted due to potential overextension.

Confidence Level

Potential Risks

Market sentiment could shift quickly, especially with upcoming economic data releases.

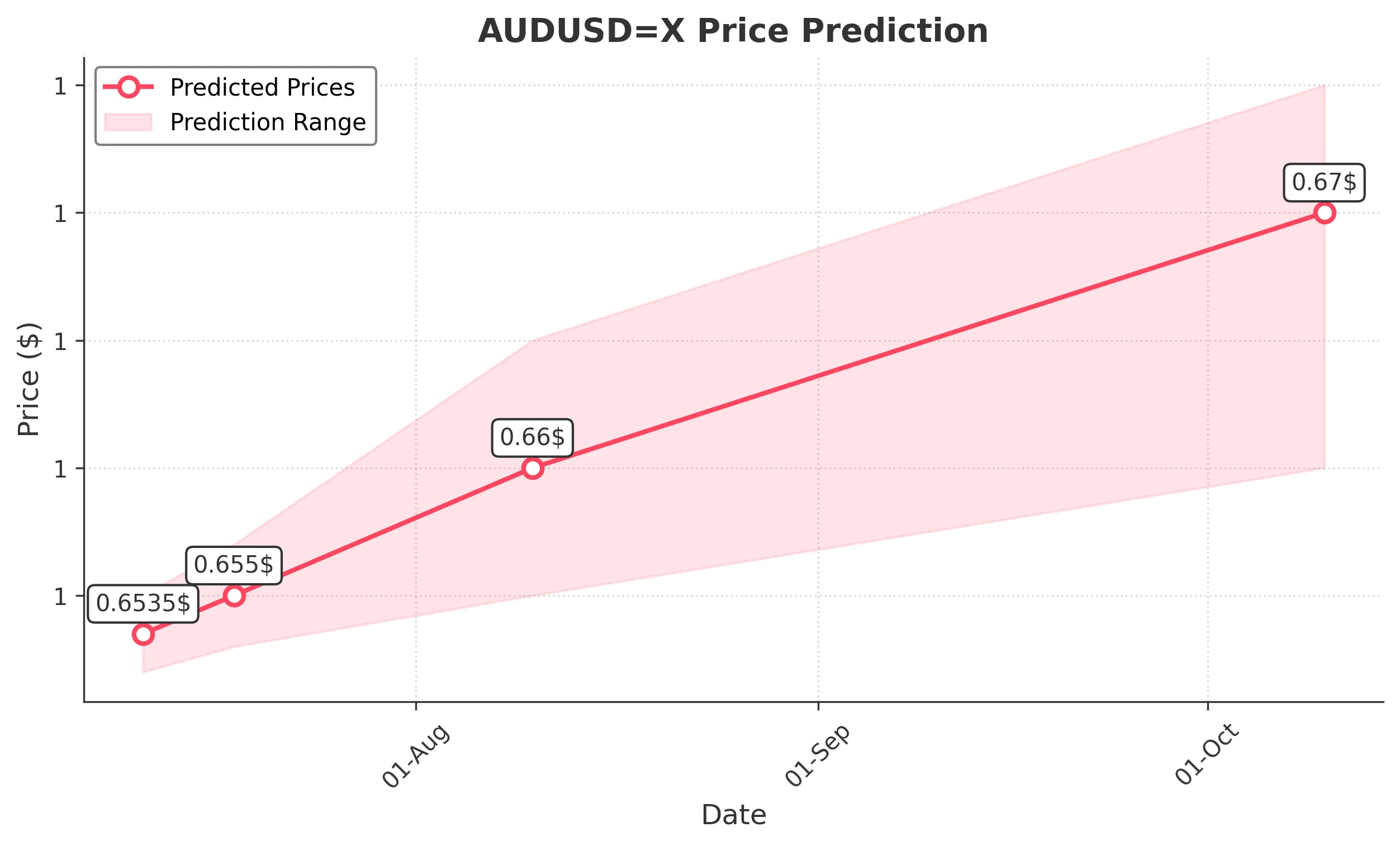

1 Month Prediction

Target: August 10, 2025$0.66

$0.658

$0.665

$0.655

Description

A bullish outlook to 0.6600 is anticipated as the market continues to favor upward momentum. Fibonacci retracement levels support this target, but overbought conditions may lead to corrections.

Analysis

The stock has been in a bullish phase, with strong support at 0.6500. The MACD and RSI indicate upward momentum, but caution is advised as the price approaches resistance levels. Volume trends suggest a lack of strong buying pressure.

Confidence Level

Potential Risks

Economic indicators could reverse the trend, especially if inflation data surprises.

3 Months Prediction

Target: October 10, 2025$0.67

$0.668

$0.675

$0.66

Description

Long-term bullish sentiment suggests a target of 0.6700, driven by macroeconomic stability and positive market sentiment. However, potential geopolitical risks could impact this outlook.

Analysis

The overall trend remains bullish, with key support at 0.6500 and resistance at 0.6750. The market sentiment is cautiously optimistic, but external factors could introduce volatility. The ATR indicates increasing volatility, suggesting potential price swings.

Confidence Level

Potential Risks

Unforeseen geopolitical events or economic downturns could lead to significant volatility.