AUDUSDX Trading Predictions

1 Day Prediction

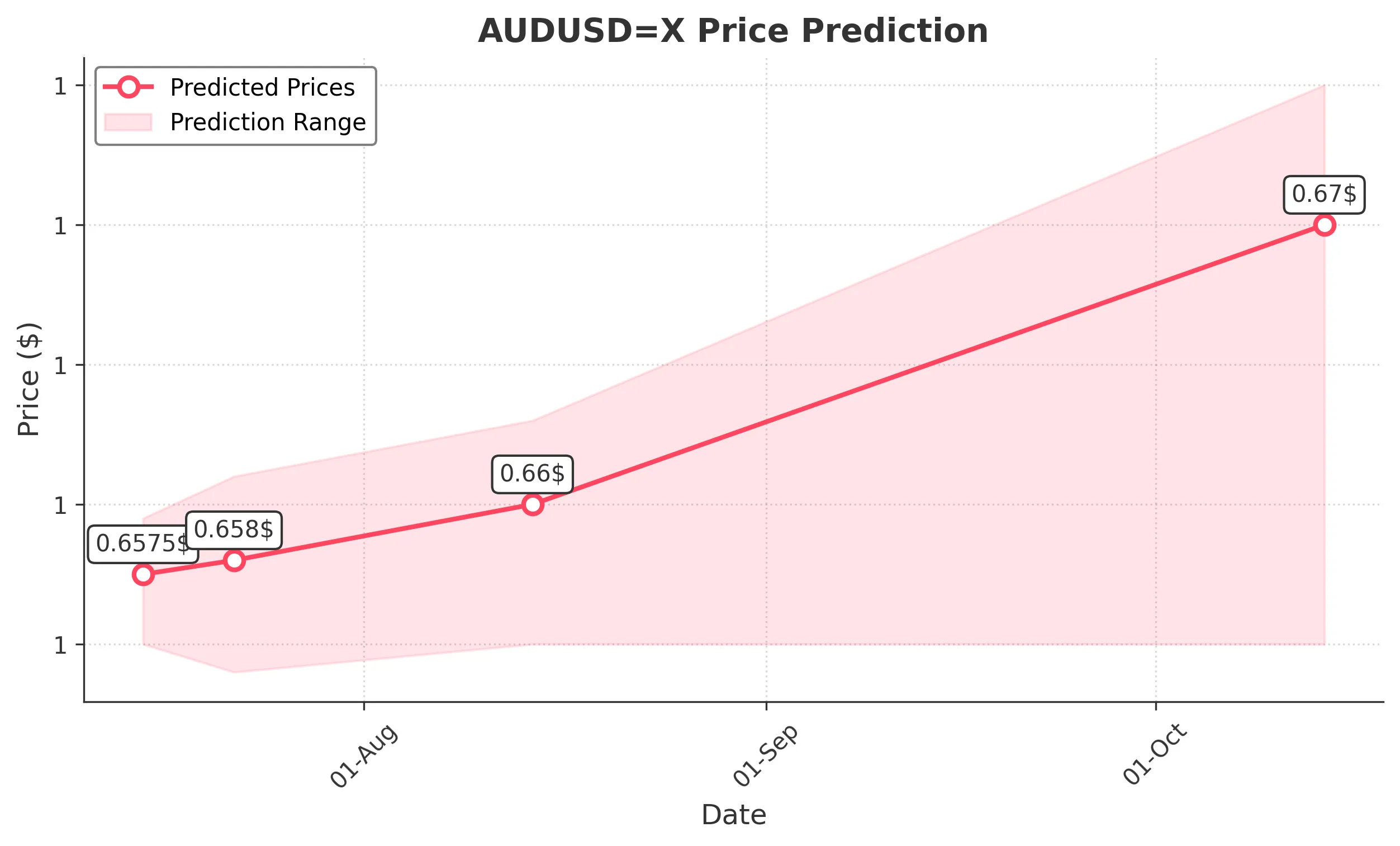

Target: July 15, 2025$0.6575

$0.657

$0.6595

$0.655

Description

The recent bullish trend suggests a slight upward movement. The RSI is near 60, indicating strength, while MACD shows a bullish crossover. However, resistance at 0.659 may limit gains.

Analysis

The past 3 months show a bullish trend with significant support at 0.650 and resistance at 0.659. The MACD and RSI indicate upward momentum, but recent candlestick patterns suggest caution as volatility increases.

Confidence Level

Potential Risks

Potential reversal if market sentiment shifts or if external news impacts trading.

1 Week Prediction

Target: July 22, 2025$0.658

$0.6575

$0.661

$0.654

Description

The bullish trend is expected to continue, supported by recent price action. However, the proximity to resistance levels may lead to a pullback. Watch for volume spikes for confirmation.

Analysis

The stock has shown resilience with a series of higher lows. The Bollinger Bands indicate tightening, suggesting a potential breakout. However, the market remains sensitive to macroeconomic factors.

Confidence Level

Potential Risks

Market volatility and potential bearish news could impact the forecast.

1 Month Prediction

Target: August 14, 2025$0.66

$0.6585

$0.663

$0.655

Description

If the bullish momentum persists, we could see a gradual rise towards 0.660. The Fibonacci retracement levels support this target, but caution is advised as overbought conditions may trigger a correction.

Analysis

The overall trend remains bullish, with key support at 0.650. The RSI is approaching overbought territory, indicating a potential pullback. Volume analysis shows consistent buying interest, but caution is warranted.

Confidence Level

Potential Risks

Economic data releases and geopolitical events could lead to unexpected volatility.

3 Months Prediction

Target: October 14, 2025$0.67

$0.668

$0.675

$0.655

Description

Long-term bullish sentiment could push prices towards 0.670, supported by macroeconomic recovery. However, any signs of economic slowdown could reverse this trend.

Analysis

The stock has shown a strong upward trajectory, but the potential for market corrections exists. Key resistance at 0.675 may pose challenges. Monitoring economic indicators will be crucial for future predictions.

Confidence Level

Potential Risks

Unforeseen economic events or shifts in market sentiment could lead to significant price fluctuations.