AUDUSDX Trading Predictions

1 Day Prediction

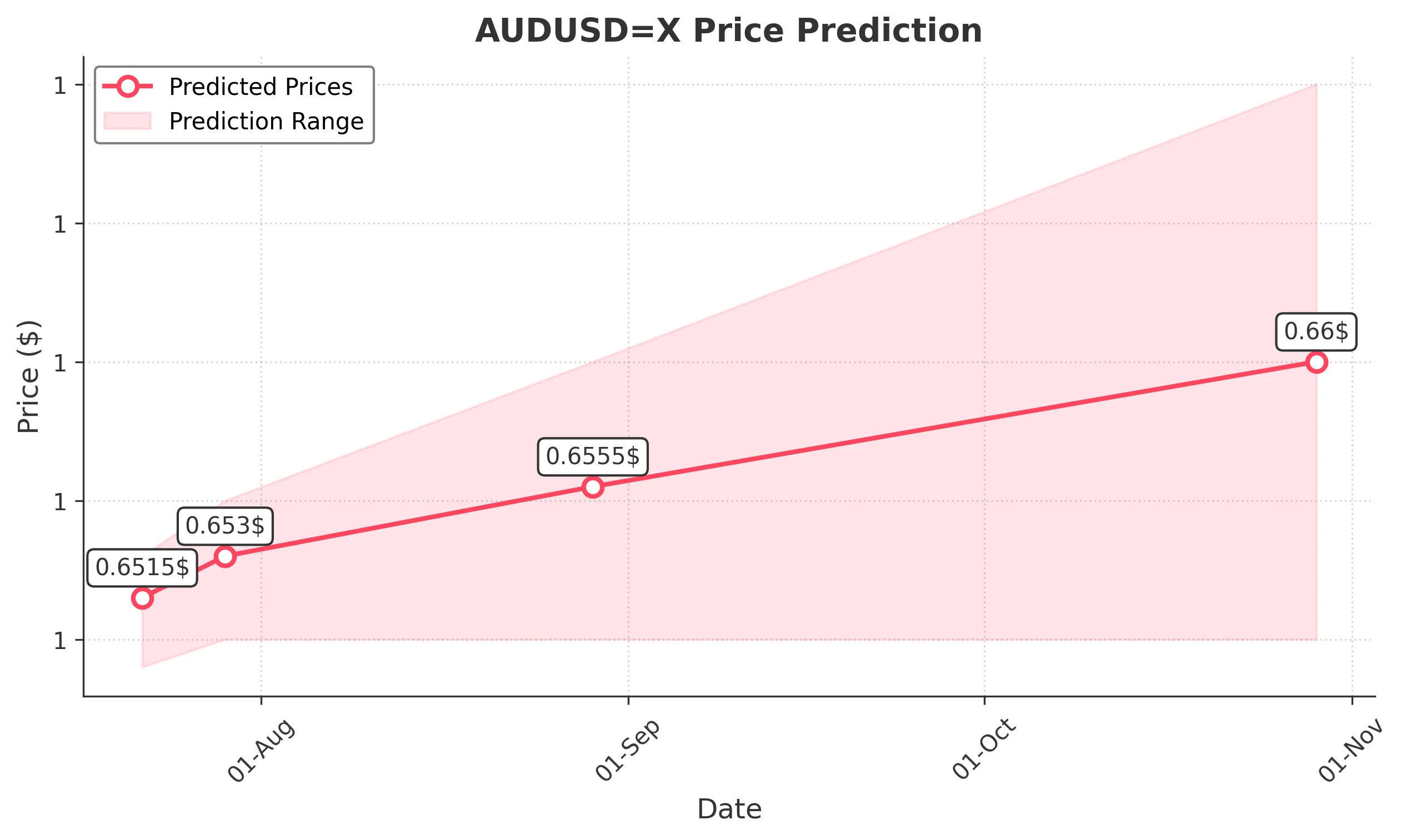

Target: July 22, 2025$0.6515

$0.650999

$0.653

$0.649

Description

The recent bullish trend suggests a slight upward movement. The RSI is neutral, indicating no overbought conditions. A potential Doji pattern indicates indecision, but overall sentiment remains positive.

Analysis

The past three months show a bullish trend with significant support at 0.6500. The MACD is positive, and the price is above the 50-day moving average. However, recent candlestick patterns indicate potential indecision.

Confidence Level

Potential Risks

Market volatility and external news could impact the price unexpectedly.

1 Week Prediction

Target: July 29, 2025$0.653

$0.6515

$0.655

$0.65

Description

The bullish momentum is expected to continue, supported by a recent breakout above resistance levels. The MACD shows increasing bullish momentum, while the RSI remains healthy.

Analysis

The stock has shown a consistent upward trend, with key resistance at 0.6550. The Bollinger Bands indicate potential for further upward movement, but caution is advised due to possible market corrections.

Confidence Level

Potential Risks

Any geopolitical events or economic data releases could lead to sudden price changes.

1 Month Prediction

Target: August 29, 2025$0.6555

$0.653

$0.66

$0.65

Description

The overall trend remains bullish, with strong support at 0.6500. The Fibonacci retracement levels suggest a target around 0.6550, with potential for further gains if momentum continues.

Analysis

The stock has been in a bullish phase, with the 50-day moving average trending upwards. Volume patterns indicate healthy buying interest, but caution is warranted as the market may face corrections.

Confidence Level

Potential Risks

Economic indicators and central bank decisions could introduce volatility.

3 Months Prediction

Target: October 29, 2025$0.66

$0.6555

$0.67

$0.65

Description

If the current bullish trend persists, the price could reach 0.6600. However, potential resistance at 0.6700 may limit gains. Market sentiment remains positive, but external factors could alter this outlook.

Analysis

The stock has shown resilience with a bullish trend, but the market is susceptible to external shocks. Key resistance levels at 0.6700 could pose challenges, and macroeconomic factors will play a crucial role.

Confidence Level

Potential Risks

Long-term predictions are uncertain due to potential economic shifts and market corrections.