AUDUSDX Trading Predictions

1 Day Prediction

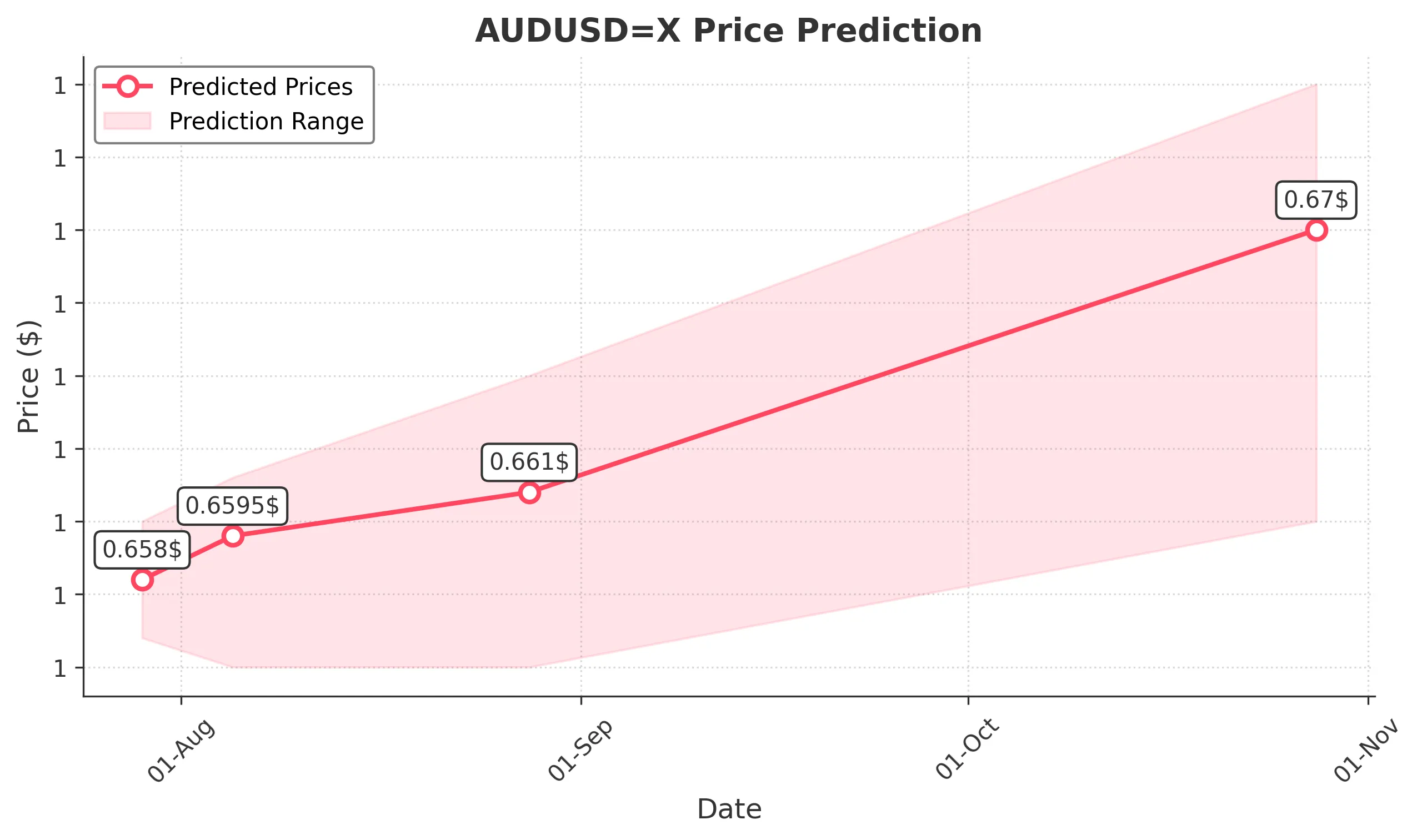

Target: July 29, 2025$0.658

$0.6575

$0.66

$0.656

Description

The price is expected to stabilize around 0.658 due to recent bullish momentum. The RSI is neutral, and MACD shows a slight upward trend. However, a potential resistance at 0.660 may limit gains.

Analysis

The past three months show a bullish trend with significant support at 0.650 and resistance at 0.660. The MACD is positive, and the RSI is around 50, indicating potential for upward movement. Volume has been stable, but any sudden news could shift sentiment.

Confidence Level

Potential Risks

Market volatility and external economic news could impact the price unexpectedly.

1 Week Prediction

Target: August 5, 2025$0.6595

$0.658

$0.6615

$0.655

Description

The price is projected to rise slightly as bullish sentiment persists. The 50-day moving average supports this trend, but caution is advised as the market approaches resistance levels.

Analysis

The stock has shown a consistent upward trend, with recent highs around 0.660. The Bollinger Bands indicate tightening, suggesting a potential breakout. However, the RSI nearing overbought levels raises concerns about sustainability.

Confidence Level

Potential Risks

Potential market corrections or geopolitical events could lead to price fluctuations.

1 Month Prediction

Target: August 28, 2025$0.661

$0.659

$0.665

$0.655

Description

A gradual increase to 0.661 is expected as the market remains bullish. The Fibonacci retracement levels suggest support at 0.655, while the MACD indicates continued upward momentum.

Analysis

The overall trend is bullish, with key support at 0.655 and resistance at 0.665. The MACD is positive, and the RSI is approaching overbought territory, indicating potential for a pullback. Volume trends are stable, but external factors could introduce volatility.

Confidence Level

Potential Risks

Economic data releases could alter market sentiment and affect the price trajectory.

3 Months Prediction

Target: October 28, 2025$0.67

$0.663

$0.675

$0.66

Description

Long-term bullish sentiment may push prices to 0.670, supported by strong economic indicators. However, resistance at 0.675 could pose challenges.

Analysis

The stock has shown a strong upward trend over the past three months, with key support at 0.660. The MACD remains bullish, but the RSI indicates potential overbought conditions. Market sentiment is generally positive, but external economic factors could introduce volatility.

Confidence Level

Potential Risks

Unforeseen economic events or shifts in market sentiment could lead to significant price corrections.