AUDUSDX Trading Predictions

1 Day Prediction

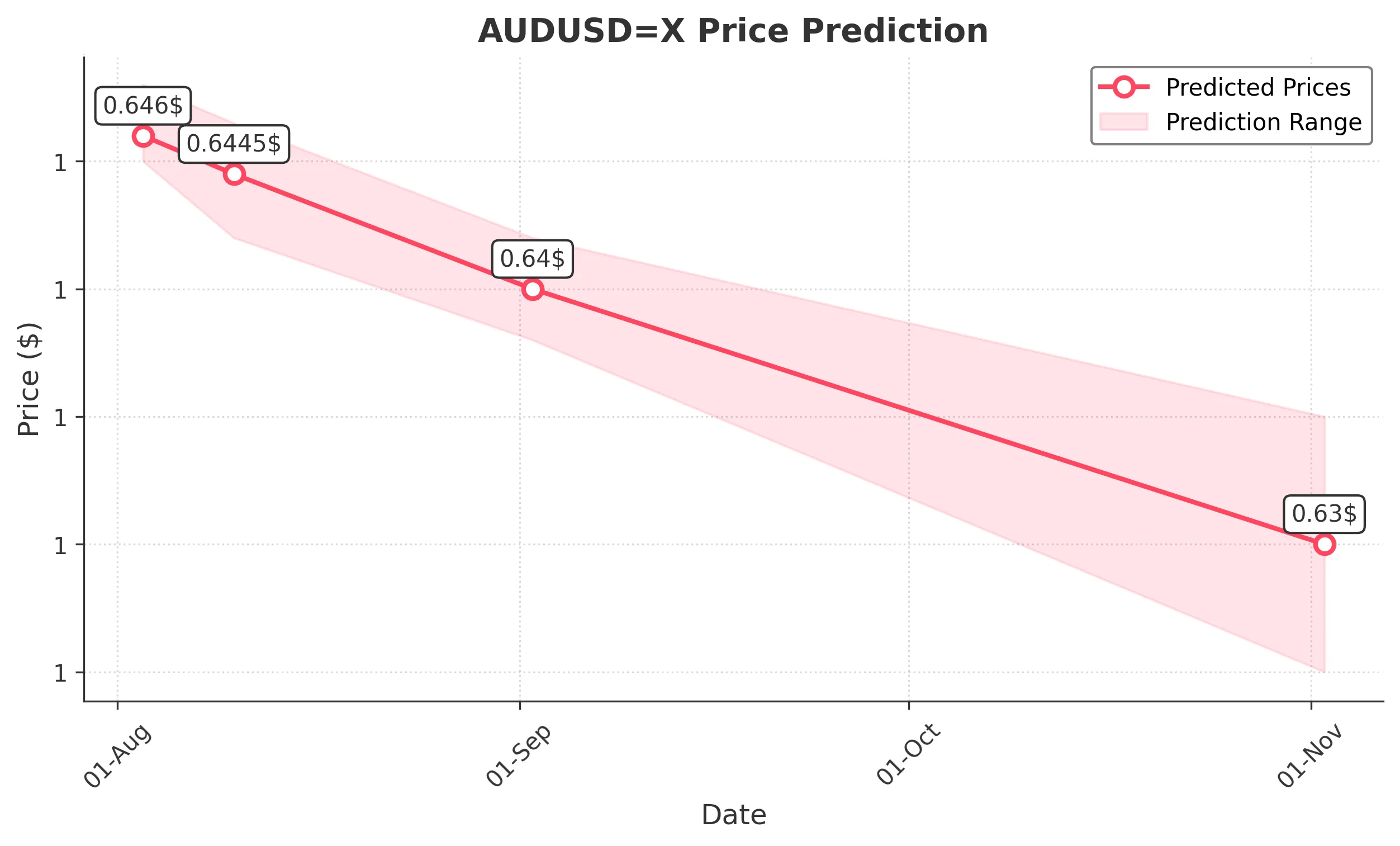

Target: August 3, 2025$0.646

$0.646

$0.648

$0.645

Description

The recent price action shows a slight bullish trend, but the RSI indicates overbought conditions. A potential pullback is expected, leading to a close around 0.646. Support at 0.645 may hold.

Analysis

The past three months show a bullish trend with significant resistance at 0.660. Recent candlestick patterns indicate indecision, and the RSI is nearing overbought levels, suggesting a possible correction.

Confidence Level

Potential Risks

Market volatility and external news could impact the price unexpectedly.

1 Week Prediction

Target: August 10, 2025$0.6445

$0.645

$0.6465

$0.642

Description

Expect a slight bearish trend as the market corrects from overbought conditions. The MACD shows a potential crossover, indicating weakening momentum. A close around 0.6445 is likely.

Analysis

The stock has shown bullish momentum but is facing resistance at 0.660. The recent price action suggests a potential pullback, with support levels around 0.640. Volume has been low, indicating a lack of strong conviction.

Confidence Level

Potential Risks

Unforeseen economic data releases could shift market sentiment rapidly.

1 Month Prediction

Target: September 2, 2025$0.64

$0.641

$0.642

$0.638

Description

A bearish trend is anticipated as the market corrects further. Fibonacci retracement levels suggest support around 0.640. The RSI indicates a potential reversal, leading to a close around 0.640.

Analysis

The overall trend has been bullish, but recent price action shows signs of exhaustion. Key support at 0.640 is critical, and if broken, further declines could occur. The market sentiment is cautious.

Confidence Level

Potential Risks

Economic indicators and geopolitical events could lead to unexpected volatility.

3 Months Prediction

Target: November 2, 2025$0.63

$0.632

$0.635

$0.625

Description

A bearish outlook is expected as the market continues to correct. The MACD indicates a bearish crossover, and the RSI suggests oversold conditions. A close around 0.630 is likely.

Analysis

The stock has shown a strong bullish trend but is now facing significant resistance. The potential for a prolonged correction exists, especially if economic indicators turn negative. Key support levels will be crucial.

Confidence Level

Potential Risks

Long-term economic shifts and policy changes could significantly alter market dynamics.