BTC-USD Trading Predictions

1 Day Prediction

Target: April 4, 2025$83500

$83200

$84500

$82000

Description

The market shows signs of consolidation with a slight bearish trend. The recent candlestick patterns indicate indecision, and the RSI is approaching oversold territory, suggesting a potential bounce. However, volatility remains high.

Analysis

Over the past 3 months, BTC-USD has experienced high volatility with a bearish trend recently. Key support is around 82000, while resistance is near 85000. The RSI indicates potential oversold conditions, but MACD shows bearish momentum.

Confidence Level

Potential Risks

Market sentiment is mixed, and external factors could lead to sudden price movements. A significant news event could impact the prediction.

1 Week Prediction

Target: April 11, 2025$84000

$83500

$85500

$81000

Description

The price is expected to stabilize around 84000 as the market digests recent volatility. The Bollinger Bands suggest a tightening range, indicating potential for a breakout. However, bearish sentiment persists.

Analysis

The past 3 months show a bearish trend with significant price fluctuations. Support at 81000 is critical, while resistance at 85500 may cap upward movements. Volume spikes indicate strong interest, but overall sentiment is cautious.

Confidence Level

Potential Risks

Uncertainty remains due to macroeconomic factors and potential regulatory news that could affect market sentiment.

1 Month Prediction

Target: May 3, 2025$85000

$84000

$87000

$80000

Description

A gradual recovery is anticipated as the market stabilizes. The Fibonacci retracement levels suggest potential support at 80000, while bullish divergence in the RSI may signal a reversal. Caution is advised.

Analysis

The BTC-USD has shown a bearish trend recently, with significant support at 80000. The RSI indicates potential for a rebound, while MACD shows signs of bullish divergence. Volume analysis suggests strong interest at current levels.

Confidence Level

Potential Risks

Market volatility and external economic factors could disrupt this recovery, leading to unexpected price movements.

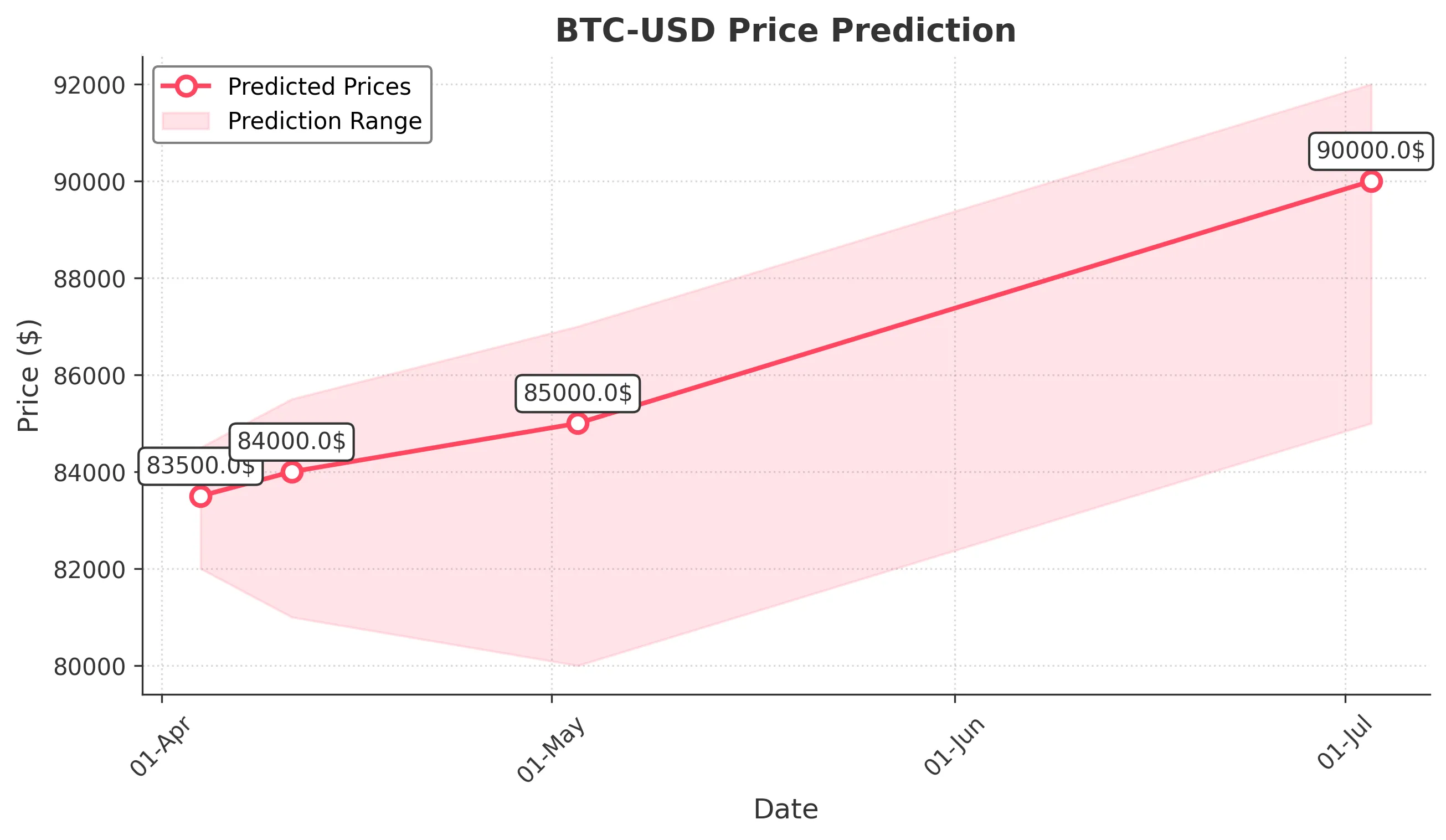

3 Months Prediction

Target: July 3, 2025$90000

$89500

$92000

$85000

Description

Long-term recovery is expected as market sentiment improves. The potential for bullish momentum is supported by technical indicators, but caution is warranted due to macroeconomic uncertainties.

Analysis

The overall trend in the past 3 months has been bearish, but signs of recovery are emerging. Key resistance at 92000 and support at 85000 will be crucial. The market sentiment is cautiously optimistic, but external factors remain a risk.

Confidence Level

Potential Risks

Economic conditions and regulatory changes could impact the market significantly, leading to volatility.