BTC-USD Trading Predictions

1 Day Prediction

Target: April 12, 2025$81200

$81000

$82000

$80000

Description

The market shows signs of consolidation after recent volatility. RSI indicates oversold conditions, suggesting a potential bounce. However, bearish sentiment persists, limiting upside. Expect a close around 81200.

Analysis

Over the past 3 months, BTC-USD has experienced significant volatility, with a recent bearish trend. Key support at 80000 is critical. Moving averages indicate a potential reversal, but volume spikes suggest uncertainty. Overall, the market sentiment remains cautious.

Confidence Level

Potential Risks

Market sentiment is fragile; any negative news could lead to further declines.

1 Week Prediction

Target: April 19, 2025$82000

$81500

$83000

$79000

Description

A slight recovery is anticipated as the market stabilizes. The MACD shows a bullish crossover, indicating potential upward momentum. However, resistance at 83000 may limit gains.

Analysis

The past three months have shown a bearish trend with significant price fluctuations. Key resistance at 83000 and support at 80000 are pivotal. Technical indicators suggest a possible short-term recovery, but overall sentiment remains cautious.

Confidence Level

Potential Risks

Continued bearish pressure could reverse gains, especially if volume decreases.

1 Month Prediction

Target: May 11, 2025$85000

$84000

$86000

$78000

Description

Expect a gradual recovery as bullish signals emerge. The RSI is approaching neutral, and a break above 83000 could trigger further buying. However, macroeconomic factors may still pose risks.

Analysis

BTC-USD has shown a bearish trend recently, with significant support at 80000. Technical indicators suggest potential for recovery, but external factors like regulatory news could influence price movements. Caution is advised.

Confidence Level

Potential Risks

Macroeconomic events could impact market sentiment, leading to volatility.

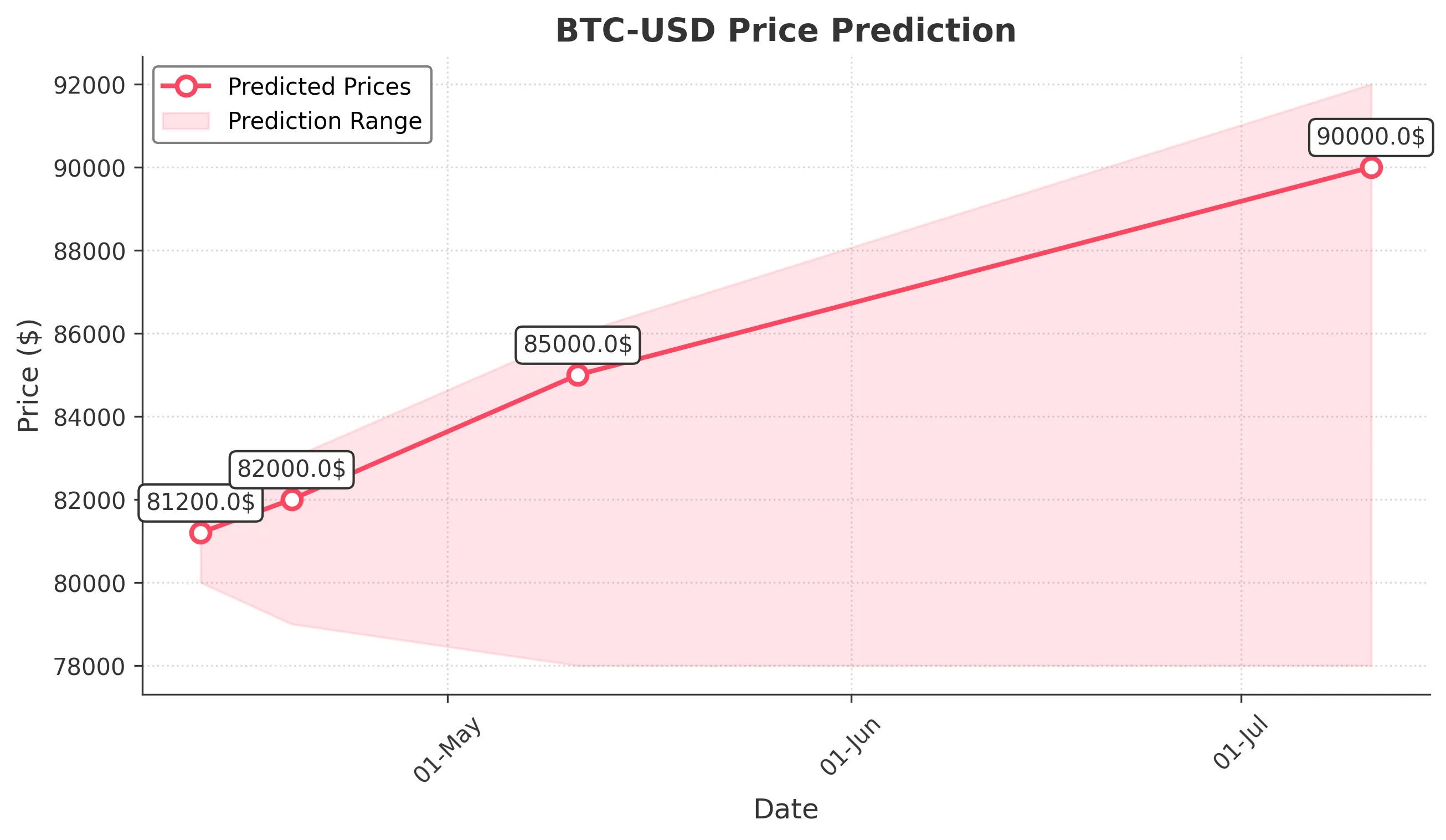

3 Months Prediction

Target: July 11, 2025$90000

$89000

$92000

$78000

Description

Long-term outlook appears bullish as market sentiment improves. A break above 86000 could lead to a rally towards 90000. However, macroeconomic uncertainties remain a concern.

Analysis

The overall trend in the past three months has been bearish, but signs of recovery are emerging. Key resistance levels at 86000 and support at 80000 are critical. Technical indicators suggest a potential bullish reversal, but caution is warranted due to external influences.

Confidence Level

Potential Risks

Potential for market corrections exists, especially if external factors shift sentiment.