BTC-USD Trading Predictions

1 Day Prediction

Target: April 13, 2025$83500

$83400

$84500

$82000

Description

The market shows signs of consolidation with a slight bearish trend. Recent candlestick patterns indicate indecision, and the RSI is approaching oversold territory, suggesting a potential bounce. However, volatility remains high, which could lead to further declines.

Analysis

Over the past 3 months, BTC-USD has experienced high volatility with significant price swings. Key support is around 82000, while resistance is near 85000. The MACD shows bearish divergence, and the ATR indicates increased volatility. Volume has been inconsistent, suggesting uncertainty in market direction.

Confidence Level

Potential Risks

Market sentiment is mixed, and external factors such as regulatory news could impact prices significantly.

1 Week Prediction

Target: April 20, 2025$82000

$83000

$83000

$80000

Description

The bearish trend may continue as the market struggles to maintain upward momentum. The RSI indicates potential oversold conditions, but the MACD remains negative. A break below 82000 could lead to further declines, while a bounce could see a retest of 83000.

Analysis

The past 3 months have shown a bearish trend with significant resistance at 85000. The recent price action indicates a struggle to maintain higher levels, and the volume patterns suggest a lack of conviction among buyers. Key support at 80000 is critical for the next week.

Confidence Level

Potential Risks

Potential for sudden market shifts due to macroeconomic events or news could affect the prediction.

1 Month Prediction

Target: May 12, 2025$85000

$84000

$86000

$80000

Description

A potential recovery could occur if the price holds above 80000. The market may see a retest of 85000, supported by bullish divergence in the RSI. However, caution is warranted as macroeconomic factors could influence volatility.

Analysis

The overall trend has been bearish, but signs of stabilization are emerging. Key support at 80000 is crucial, and if maintained, a rally towards 85000 could occur. The MACD is showing signs of potential reversal, but volume remains a concern.

Confidence Level

Potential Risks

Uncertainty in market sentiment and external economic factors could lead to unexpected price movements.

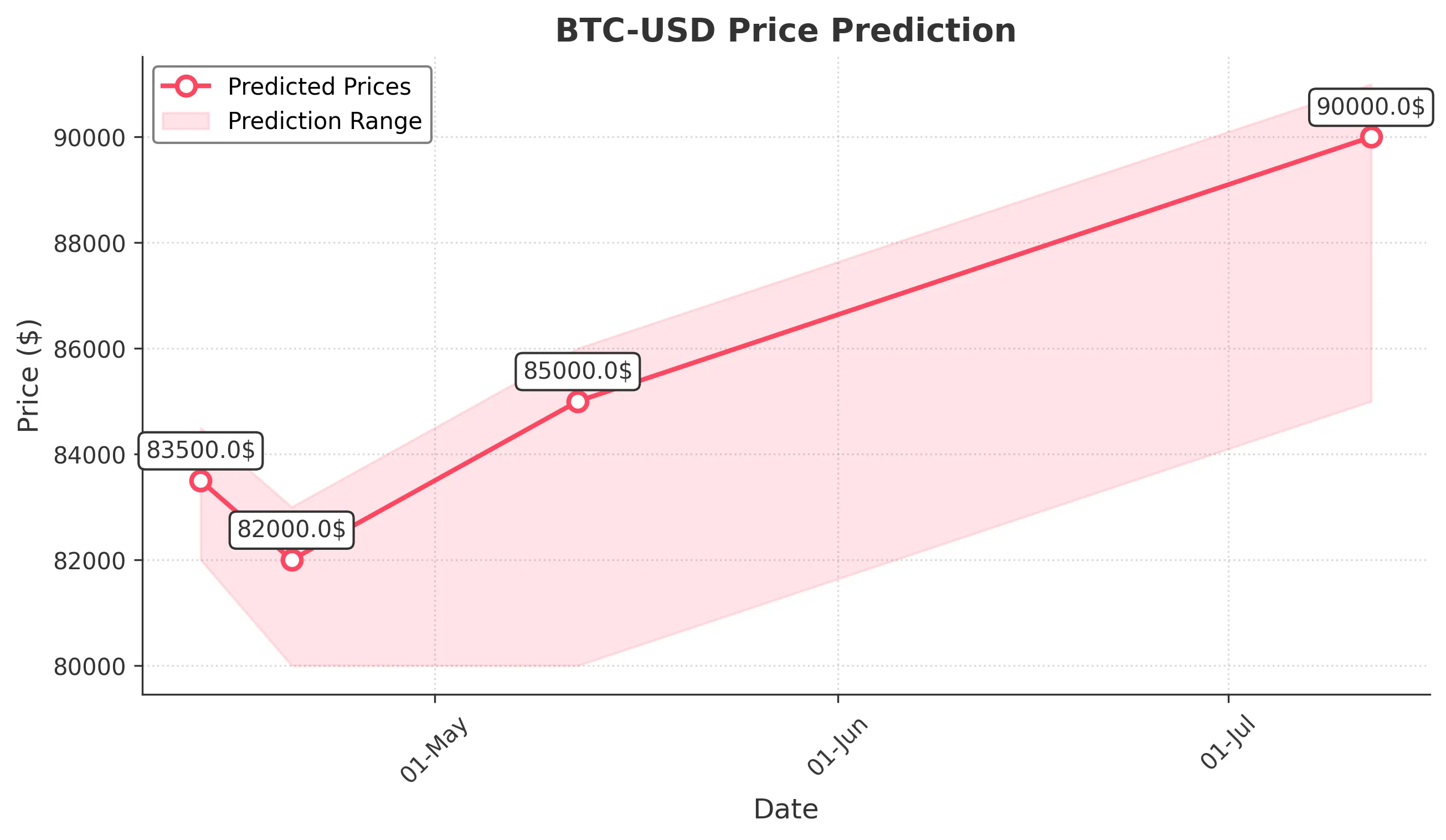

3 Months Prediction

Target: July 12, 2025$90000

$89500

$91000

$85000

Description

If the market stabilizes and breaks above 85000, a bullish trend could develop. The RSI may recover, indicating increased buying interest. However, macroeconomic conditions and regulatory news could pose risks to this outlook.

Analysis

The past 3 months have shown significant price fluctuations with a bearish bias. Key resistance levels are at 85000, while support is at 80000. The market's ability to break these levels will be crucial for future price movements. Volume trends suggest a lack of strong buying interest.

Confidence Level

Potential Risks

Long-term predictions are highly uncertain due to potential market volatility and external influences.