BTC-USD Trading Predictions

1 Day Prediction

Target: April 16, 2025$85500

$85500

$86000

$84000

Description

The price is expected to stabilize around 85500, supported by recent bullish momentum. The RSI indicates neutrality, while MACD shows a potential bullish crossover. However, volatility remains a concern due to recent fluctuations.

Analysis

Over the past 3 months, BTC-USD has shown a bearish trend with significant support around 82,000. Recent price action indicates a potential reversal, but volatility remains high. Key indicators like RSI and MACD suggest caution.

Confidence Level

Potential Risks

Market sentiment could shift quickly, and external news may impact prices significantly.

1 Week Prediction

Target: April 23, 2025$86000

$85500

$87000

$83000

Description

A slight upward trend is anticipated as the market digests recent price movements. The Bollinger Bands indicate potential for a breakout, but the ATR suggests continued volatility. Watch for volume spikes.

Analysis

The last three months have seen BTC-USD fluctuating with a bearish bias. Key resistance at 87,000 remains, while support is around 82,000. Volume patterns indicate increased trading activity, suggesting potential for upward movement.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could lead to sudden price drops, impacting the prediction.

1 Month Prediction

Target: May 15, 2025$87000

$86000

$88000

$84000

Description

Expect a gradual increase in price as bullish sentiment builds. The Fibonacci retracement levels suggest 87,000 as a key resistance point. However, the market remains sensitive to external factors.

Analysis

BTC-USD has been in a bearish trend, but recent price action shows signs of recovery. Key support at 82,000 and resistance at 87,000 are critical. Technical indicators suggest a cautious bullish outlook, but risks remain.

Confidence Level

Potential Risks

Market volatility and potential regulatory news could impact price stability.

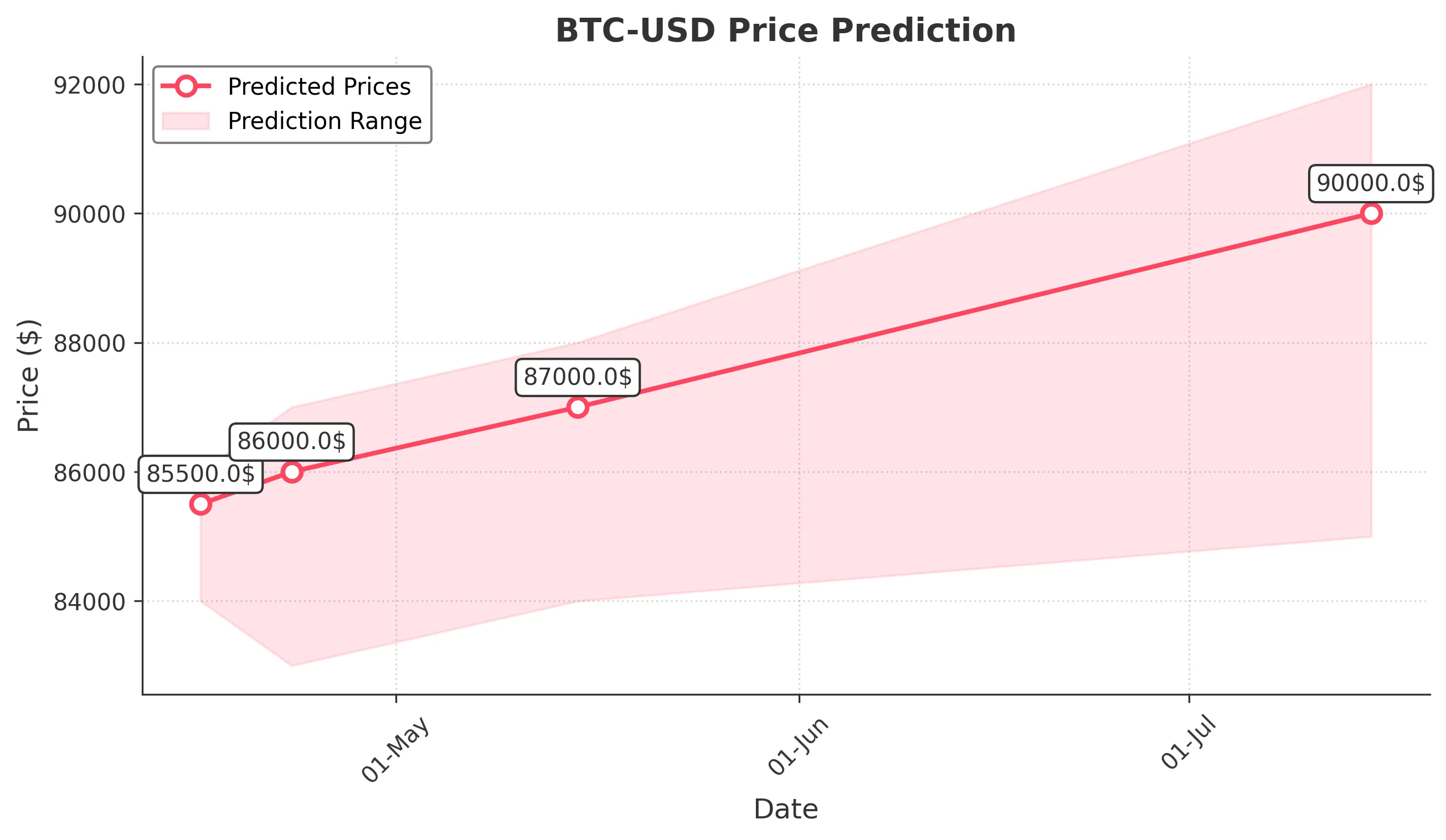

3 Months Prediction

Target: July 15, 2025$90000

$87000

$92000

$85000

Description

A bullish trend is anticipated as market sentiment improves. The MACD indicates a strong upward momentum, and the RSI is approaching overbought territory. However, caution is advised due to potential corrections.

Analysis

The past three months have shown a bearish trend, but recent indicators suggest a potential recovery. Key resistance at 87,000 and support at 82,000 remain pivotal. Market sentiment is mixed, with external factors likely influencing future price movements.

Confidence Level

Potential Risks

Long-term predictions are uncertain due to market volatility and external economic factors.